The annual percentage yield

earned for periodic statements under section 1030.6(a) is an annualized

rate that reflects the relationship between the amount of interest

actually earned on the consumer’s account during the statement period

and the average daily balance in the account for the statement period.

Pursuant to section 1030.6(b), however, if an institution uses the

average daily balance method and calculates interest for a period

other than the statement period, the annual percentage yield earned

shall reflect the relationship between the amount of interest earned

and the average daily balance in the account for that other period.

The annual percentage yield earned shall be calculated by using the

following formulas (“APY Earned” is used for convenience in the formulas):

A. General Formula APY Earned = 100 [(1 + Interest

earned/Balance)(365/Days in period) - 1]

“Balance” is the average daily balance

in the account for the period.

“Interest earned” is the actual amount of interest earned

on the account for the period.

“Days in period” is the actual number of days for the

period.

Examples:

(1) Assume an institution calculates interest

for the statement period (and uses either the daily balance or the

average daily balance method), and the account has a balance of $1,500

for 15 days and a balance of $500 for the remaining 15 days of a 30-day

statement period. The average daily balance for the period is $1,000.

The interest earned (under either balance computation method) is $5.25

during the period. The annual percentage yield earned (using the formula

above) is 6.58%:

APY Earned = 100 [(1 + 5.25/1,000)(365/30) - 1]

APY Earned = 6.58%

(2) Assume an institution calculates interest

on the average daily balance for the calendar month and provides periodic

statements that cover the period from the 16th of one month to the

15th of the next month. The account has a balance of $2,000 September

1 through September 15 and a balance of $1,000 for the remaining 15

days of September. The average daily balance for the month of September

is $1,500, which results in $6.50 in interest earned for the month.

The annual percentage yield earned for the month of September would

be shown on the periodic statement covering September 16 through October

15. The annual percentage yield earned (using the formula above) is

5.40%:

APY Earned = 100 [(6.50/1,500)(365/30) - 1]

APY Earned = 5.40%

(3) Assume an institution calculates interest

on the average daily balance for a quarter (for example, the calendar

months of September through November), and provides monthly periodic

statements covering calendar months. The account has a balance of

$1,000 throughout the 30 days of September, a balance of $2,000 throughout

the 31 days of October, and a balance of $3,000 throughout the 30

days of November. The average daily balance for the quarter is $2,000,

which results in $21 in interest earned for the quarter. The annual

percentage yield earned would be shown on the periodic statement for

November. The annual percentage yield earned (using the formula above)

is 4.28%:

APY Earned = 100 [(1 + 21/2,000)(365/91) - 1]

APY Earned = 4.28%

B. Special Formula for Use Where Periodic

Statement Is Sent More Often Than the Period for Which Interest Is

Compounded Institutions that use the

daily balance method to accrue interest and that issue periodic statements

more often than the period for which interest is compounded shall

use the following special formula:

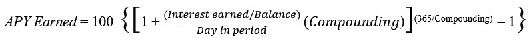

$$

\begin{align*}

APY Earned = 100 \text{ } \Bigg\{\Bigg[ 1 + \frac{(\textit{Interest earned/Balance})}{\textit{Day in period}} (Compounding) \Bigg]^{(\text{365/Compounding})} - 1 \Bigg\}

\end{align*}

$$

The following definition applies for use

in this formula (all other terms are defined under part II):

“Compounding” is the number of days

in each compounding period.

Assume an institution calculates interest for the statement

period using the daily balance method, pays a 5.00% interest rate,

compounded annually, and provides periodic statements for each monthly

cycle. The account has a daily balance of $1,000 for a 30-day statement

period. The interest earned is $4.11 for the period, and the annual

percentage yield earned (using the special formula above) is 5.00%:

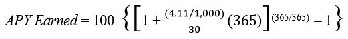

$$

\begin{align*}

APY Earned = 100 \text{ } \Bigg\{\Bigg[ 1 + \frac{(4.11/1,000)}{30} (365) \Bigg]^{(\text{365/365})} - 1 \Bigg\}

\end{align*}

$$

APY Earned = 5.00%