1. Name of the Institution or Group of

Affiliated Institutions Providing the Notice

Insert the name of the financial institution

providing the notice or a common identity of affiliated institutions

jointly providing the notice on the form wherever [name of financial

institution] appears.

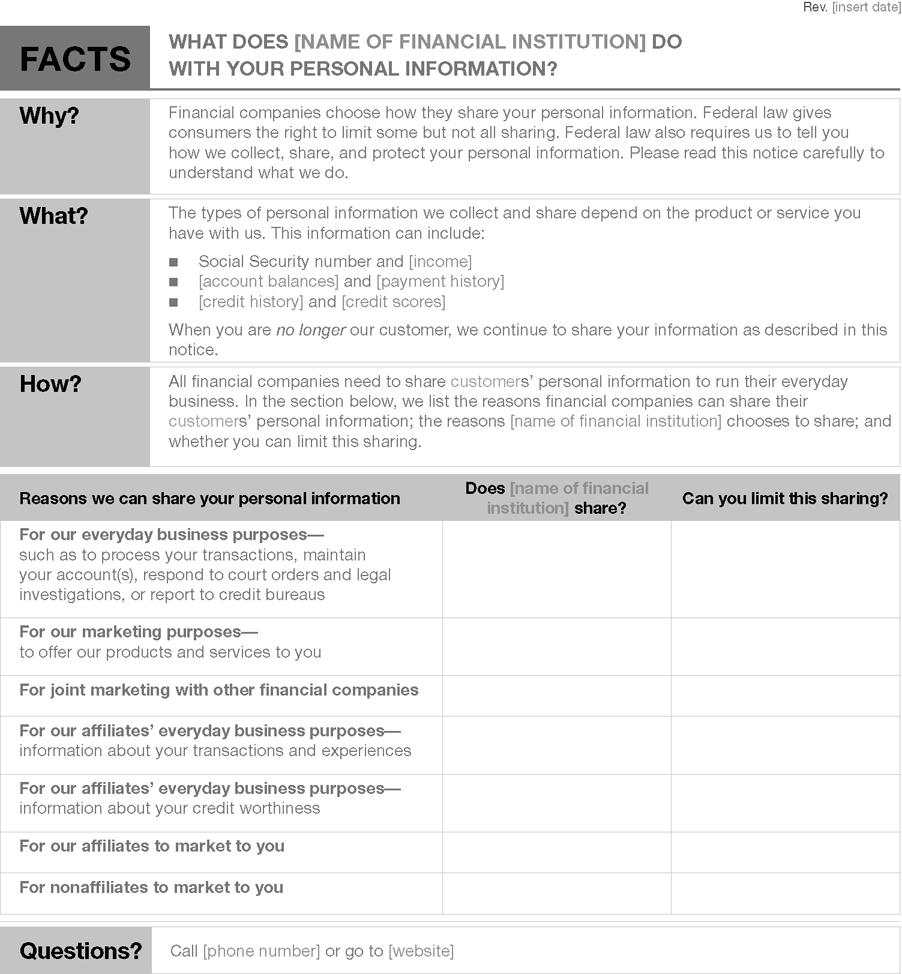

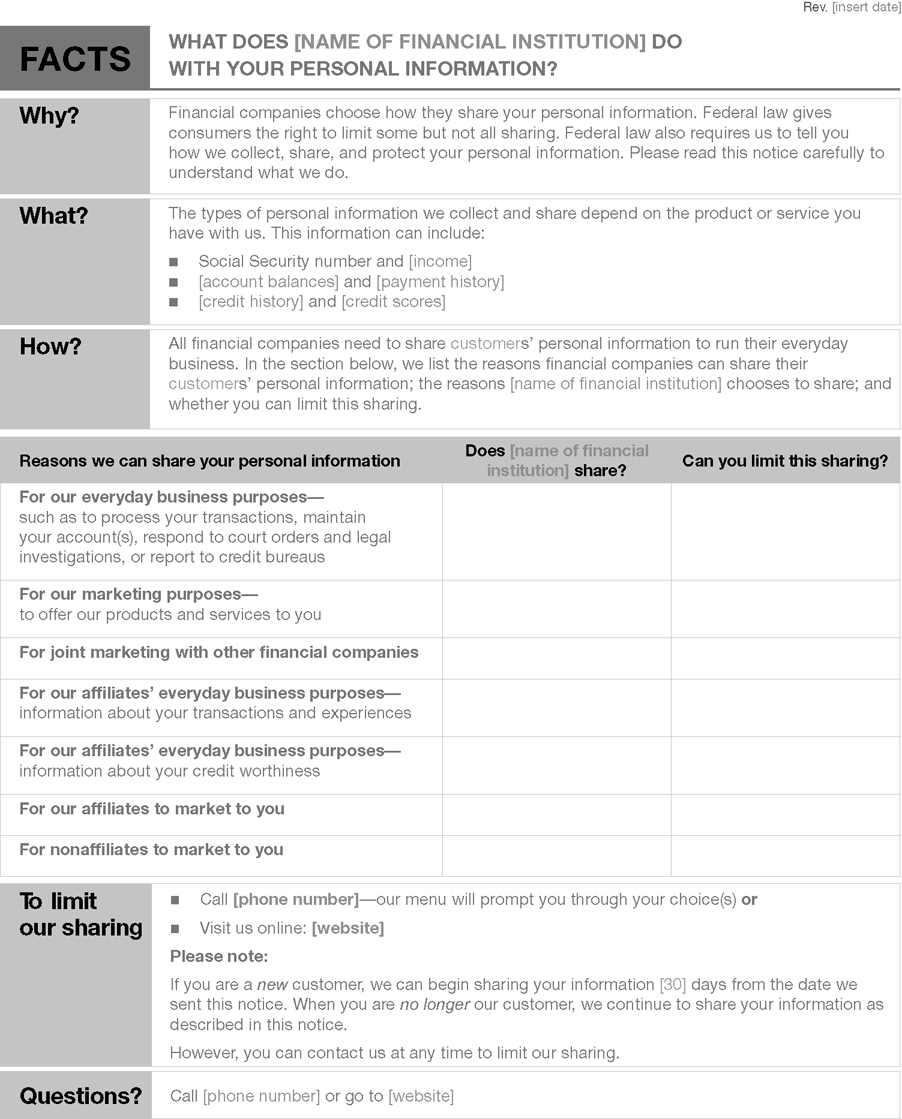

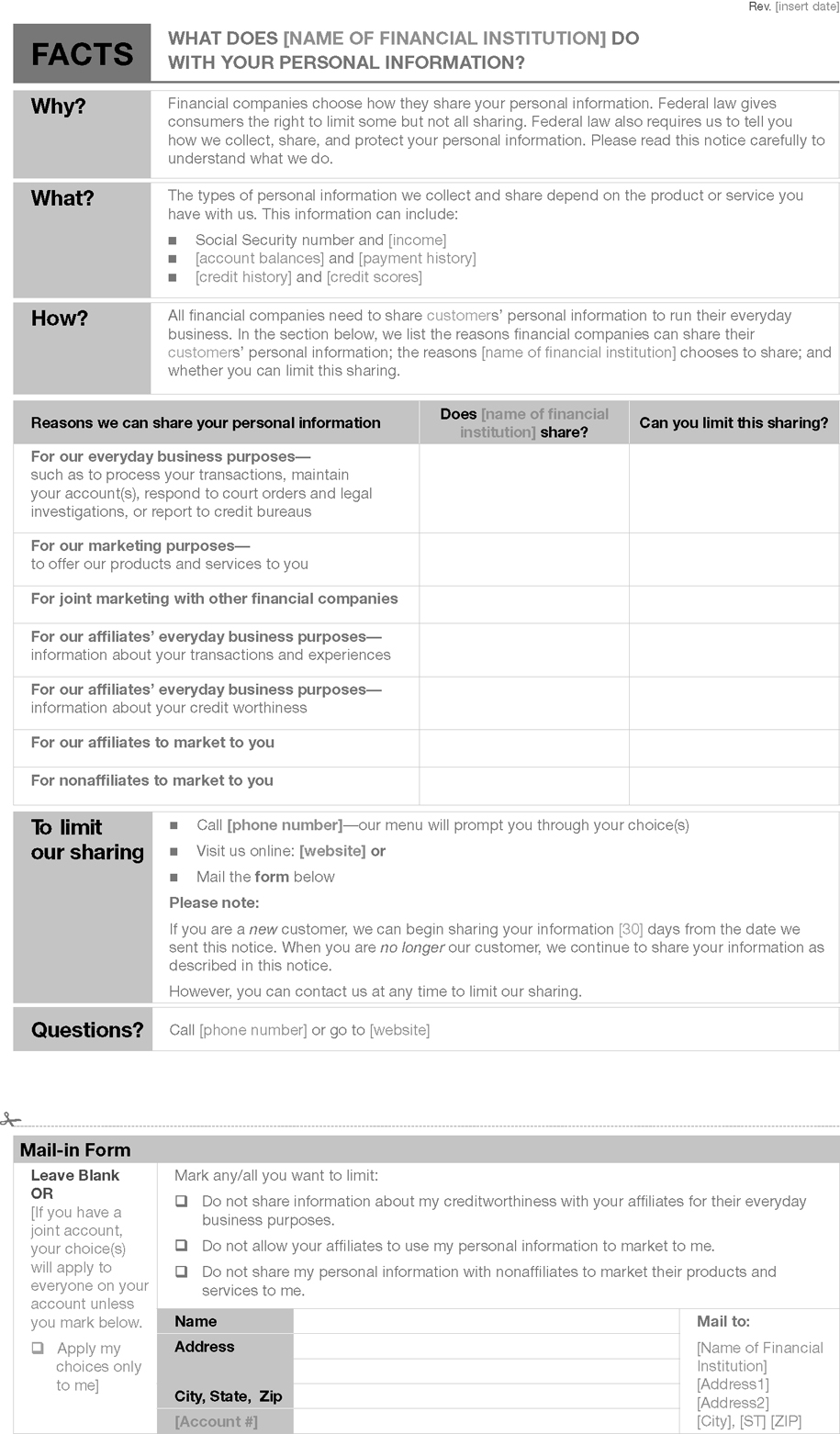

2. Page One.

(a) Last revised

date. The financial institution must insert in the upper right-hand

corner the date on which the notice was last revised. The information

shall appear in minimum 8-point font as “rev. [month/year]” using

either the name or number of the month, such as “rev. July 2009” or

“rev. 7/09”.

(b) General instructions for the “What?” box.

(1) The bulleted list identifies the types of personal information

that the institution collects and shares. All institutions must use

the term “Social Security number” in the first bullet.

(2) Institutions must use five

(5) of the following terms to complete the bulleted list: Income;

account balances; payment history; transaction history; transaction

or loss history; credit history; credit scores; assets; investment

experience; credit-based insurance scores; insurance claim history;

medical information; overdraft history; purchase history; account

transactions; risk tolerance; medical-related debts; credit card or

other debt; mortgage rates and payments; retirement assets; checking

account information; employment information; wire transfer instructions.

(c) General instructions for the disclosure table. The left column lists reasons for sharing or using personal information.

Each reason correlates to a specific legal provision described in

paragraph C.2(d) of this Instruction. In the middle column, each institution

must provide a “Yes” or “No” response that accurately reflects its

information sharing policies and practices with respect to the reason

listed on the left. In the right column, each institution must provide

in each box one of the following three (3) responses, as applicable,

that reflects whether a consumer can limit such sharing: “Yes” if

it is required to or voluntarily provides an opt-out; “No” if it does

not provide an opt-out; or “We don’t share” if it answers “No” in

the middle column. Only the sixth row (“For our affiliates to market

to you”) may be omitted at the option of the institution. See paragraph C.2(d)(6) of this Instruction.

(d) Specific

disclosures and corresponding legal provisions.

(1) For our everyday business purposes. This

reason incorporates sharing information under sections 1016.14 and

1016.15 and with service providers pursuant to section 1016.13 of

this part other than the purposes specified in paragraphs C.2(d)(2)

or C.2(d)(3) of these Instructions.

(2) For our marketing

purposes. This reason incorporates sharing information with service

providers by an institution for its own marketing pursuant to section

1016.13 of this part. An institution that shares for this reason may

choose to provide an opt-out.

(3) For joint marketing with other financial

companies. This reason incorporates sharing information under

joint marketing agreements between two or more financial institutions

and with any service provider used in connection with such agreements

pursuant to section 1016.13 of this part. An institution that shares

for this reason may choose to provide an opt-out.

(4) For our affiliates’

everyday business purposes—information about transactions and experiences. This reason incorporates sharing information specified in section

603(d)(2)(A)(i) and (ii) of the FCRA. An institution that shares for

this reason may choose to provide an opt-out.

(5) For our affiliates’

everyday business purposes—information about creditworthiness. This reason incorporates sharing information pursuant to section

603(d)(2)(A)(iii) of the FCRA. An institution that shares for this

reason must provide an opt-out.

(6) For our affiliates

to market to you. This reason incorporates sharing information

specified in section 624 of the FCRA. This reason may be omitted from

the disclosure table when: the institution does not have affiliates

(or does not disclose personal information to its affiliates); the

institution’s affiliates do not use personal information in a manner

that requires an opt-out; or the institution provides the affiliate

marketing notice separately. Institutions that include this reason

must provide an opt-out of indefinite duration. An institution that

is required to provide an affiliate marketing opt-out, but does not

include that opt-out in the model form under this part, must comply

with section 624 of the FCRA and 12 CFR part 1022, subpart C, with

respect to the initial notice and opt-out and any subsequent renewal

notice and opt-out. An institution not required to provide an opt-out

under this subparagraph may elect to include this reason in the model

form.

(7) For nonaffiliates to market to you. This

reason incorporates sharing described in sections 1016.7 and 1016.10(a)

of this part. An institution that shares personal information for

this reason must provide an opt-out.

(e) To limit

our sharing: A financial institution must include this section

of the model form only if it provides an opt-out. The word “choice”

may be written in either the singular or plural, as appropriate. Institutions

must select one or more of the applicable opt-out methods described:

Telephone, such as by a toll-free number; a Web site; or use of a

mail-in opt-out form. Institutions may include the words “toll-free”

before telephone, as appropriate. An institution that allows consumers

to opt-out online must provide either a specific Web address that

takes consumers directly to the opt-out page or a general Web address

that provides a clear and conspicuous direct link to the opt-out page.

The opt-out choices made available to the consumer who contacts the

institution through these methods must correspond accurately to the

“Yes” responses in the third column of the disclosure table. In the

part titled “Please note,” institutions may insert a number that is

30 or greater in the space marked “[30].” Instructions on voluntary or

state privacy law opt-out information are in paragraph C.2(g)(5) of

these Instructions.

(f) Questions box. Customer service

contact information must be inserted as appropriate, where [phone

number] or [Web site] appear. Institutions may elect to provide either

a phone number, such as a toll-free number, or a web address, or both.

Institutions may include the words “toll-free” before the telephone

number, as appropriate.

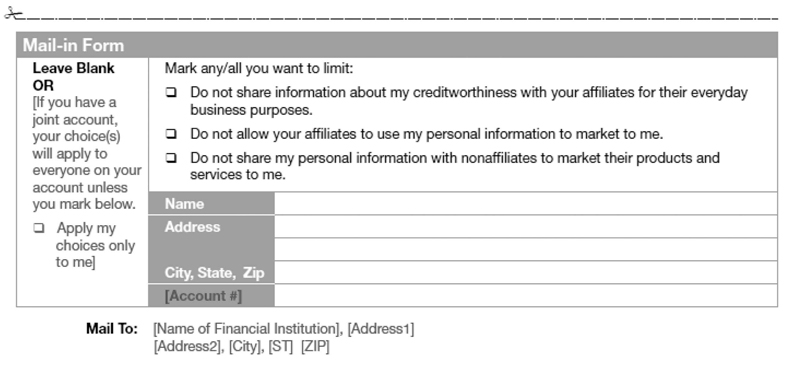

(g) Mail-in opt-out form. Financial

institutions must include this mail-in form only if they state

in the “To limit our sharing” box that consumers can opt-out by mail.

The mail-in form must provide opt-out options that correspond accurately

to the “Yes” responses in the third column in the disclosure table.

Institutions that require customers to provide only name and address

may omit the section identified as “[account #].” Institutions that

require additional or different information, such as a random opt-out

number or a truncated account number, to implement an opt-out election

should modify the “[account #]” reference accordingly. This includes

institutions that require customers with multiple accounts to identify

each account to which the opt-out should apply. An institution must

enter its opt-out mailing address: in the far right of this form (see version 3); or below the form (see version 4). The

reverse side of the mail-in opt-out form must not include any content

of the model form.

(1) Joint accountholder. Only institutions that provide their joint accountholders the choice

to opt-out for only one accountholder, in accordance with paragraph

C.3(a)(5) of these Instructions, must include in the far left column

of the mail-in form the following statement: “If you have a joint

account, your choice(s) will apply to everyone on your account unless

you mark below. *Apply my choice(s) only to me.” The word “choice”

may be written in either the singular or plural, as appropriate. Financial

institutions that provide insurance products or services, provide

this option, and elect to use the model form may substitute the word

“policy” for “account” in this statement. Institutions that do not

provide this option may eliminate this left column from the mail-in

form.

(2) FCRA section 603(d)(2)(A)(iii) opt-out. If the institution shares personal information pursuant to section

603(d)(2)(A)(iii) of the FCRA, it must include in the mail-in opt-out

form the following statement: “*Do not share information about my

creditworthiness with your affiliates for their everyday business

purposes.”

(3) FCRA section 624 opt-out. If the institution

incorporates section 624 of the FCRA in accord with paragraph C.2(d)(6)

of these Instructions, it must include in the mail-in opt-out form

the following statement: “*Do not allow your affiliates to use my

personal information to market to me.”

(4) Nonaffiliate

opt-out. If the financial institution shares personal information

pursuant to section 1016.10(a) of this part, it must include in the

mail-in opt-out form the following statement: “*Do not share my personal

information with nonaffiliates to market their products and services

to me.”

(5) Additional opt-outs. Financial institutions

that use the disclosure table to provide opt-out options beyond those

required by Federal law must provide those opt-outs in this section

of the model form. A financial institution that chooses to offer an

opt-out for its own marketing in the mail-in opt-out form must include

one of the two following statements: “*Do not share my personal information

to market to me.” or “*Do not use my personal information to market

to me.” A financial institution that chooses to offer an opt-out for

joint marketing must include the following statement: “*Do not share my personal

information with other financial institutions to jointly market to

me.”

(h) Barcodes. A financial institution

may elect to include a barcode and/or “tagline” (an internal identifier)

in 6-point font at the bottom of page one, as needed for information

internal to the institution, so long as these do not interfere with

the clarity or text of the form.

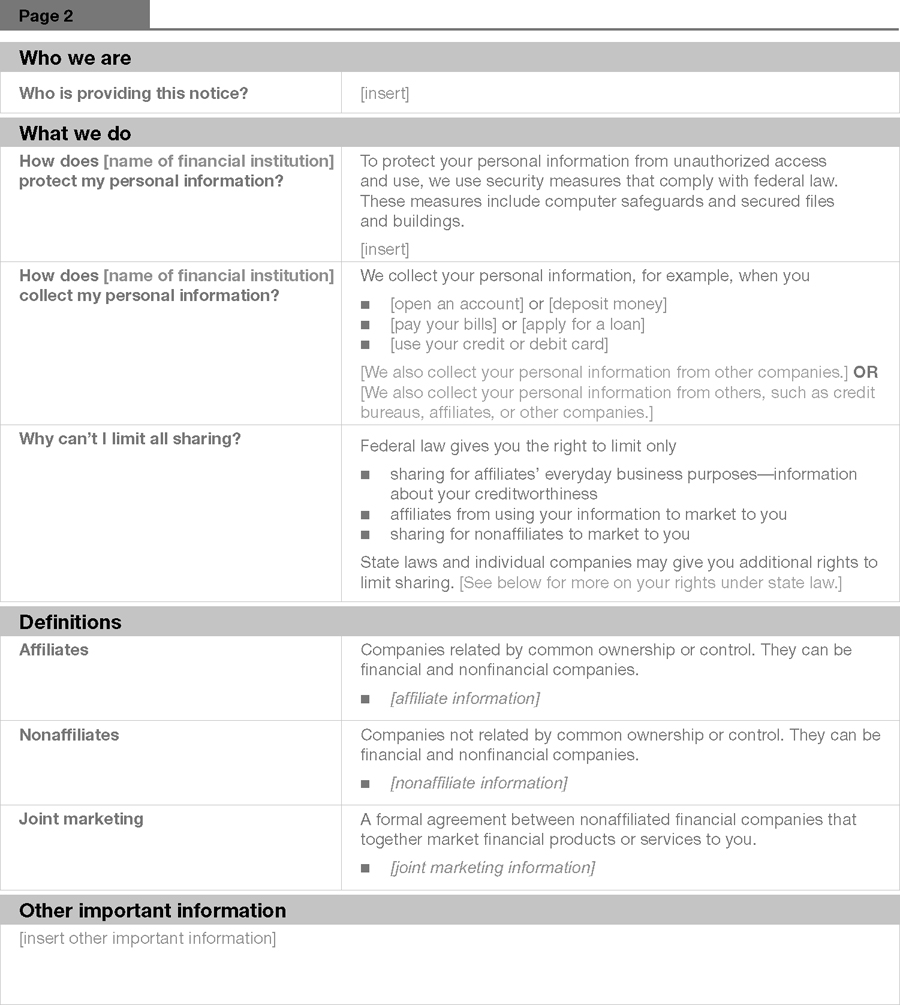

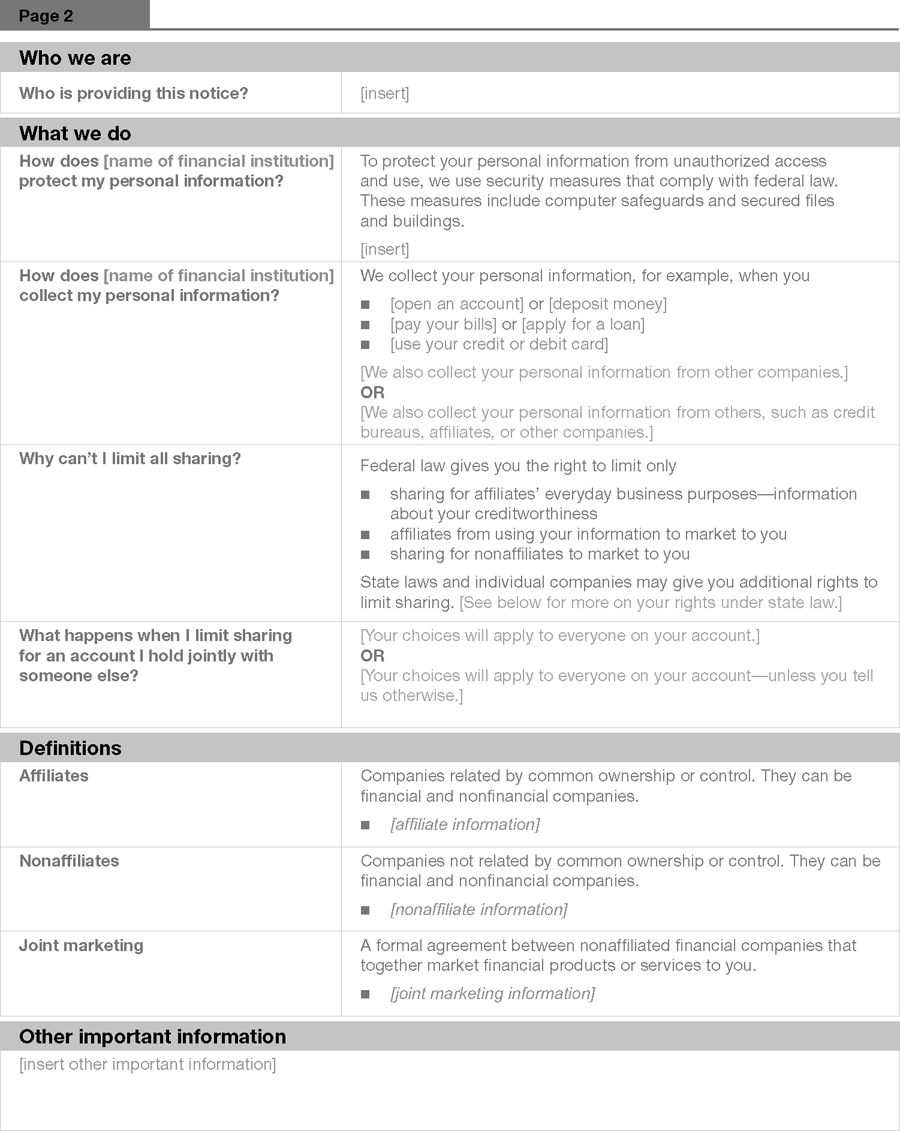

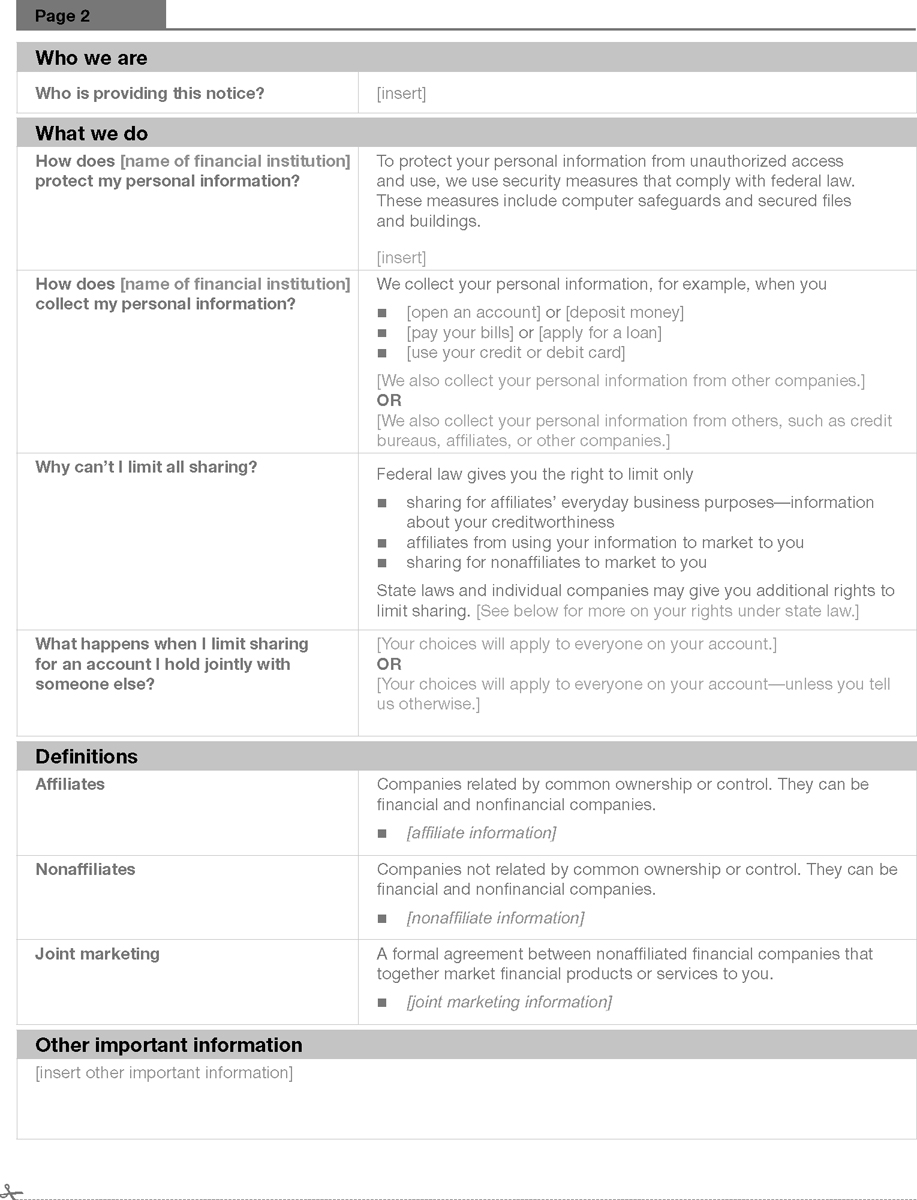

3. Page Two.

(a) General instructions for the questions. Certain of the questions may be customized as follows:

(1) “Who is providing this notice?” This question

may be omitted where only one financial institution provides the model

form and that institution is clearly identified in the title on page

one. Two or more financial institutions that jointly provide the model

form must use this question to identify themselves as required by

section 1016.9(f) of this part. Where the list of institutions exceeds

four (4) lines, the institution must describe in the response to this

question the general types of institutions jointly providing the notice

and must separately identify those institutions, in minimum 8-point

font, directly following the “Other important information” box, or,

if that box is not included in the institution’s form, directly following

the “Definitions.” The list may appear in a multi-column format.

(2) “How does [name of financial institution] protect my personal information?” The financial institution may only provide additional information

pertaining to its safeguards practices following the designated response

to this question. Such information may include information about the

institution’s use of cookies or other measures it uses to safeguard

personal information. Institutions are limited to a maximum of 30

additional words.

(3) “How does [name of financial institution] collect

my personal information?” Institutions must use five (5) of the

following terms to complete the bulleted list for this question: Open

an account; deposit money; pay your bills; apply for a loan; use your

credit or debit card; seek financial or tax advice; apply for insurance;

pay insurance premiums; file an insurance claim; seek advice about

your investments; buy securities from us; sell securities to us; direct

us to buy securities; direct us to sell your securities; make deposits

or withdrawals from your account; enter into an investment advisory

contract; give us your income information; provide employment information;

give us your employment history; tell us about your investment or

retirement portfolio; tell us about your investment or retirement

earnings; apply for financing; apply for a lease; provide account

information; give us your contact information; pay us by check; give

us your wage statements; provide your mortgage information; make a

wire transfer; tell us who receives the money; tell us where to send

the money; show your government-issued ID; show your driver’s license;

order a commodity futures or option trade. Institutions that collect

personal information from their affiliates and/or credit bureaus must

include after the bulleted list the following statement: “We also

collect your personal information from others, such as credit bureaus,

affiliates, or other companies.” Institutions that do not collect

personal information from their affiliates or credit bureaus but do

collect information from other companies must include the following

statement instead: “We also collect your personal information from

other companies.” Only institutions that do not collect any personal

information from affiliates, credit bureaus, or other companies can

omit both statements.

(4) “Why can’t I limit all sharing?” Institutions that describe state privacy law provisions in the “Other important information” box must use the bracketed sentence:

“See below for more on your rights under state law.” Other institutions

must omit this sentence.

(5) “What happens when I limit sharing

for an account I hold jointly with someone else?” Only financial

institutions that provide opt-out options must use this question.

Other institutions must omit this question. Institutions must choose

one of the following two statements to respond to this question: “Your

choices will apply to everyone on your account.” or “Your choices

will apply to everyone on your account—unless you tell us otherwise.”

Financial institutions that provide insurance products or services

and elect to use the model form may substitute the word “policy” for

“account” in these statements.

(b) General

instructions for the definitions. The financial institution must

customize the space below the responses to the three definitions in

this section. This specific information must be in italicized lettering

to set off the information from the standardized definitions.

(1) Affiliates. As required by section 1016.6(a)(3)

of this part, where [affiliate information] appears, the financial

institution must:

(i) If it has no affiliates, state: “[name of financial institution]

has no affiliates”;

(ii) If it has affiliates but does not share personal information,

state: “[name of financial institution] does not share with our

affiliates”; or

(iii)

If it shares with its affiliates, state, as applicable: “Our affiliates

include companies with a [common corporate identity of financial institution]

name; financial companies such as [insert illustrative list of companies];

nonfinancial companies, such as [insert illustrative list of companies];

and others, such as [insert illustrative list].”

(2) Nonaffiliates. As required by section 1016.6(c)(3) of this part,

where [nonaffiliate information] appears, the financial institution

must:

(i) If it does not share with

nonaffiliated third parties, state: “[name of financial institution]

does not share with nonaffiliates so they can market to you”; or

(ii) If it shares with nonaffiliated

third parties, state, as applicable: “Nonaffiliates we share with

can include [list categories of companies such as mortgage companies,

insurance companies, direct marketing companies, and nonprofit organizations].”

(3) Joint Marketing. As required by section

1016.13 of this part, where [joint marketing] appears, the financial

institution must:

(i) If it does not engage in joint marketing, state: “[name of

financial institution] doesn’t jointly market”; or

(ii) If it shares personal information

for joint marketing, state, as applicable: “Our joint marketing

partners include [list categories of companies such as credit card

companies].”

(c) General

instructions for the “Other important information” box. This

box is optional. The space provided for information in this box is

not limited. Only the following types of information can appear in

this box.

(1) State and/or international privacy law

information; and/or

(2)

Acknowledgment of receipt form.