(1) To recognize the risk-mitigating effects

of financial collateral, a Board-regulated institution may use:

(i) The simple approach in paragraph (b) of this section for any

exposure; or

(ii)

The collateral haircut approach in paragraph (c) of this section for

repo-style transactions, eligible margin loans, collateralized derivative

contracts, and single-product netting sets of such transactions.

(2) A Board-regulated

institution may use any approach described in this section that is

valid for a particular type of exposure or transaction; however, it

must use the same approach for similar exposures or transactions.

(1) General requirements.

(i) A Board-regulated institution may

recognize the credit risk mitigation benefits of financial collateral

that secures any exposure.

(ii) To qualify for the simple approach, the financial collateral

must meet the following requirements:

(A) The collateral must be

subject to a collateral agreement for at least the life of the exposure;

(B) The collateral must

be revalued at least every six months; and

(C) The collateral (other than gold) and the

exposure must be denominated in the same currency.

(2) Risk weight substitution.

(i) A Board-regulated

institution may apply a risk weight to the portion of an exposure

that is secured by the fair value of financial collateral (that meets

the requirements of paragraph (b)(1) of this section) based on the

risk weight assigned to the collateral under this subpart D. For repurchase

agreements, reverse repurchase agreements, and securities lending

and borrowing transactions, the collateral is the instruments, gold,

and cash the Board-regulated institution has borrowed, purchased subject

to resale, or taken as collateral from the counterparty under the

transaction. Except as provided in paragraph (b)(3) of this section,

the risk weight assigned to the collateralized portion of the exposure

may not be less than 20 percent.

(ii) A Board-regulated institution must

apply a risk weight to the unsecured portion of the exposure based

on the risk weight applicable to the exposure under this subpart.

(3) Exceptions to the 20 percent risk-weight floor

and other requirements. Notwithstanding paragraph (b)(2)(i) of

this section:

(i) A Board-regulated institution may

assign a zero percent risk weight to an exposure to an OTC derivative

contract that is marked-to-market on a daily basis and subject to

a daily margin maintenance requirement, to the extent the contract

is collateralized by cash on deposit.

(ii) A Board-regulated institution may

assign a 10 percent risk weight to an exposure to an OTC derivative

contract that is marked-to-market daily and subject to a daily margin

maintenance requirement, to the extent that the contract is collateralized

by an exposure to a sovereign that qualifies for a zero percent risk

weight under section 217.32.

(iii) A Board-regulated institution

may assign a zero percent risk weight to the collateralized portion

of an exposure where:

(A) The financial collateral is cash on deposit;

or

(B) The financial collateral

is an exposure to a sovereign that qualifies for a zero percent risk

weight under section 217.32, and the Board-regulated institution has

discounted the fair value of the collateral by 20 percent.

(1) General. A Board-regulated institution may recognize the credit risk mitigation

benefits of financial collateral that secures an eligible margin loan,

repo-style transaction, collateralized derivative contract, or single-product

netting set of such transactions, and of any collateral that secures

a repo-style transaction that is included in the Board-regulated institution’s

VaR-based measure under subpart F of this part by using the collateral

haircut approach in this section. A Board-regulated institution may

use the standard supervisory haircuts in paragraph (c)(3) of this

section or, with prior written approval of the Board, its own estimates

of haircuts according to paragraph (c)(4) of this section.

(2) Exposure amount equation. A Board-regulated institution must

determine the exposure amount for an eligible margin loan, repo-style

transaction, collateralized derivative contract, or a single-product

netting set of such transactions by setting the exposure amount equal

to max {0, [(ΣE − ΣC) + Σ(Es × Hs) + Σ(Efx × Hfx)]}, where:

(i) (A) For eligible margin loans and repo-style transactions and

netting sets thereof, ΣE equals the value of the exposure (the sum

of the current fair values of all instruments, gold, and cash the

Board-regulated institution has lent, sold subject to repurchase,

or posted as collateral to the counterparty under the transaction (or

netting set)); and

(B) For collateralized derivative contracts

and netting sets thereof, ΣE equals the exposure amount of the OTC

derivative contract (or netting set) calculated under section 217.34

(b)(1) or (2).

(ii) ΣC equals the value of the collateral

(the sum of the current fair values of all instruments, gold and cash

the Board-regulated institution has borrowed, purchased subject to

resale, or taken as collateral from the counterparty under the transaction

(or netting set));

(iii) Es equals the absolute value of the net position

in a given instrument or in gold (where the net position in the instrument

or gold equals the sum of the current fair values of the instrument

or gold the Board-regulated institution has lent, sold subject to

repurchase, or posted as collateral to the counterparty minus the

sum of the current fair values of that same instrument or gold the

Board-regulated institution has borrowed, purchased subject to resale,

or taken as collateral from the counterparty);

(iv) Hs equals the market

price volatility haircut appropriate to the instrument or gold referenced

in Es;

(v) Efx equals the absolute value of the net position

of instruments and cash in a currency that is different from the settlement

currency (where the net position in a given currency equals the sum

of the current fair values of any instruments or cash in the currency

the Board-regulated institution has lent, sold subject to repurchase,

or posted as collateral to the counterparty minus the sum of the current

fair values of any instruments or cash in the currency the Board-regulated

institution has borrowed, purchased subject to resale, or taken as

collateral from the counterparty); and

(vi) Hfx equals the haircut

appropriate to the mismatch between the currency referenced in Efx and the settlement currency.

(3) Standard

supervisory haircuts.

(i) A Board-regulated institution must

use the haircuts for market price volatility (Hs) provided

in Table 1 to section 217.37, as adjusted in certain circumstances

in accordance with the requirements of paragraphs (c)(3)(iii) and

(iv) of this section.

Table 1 to section

217.37—Standard supervisory market price volatility haircuts

| |

Haircut (in percent) assigned based on: |

Investment grade securitization exposures (in percent) |

| Residual maturity |

Sovereign issuers risk weight under section 217.32 (in percent)2 |

Non-sovereign issuers risk weight under section 217.32 (in percent) |

| |

Zero |

20

or 50 |

100 |

20 |

50 |

100 |

| Less than or equal to 1 year |

0.5 |

1.0 |

15.0 |

1.0 |

2.0 |

4.0 |

4.0 |

| Greater than 1 year and less than or equal to

5 years |

2.0 |

3.0 |

15.0 |

4.0 |

6.0 |

8.0 |

12.0 |

| Greater than 5 years |

4.0 |

6.0 |

15.0 |

8.0 |

12.0 |

16.0 |

24.0 |

| Main index equities

(including convertible bonds) and gold |

15.0 |

| Other publicly traded

equities (including convertible bonds) |

25.0 |

| Mutual funds |

Highest

haircut applicable to any security in which the fund can invest |

| Cash collateral held |

Zero |

| Other exposure

types |

25.0 |

1 The market price volatility haircuts in Table

1 to section 217.37 are based on a 10 business-day holding period.

2 Includes a foreign PSE that receives a zero percent risk

weight.

(ii) For currency mismatches, a Board-regulated

institution must use a haircut for foreign exchange rate volatility

(Hfx) of 8.0 percent, as adjusted in certain circumstances

under paragraphs (c)(3)(iii) and (iv) of this section.

(iii) For repo-style transactions

and client-facing derivative transactions, a Board-regulated institution

may multiply the standard supervisory haircuts provided in paragraphs

(c)(3)(i) and (ii) of this section by the square root of ½ (which

equals 0.707107). For client-facing derivative transactions, if a

larger scaling factor is applied under section 217.34(f), the same

factor must be used to adjust the supervisory haircuts.

(iv) If the number of trades

in a netting set exceeds 5,000 at any time during a quarter, a Board-regulated

institution must adjust the supervisory haircuts provided in paragraphs

(c)(3)(i) and (ii) of this section upward on the basis of a holding

period of twenty business days for the following quarter except in

the calculation of the exposure amount for purposes of section 217.35.

If a netting set contains one or more trades involving illiquid collateral

or an OTC derivative that cannot be easily replaced, a Board-regulated

institution must adjust the supervisory haircuts upward on the basis

of a holding period of twenty business days. If over the two previous

quarters more than two margin disputes on a netting set have occurred

that lasted more than the holding period, then the Board-regulated

institution must adjust the supervisory haircuts upward for that netting

set on the basis of a holding period that is at least two times the

minimum holding period for that netting set. A Board-regulated institution

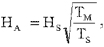

must adjust the standard supervisory haircuts upward using the following

formula:

Figure 1. DISPLAY EQUATION

$$

\mathrm{H_A = H_s \sqrt{\frac{T_M}{T_S}}} \text{ ,}

$$

where

(A) TM equals a holding period of longer than 10 business

days for eligible margin loans and derivative contracts other than

client-facing derivative transactions or longer than 5 business days

for repo-style transactions and client-facing derivative transactions;

(B) HS equals

the standard supervisory haircut; and

(C) TS equals 10 business days

for eligible margin loans and derivative contracts other than client-facing

derivative transactions or 5 business days for repo-style transactions

and client-facing derivative transactions.

(v) If the instrument a Board-regulated

institution has lent, sold subject to repurchase, or posted as collateral

does not meet the definition of financial collateral, the Board-regulated

institution must use a 25.0 percent haircut for market price volatility

(Hs).

(4) Own internal

estimates for haircuts. With the prior written approval of the

Board, a Board-regulated institution may calculate haircuts (Hs and Hfx) using its own internal estimates of

the volatilities of market prices and foreign exchange rates:

(i) To receive

Board approval to use its own internal estimates, a Board-regulated

institution must satisfy the following minimum standards:

(A) A Board-regulated

institution must use a 99th percentile one-tailed confidence interval.

(B) The minimum holding

period for a repo-style transaction and client-facing derivative transaction

is five business days and for an eligible margin loan and a derivative

contract other than a client-facing derivative transaction is ten

business days except for transactions or netting sets for which paragraph

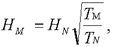

(c)(4)(i)(C) of this section applies. When a Board-regulated institution

calculates an own-estimates haircut on a TN-day holding

period, which is different from the minimum holding period for the

transaction type, the applicable haircut (HM) is calculated

using the following square root of time formula:

Figure 2. DISPLAY EQUATION

$$

H_M = H_N \sqrt{\frac{T_\mathrm{M}}{T_N}} \text{ ,}

$$

where

(1) TM equals 5 for repo-style

trans actions and client-facing derivative transactions and 10 for eligible

margin loans and derivative contracts other than client-facing derivative

transactions;

(2) TN equals the holding period used by the Board-regulated

institution to derive HN; and

(3) HN equals the haircut

based on the holding period TN.

(C) If the number of trades in a netting set

exceeds 5,000 at any time during a quarter, a Board-regulated institution

must calculate the haircut using a minimum holding period of twenty

business days for the following quarter except in the calculation

of the exposure amount for purposes of section 217.35. If a netting

set contains one or more trades involving illiquid collateral or an

OTC derivative that cannot be easily replaced, a Board-regulated institution

must calculate the haircut using a minimum holding period of twenty

business days. If over the two previous quarters more than two margin

disputes on a netting set have occurred that lasted more than the

holding period, then the Board-regulated institution must calculate

the haircut for transactions in that netting set on the basis of a

holding period that is at least two times the minimum holding period

for that netting set.

(D)

A Board-regulated institution is required to calculate its own internal

estimates with inputs calibrated to historical data from a continuous

12-month period that reflects a period of significant financial stress

appropriate to the security or category of securities.

(E) A Board-regulated institution

must have policies and procedures that describe how it determines

the period of significant financial stress used to calculate the Board-regulated

institution’s own internal estimates for haircuts under this section

and must be able to provide empirical support for the period used.

The Board-regulated institution must obtain the prior approval of

the Board for, and notify the Board if the Board-regulated institution

makes any material changes to, these policies and procedures.

(F) Nothing in this section prevents

the Board from requiring a Board-regulated institution to use a different

period of significant financial stress in the calculation of own internal

estimates for haircuts.

(G) A Board-regulated institution must update its data sets and calculate

haircuts no less frequently than quarterly and must also reassess

data sets and haircuts whenever market prices change materially.

(ii)

With respect to debt securities that are investment grade, a Board-regulated

institution may calculate haircuts for categories of securities. For

a category of securities, the Board-regulated institution must calculate

the haircut on the basis of internal volatility estimates for securities

in that category that are representative of the securities in that

category that the Board-regulated institution has lent, sold subject

to repurchase, posted as collateral, borrowed, purchased subject to

resale, or taken as collateral. In determining relevant categories,

the Board-regulated institution must at a minimum take into account:

(A) The type of issuer of the security;

(B) The credit quality of the security;

(C) The maturity of the

security; and

(D) The

interest rate sensitivity of the security.

(iii) With respect to debt

securities that are not investment grade and equity securities, a

Board-regulated institution must calculate a separate haircut for

each individual security.

(iv) Where an exposure or collateral

(whether in the form of cash or securities) is denominated in a currency

that differs from the settlement currency, the Board-regulated institution

must calculate a separate currency mismatch haircut for its net position

in each mismatched currency based on estimated volatilities of foreign

exchange rates between the mismatched currency and the settlement

currency.

(v) A

Board-regulated institution’s own estimates of market price and foreign

exchange rate volatilities may not take into account the correlations

among securities and foreign exchange rates on either the exposure

or collateral side of a transaction (or netting set) or the

correlations among securities and foreign exchange rates between the

exposure and collateral sides of the transaction (or netting set).