(a) General requirements.

(1) Clearing

member clients. A Board-regulated institution that is a clearing

member client must use the methodologies described in paragraph (b)

of this section to calculate risk-weighted assets for a cleared transaction.

(2) Clearing members. A Board-regulated institution

that is a clearing member must use the methodologies described in

paragraph (c) of this section to calculate its risk-weighted assets

for a cleared transaction and paragraph (d) of this section to calculate

its risk-weighted assets for its default fund contribution to a CCP.

(3) Alternate

requirements. Notwithstanding any other provision of this section,

an advanced approaches Board-regulated institution or a Board-regulated

institution that is not an advanced approaches Board-regulated institution

and that has elected to use SA-CCR under section 217.34(a)(1) must

apply section 217.133 to its derivative contracts that are cleared

transactions rather than this section.

(b) Clearing member client Board-regulated

institutions.

(1) Risk-weighted

assets for cleared transactions.

(i) To determine the

risk-weighted asset amount for a cleared transaction, a Board-regulated

institution that is a clearing member client must multiply the trade

exposure amount for the cleared transaction, calculated in accordance

with paragraph (b)(2) of this section, by the risk weight appropriate

for the cleared transaction, determined in accordance with paragraph

(b)(3) of this section.

(ii) A clearing member client Board-regulated

institution’s total risk-weighted assets for cleared transactions

is the sum of the risk-weighted asset amounts for all its cleared

transactions.

(2) Trade exposure amount.

(i) For

a cleared transaction that is either a derivative contract or a netting

set of derivative contracts, the trade exposure amount equals:

(A) The exposure amount for the derivative contract or netting set

of derivative contracts, calculated using the methodology used to

calculate exposure amount for OTC derivative contracts under section

217.34; plus

(B) The fair

value of the collateral posted by the clearing member client Board-regulated

institution and held by the CCP, clearing member, or custodian in

a manner that is not bankruptcy remote.

(ii) For a cleared transaction

that is a repo-style transaction or netting set of repo-style transactions,

the trade exposure amount equals:

(A) The exposure amount for the

repo-style transaction calculated using the methodologies under section

217.37(c); plus

(B) The

fair value of the collateral posted by the clearing member client

Board-regulated institution and held by the CCP, clearing member,

or custodian in a manner that is not bankruptcy remote.

(3) Cleared transaction risk weights.

(i) For

a cleared transaction with a QCCP, a clearing member client Board-regulated

institution must apply a risk weight of:

(A) 2 percent if the collateral

posted by the Board-regulated institution to the QCCP or clearing

member is subject to an arrangement that prevents any losses to the

clearing member client Board-regulated institution due to the joint

default or a concurrent insolvency, liquidation, or receivership proceeding

of the clearing member and any other clearing member clients of the

clearing member; and the clearing member client Board-regulated institution

has conducted sufficient legal review to conclude with a well-founded

basis (and maintains sufficient written documentation of that legal review)

that in the event of a legal challenge (including one resulting from

an event of default or from liquidation, insolvency, or receivership

proceedings) the relevant court and administrative authorities would

find the arrangements to be legal, valid, binding and enforceable

under the law of the relevant jurisdictions; or

(B) 4 percent if the requirements of section

217.35(b)(3)(A) are not met.

(ii) For a cleared transaction with

a CCP that is not a QCCP, a clearing member client Board-regulated

institution must apply the risk weight appropriate for the CCP according

to this subpart D.

(4) Collateral.

(i) Notwithstanding

any other requirements in this section, collateral posted by a clearing

member client Board-regulated institution that is held by a custodian

(in its capacity as custodian) in a manner that is bankruptcy remote

from the CCP, clearing member, and other clearing member clients of

the clearing member, is not subject to a capital requirement under

this section.

(ii) A clearing

member client Board-regulated institution must calculate a risk-weighted

asset amount for any collateral provided to a CCP, clearing member,

or custodian in connection with a cleared transaction in accordance

with the requirements under this subpart D.

(c) Clearing member Board-regulated

institutions.

(1) Risk-weighted

assets for cleared transactions.

(i) To determine the

risk-weighted asset amount for a cleared transaction, a clearing member

Board-regulated institution must multiply the trade exposure amount

for the cleared transaction, calculated in accordance with paragraph

(c)(2) of this section, by the risk weight appropriate for the cleared

transaction, determined in accordance with paragraph (c)(3) of this

section.

(ii) A clearing

member Board-regulated institution’s total risk-weighted assets

for cleared transactions is the sum of the risk-weighted asset amounts

for all of its cleared transactions.

(2) Trade exposure

amount. A clearing member Board-regulated institution must calculate

its trade exposure amount for a cleared transaction as follows:

(i) For a cleared transaction that is either a derivative contract

or a netting set of derivative contracts, the trade exposure amount

equals:

(A) The exposure amount for the derivative

contract, calculated using the methodology to calculate exposure amount

for OTC derivative contracts under section 217.34; plus

(B) The fair value of the collateral

posted by the clearing member Board-regulated institution and held

by the CCP in a manner that is not bankruptcy remote.

(ii) For a cleared

transaction that is a repo-style transaction or netting set of repo-style

transactions, trade exposure amount equals:

(A) The exposure

amount for repo-style transactions calculated using methodologies

under section 217.37(c); plus

(B) The fair value of the collateral posted

by the clearing member Board-regulated institution and held by the

CCP in a manner that is not bankruptcy remote.

(3) Cleared transaction risk weight.

(i) A clearing

member Board-regulated institution must apply a risk weight of 2 percent

to the trade exposure amount for a cleared transaction with a QCCP.

(ii) For a cleared

transaction with a CCP that is not a QCCP, a clearing member Board-regulated

institution must apply the risk weight appropriate for the CCP according

to this subpart D.

(iii) Notwithstanding

paragraphs (c)(3)(i) and (ii) of this section, a clearing member Board-regulated

institution may apply a risk weight of zero percent to the trade exposure

amount for a cleared transaction with a CCP where the clearing member

Board-regulated institution is acting as a financial intermediary

on behalf of a clearing member client, the transaction offsets another

transaction that satisfies the requirements set forth in section 217.3(a),

and the clearing member Board-regulated institution is not obligated

to reimburse the clearing member client in the event of the CCP default.

(4) Collateral.

(i) Notwithstanding any other requirement

in this section, collateral posted by a clearing member Board-regulated

institution that is held by a custodian in a manner that is bankruptcy

remote from the CCP is not subject to a capital requirement under

this section.

(ii) A clearing

member Board-regulated institution must calculate a risk-weighted

asset amount for any collateral provided to a CCP, clearing member,

or a custodian in connection with a cleared transaction in accordance

with requirements under this subpart D.

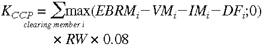

(d) Default fund contributions.

(1) General requirement. A clearing member Board-regulated institution

must determine the risk-weighted asset amount for a default fund contribution

to a CCP at least quarterly, or more frequently if, in the opinion

of the Board-regulated institution or the Board, there is a material

change in the financial condition of the CCP.

(2) Risk-weighted

asset amount for default fund contributions to non-qualifying CCPs. A clearing member Board-regulated institution’s risk-weighted

asset amount for default fund contributions to CCPs that are not QCCPs

equals the sum of such default fund contributions multiplied by 1,250

percent, or an amount determined by the Board, based on factors such

as size, structure and membership characteristics of the CCP and riskiness

of its transactions, in cases where such default fund contributions

may be unlimited.

(3) Risk-weighted asset amount for default fund

contributions to QCCPs. A clearing member Board-regulated institution’s

risk-weighted asset amount for default fund contributions to QCCPs

equals the sum of its capital requirement, KCM for each

QCCP, as calculated under the methodology set forth in paragraphs

(d)(3)(i) through (iii) of this section (Method 1), multiplied by

1,250 percent or in paragraphs (d)(3)(iv) of this section (Method

2).

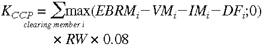

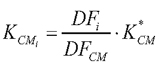

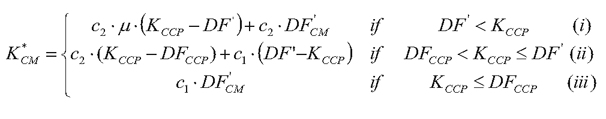

(i) Method

1. The hypothetical capital requirement of a QCCP (KCCP) equals:

Figure 1. DISPLAY EQUATION

$$

\begin{align*}

K_{CCP} = & \sum_{\tiny\text{{clearing member i}}}\mathrm{max} (EBRM_i-VM_i-IM_i-DF_i;0) \\

& \times RW \times 0.08

\end{align*}

$$

Where

(A) EBRMi = the exposure amount for each transaction cleared

through the QCCP by clearing member i, calculated in accordance with

section 217.34 for OTC derivative contracts and section 217.37(c)(2)

for repo-style transactions, provided that:

(1) For purposes of this section,

in calculating the exposure amount the Board-regulated institution

may replace the formula provided in section 217.34(a)(2)(ii) with

the following: ANet = (0.15 × Agross)

+ (0.85 × NGR × Agross); and

(2) For option derivative contracts

that are cleared transactions, the PFE described in section 217.34(a)(1)(ii)

must be adjusted by multiplying the notional principal amount of the

derivative contract by the appropriate conversion factor in Table

1 to section 217.34 and the absolute value of the option’s delta,

that is, the ratio of the change in the value of the derivative contract

to the corresponding change in the price of the underlying asset.

(3) For repo-style

transactions, when applying section 217.37(c)(2), the Board-regulated

institution must use the methodology in section 217.37(c)(3);

(B) VMi = any

collateral posted by clearing member i to the QCCP that it is entitled

to receive from the QCCP, but has not yet received, and any collateral

that the QCCP has actually received from clearing member i;

(C) IMi = the collateral

posted as initial margin by clearing member i to the QCCP;

(D) DFi = the funded

portion of clearing member i’s default fund contribution that

will be applied to reduce the QCCP’s loss upon a default by

clearing member i;

(E)

RW = 20 percent, except when the Board has determined that a higher

risk weight is more appropriate based on the specific characteristics

of the QCCP and its clearing members; and

(F) Where a QCCP has provided its KCCP, a Board-regulated institution must rely on such disclosed figure

instead of calculating KCCP under this paragraph (d), unless

the Board-regulated institution determines that a more conservative

figure is appropriate based on the nature, structure, or characteristics

of the QCCP.

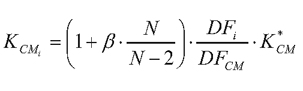

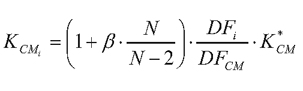

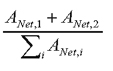

(ii) For a Board-regulated institution

that is a clearing member of a QCCP with a default fund supported

by funded commitments, KCM equals:

Figure 2. DISPLAY EQUATION

$$

K_{CM_{i}} = \Bigg\lgroup 1 + \beta \cdot \frac{N}{N-2} \Bigg\rgroup \cdot \frac{DF_i}{DF_{CM}} \cdot K^\ast_{CM}

$$

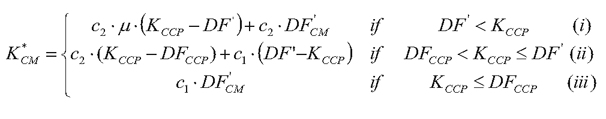

Figure 3. DISPLAY EQUATION

$$

K^\ast_{CM} =

\begin{cases}

\quad\quad c_2 \cdot \mu \cdot (K_{CCP} - DF)+c_2 \cdot DF^\prime_{CM} & \quad \text{if } \quad\quad\quad DF^\prime < K_{CCP} & \text{ (i) } \\

c_2 \cdot (K_{CCP} - DF_{CCP}) + c_1 \cdot (DF^\prime - K_{CCP}) & \quad \text{if } \quad DF_{CCP} < K_{CCP} \leq DF^\prime & \text{ (ii)} \\

\qquad\qquad\qquad c_1 \cdot DF^\prime_{CM} & \quad \text{if } \quad\quad\quad K_{CCP} \leq DF_{CCP} & \text{(iii)} \\

\end{cases}

$$

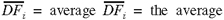

Where

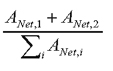

(A) β =

Figure 4. DISPLAY EQUATION

$$

\frac{A_{Net,1} + A_{Net,2}}

{\sum_i A_{Net,i}}

$$

Subscripts

1 and 2 denote the clearing members with the two largest ANet values. For purposes of this paragraph (d), for derivatives ANet is defined in section 217.34(a)(2)(ii) and for repo-style

transactions, ANet means the exposure amount as defined

in section 217.37(c)(2) using the methodology in section 217.37(c)(3);

(B) N = the number of clearing

members in the QCCP;

(C)

DFCCP = the QCCP’s own funds and other financial

resources that would be used to cover its losses before clearing members’

default fund contributions are used to cover losses;

(D) DFCM = funded default fund

contributions from all clearing members and any other clearing member

contributed financial resources that are available to absorb mutualized

QCCP losses;

(E) DF =

DFCCP + DFCM (that is, the total funded default

fund contribution);

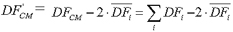

(F)

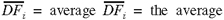

Figure 5. DISPLAY EQUATION

$$

\overline{DF_i} = \text{ average } \overline{DF_i} = \text{ the average}

$$

funded default fund

contribution from an individual clearing member;

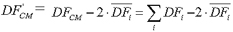

(G)

Figure 6. DISPLAY EQUATION

$$

DF^\prime_{CM} = DF_{CM} -2 \cdot \overline{DF_i} = \sum_i DF_i -2 \cdot \overline{DF_i}

$$

(that is, the funded default fund contribution from

surviving clearing members assuming that two average clearing members

have defaulted and their default fund contributions and initial margins

have been used to absorb the resulting losses);

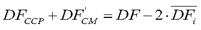

(H)

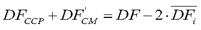

DF’ =

Figure 7. DISPLAY EQUATION

$$

DF_{CCP} + DF^\prime_{CM} = DF - 2 \cdot \overline{DF_i}

$$

(that is, the total funded

default fund contributions from the QCCP and the surviving clearing

members that are available to mutualize losses, assuming that two

average clearing members have defaulted);

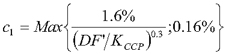

(I)

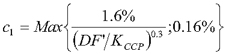

Figure 8. DISPLAY EQUATION

$$

c_1 = Max \Bigg\{ \frac{1.6\%}{(DF^\prime / K_{CCP})^{0.3}} ;0.16\% \Bigg\}

$$

(that

is, a decreasing capital factor, between 1.6 percent and 0.16 percent,

applied to the excess funded default funds provided by clearing members);

(J) c2 = 100 percent;

and

(K) µ = 1.2;

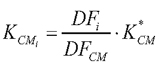

(iii) (A) For a Board-regulated

institution that is a clearing member of a QCCP with a default fund

supported by unfunded commitments, KCM equals:

Figure 9. DISPLAY EQUATION

$$

K_{CM_i} = \frac{DF_i}{DF_{CM}} \cdot K^\ast_{CM}

$$

Where

(1) DFi = the Board-regulated

institution’s unfunded commitment to the default fund;

(2) DFCM =

the total of all clearing members’ unfunded commitment to the

default fund; and

(3) K* CM as defined in paragraph (d)(3)(ii)

of this section.

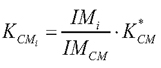

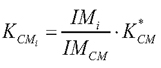

(B) For a Board-regulated institution that

is a clearing member of a QCCP with a default fund supported by unfunded

commitments and is unable to calculate KCM using the methodology

described in paragraph (d)(3)(iii) of this section, KCM equals:

Figure 10. DISPLAY EQUATION

$$

K_{CM_i} = \frac{IM_i}{IM_{CM}} \cdot K^\ast_{CM}

$$

Where

(1) IMi =

the Board-regulated institution’s initial margin posted to the QCCP;

(2) IMCM = the total of initial margin posted to the QCCP; and

(3) K* CM as defined in paragraph (d)(3)(ii) of this section.

(iv) Method

2. A clearing member Board-regulated institution’s risk-weighted

asset amount for its default fund contribution to a QCCP, RWADF, equals:

RWADF = Min {12.5 * DF; 0.18 * TE}

Where

(A) TE = the Board-regulated

institution’s trade exposure amount to the QCCP, calculated

according to section 35(c)(2);

(B) DF = the funded portion of the Board-regulated

institution’s default fund contribution to the QCCP.

(4) Total risk-weighted assets for default fund

contributions. Total risk-weighted assets for default fund contributions

is the sum of a clearing member Board-regulated institution’s

risk-weighted assets for all of its default fund contributions to

all CCPs of which the Board-regulated institution is a clearing member.