(a) General requirements for the SSFA. To use the SSFA to determine

the risk weight for a securitization exposure, a Board-regulated institution

must have data that enables it to assign accurately the parameters

described in paragraph (b) of this section. Data used to assign the

parameters described in paragraph (b) of this section must be the

most currently available data; if the contracts governing the underlying

exposures of the securitization require payments on a monthly or quarterly

basis, the data used to assign the parameters described in paragraph

(b) of this section must be no more than 91 calendar days old. A Board-regulated

institution that does not have the appropriate data to assign the

parameters described in paragraph (b) of this section must assign

a risk weight of 1,250 percent to the exposure.

(b) SSFA parameters. To calculate

the risk weight for a securitization exposure using the SSFA, a Board-regulated

institution must have accurate information on the following five inputs

to the SSFA calculation:

(1) KG is the weighted-average

(with unpaid principal used as the weight for each exposure) total

capital requirement of the underlying exposures calculated using this

subpart. KG is expressed as a decimal value between zero

and one (that is, an average risk weight of 100 percent represents

a value of KG equal to 0.08).

(2) Parameter W is expressed as a decimal

value between zero and one. Parameter W is the ratio of the sum of

the dollar amounts of any underlying exposures of the securitization

that meet any of the criteria as set forth in paragraphs (b)(2)(i)

through (vi) of this section to the balance, measured in dollars,

of underlying exposures:

(i) Ninety days or more past due;

(ii) Subject to a bankruptcy

or insolvency proceeding;

(iii) In the process of foreclosure;

(iv) Held as real estate

owned;

(v) Has contractually

deferred payments for 90 days or more, other than principal or interest

payments deferred on:

(A) Federally-guaranteed student loans, in accordance

with the terms of those guarantee programs; or

(B) Consumer loans, including non-federally-guaranteed

student loans, provided that such payments are deferred pursuant to

provisions included in the contract at the time funds are disbursed

that provide for period(s) of deferral that are not initiated based

on changes in the creditworthiness of the borrower; or

(vi) Is in default.

(3) Parameter

A is the attachment point for the exposure, which represents the threshold

at which credit losses will first be allocated to the exposure. Except

as provided in section 217.42(i) for nth-to-default credit

derivatives, parameter A equals the ratio of the current dollar amount

of underlying exposures that are subordinated to the exposure of the

Board-regulated institution to the current dollar amount of underlying

exposures. Any reserve account funded by the accumulated cash flows

from the underlying exposures that is subordinated to the Board-regulated

institution’s securitization exposure may be included in the calculation

of parameter A to the extent that cash is present in the account.

Parameter A is expressed as a decimal value between zero and one.

(4) Parameter D is the

detachment point for the exposure, which represents the threshold

at which credit losses of principal allocated to the exposure would

result in a total loss of principal. Except as provided in section

42(i) for nth-to-default credit derivatives, parameter

D equals parameter A plus the ratio of the current dollar amount of

the securitization exposures that are pari passu with the exposure

(that is, have equal seniority with respect to credit risk) to the

current dollar amount of the underlying exposures. Parameter D is

expressed as a decimal value between zero and one.

(5) A supervisory calibration parameter,

p, is equal to 0.5 for securitization exposures that are not resecuritization

exposures and equal to 1.5 for resecuritization exposures.

(c) Mechanics of the SSFA. KG and W are used to calculate KA, the augmented

value of KG, which reflects the observed credit quality

of the underlying exposures. KA is defined in paragraph

(d) of this section. The values of parameters A and D, relative to

KA determine the risk weight assigned to a securitization

exposure as described in paragraph (d) of this section. The risk weight

assigned to a securitization exposure, or portion of a securitization

exposure, as appropriate, is the larger of the risk weight determined

in accordance with this paragraph (c) or paragraph (d) of this section

and a risk weight of 20 percent.

(1) When the detachment point, parameter

D, for a securitization exposure is less than or equal to KA, the exposure must be assigned a risk weight of 1,250 percent.

(2) When the attachment

point, parameter A, for a securitization exposure is greater than

or equal to KA, the Board-regulated institution must calculate

the risk weight in accordance with paragraph (d) of this section.

(3) When A is less than

KA and D is greater than KA, the risk weight

is a weighted-average of 1,250 percent and 1,250 percent times KSSFA calculated in accordance with paragraph (d) of this section.

For the purpose of this weighted-average calculation:

(i) The weight

assigned to 1,250 percent equals

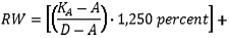

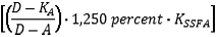

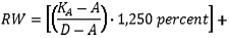

Figure 1. DISPLAY EQUATION

$$\mathrm{\frac{K_A - A}{D - A}}$$

(ii)

The weight assigned to 1,250 percent times K

SSFA equals

Figure 2. DISPLAY EQUATION

$$\frac{D-K_A}{D - A}$$

(iii)

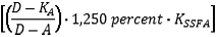

The risk weight will be set equal to:

Figure 3. DISPLAY EQUATION

$$

RW = \bigg[ \bigg(\frac{K_A - A}{D-A} \bigg) \cdot \text{1,250 } percent \bigg] + \\

\bigg[ \bigg(\frac{D-K_A}{D-A} \bigg) \cdot \text{1,250 } percent \cdot K_{SSFA}\bigg]

$$

Figure 4. DISPLAY EQUATION

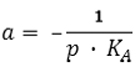

(d) SSFA equation.

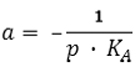

(1) The Board-regulated institution must

define the following parameters:

K A = (1 −W) • K G + (0 . 5 • W)

Figure 5. DISPLAY EQUATION

$$

a = - \frac{1}{p \cdot K_A}

$$

u

= D − K A

l = max(A − K A, 0)

e = 2.71828,

the base of the natural logarithms.

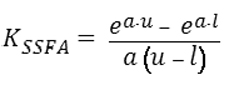

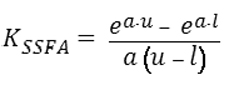

(2) Then the Board-regulated institution must calculate

KSSFA according to the following equation:

Figure 6. DISPLAY EQUATION

$$

K_{SSFA} = \frac{e^{a \cdot u} - e^{a \cdot l}}{a(u-l)}

$$

(3) The risk weight for

the exposure (expressed as a percent) is equal to KSSFA × 1,250.

(e) Gross-up approach.

(1) Applicability. A Board-regulated institution that is not subject to subpart F of

this part may apply the gross-up approach set forth in this section

instead of the SSFA to determine the risk weight of its securitization

exposures, provided that it applies the gross-up approach to all of

its securitization exposures, except as otherwise provided for certain

securitization exposures in sections 217.44 and 217.45.

(2) To use the gross-up approach,

a Board-regulated institution must calculate the following four inputs:

(i) Pro rata share, which is the par value of the Board-regulated

institution’s securitization exposure as a percent of the par value

of the tranche in which the securitization exposure resides;

(ii) Enhanced amount, which

is the par value of tranches that are more senior to the tranche in

which the Board-regulated institution’s securitization resides;

(iii) Exposure amount

of the Board-regulated institution’s securitization exposure calculated

under section 217.42(c); and

(iv) Risk weight, which is the weighted-average

risk weight of underlying exposures of the securitization as calculated

under this subpart.

(3) Credit equivalent

amount. The credit equivalent amount of a securitization exposure

under this section equals the sum of:

(i) The exposure amount

of the Board-regulated institution’s securitization exposure; and

(ii) The pro rata share

multiplied by the enhanced amount, each calculated in accordance with

paragraph (e)(2) of this section.

(4) Risk-weighted

assets. To calculate risk-weighted assets for a securitization

exposure under the gross-up approach, a Board-regulated institution

must apply the risk weight required under paragraph (e)(2) of this

section to the credit equivalent amount calculated in paragraph (e)(3)

of this section.

(f) Limitations. Notwithstanding any other

provision of this section, a Board-regulated institution must assign

a risk weight of not less than 20 percent to a securitization exposure.