(1) Risk-weighted

assets for cleared transactions.

(i) To determine the

risk-weighted asset amount for a cleared transaction, a Board-regulated

institution that is a clearing member client must multiply the trade

exposure amount for the cleared transaction, calculated in accordance

with paragraph (b)(2) of this section, by the risk weight appropriate

for the cleared transaction, determined in accordance with paragraph

(b)(3) of this section.

(ii) A clearing member client Board-regulated institution’s

total risk-weighted assets for cleared transactions is the sum of

the risk-weighted asset amounts for all of its cleared transactions.

(2) Trade exposure amount.

(i) For

a cleared transaction that is a derivative contract or a netting set

of derivative contracts, trade exposure amount equals the EAD for

the derivative contract or netting set of derivative contracts calculated

using the methodology used to calculate EAD for derivative contracts

set forth in section 217.132(c) or (d), plus the fair value of the

collateral posted by the clearing member client Board-regulated institution

and held by the CCP or a clearing member in a manner that is not bankruptcy

remote. When the Board-regulated institution calculates EAD for the

cleared transaction using the methodology in section 217.132(d), EAD

equals EADunstressed.

(ii) For a cleared transaction that

is a repo-style transaction or netting set of repo-style transactions,

trade exposure amount equals the EAD for the repo-style transaction

calculated using the methodology set forth in section 217.132(b)(2)

or (3) or (d), plus the fair value of the collateral posted by the

clearing member client Board-regulated institution and held by the

CCP or a clearing member in a manner that is not bankruptcy remote.

When the Board-regulated institution calculates EAD for the cleared

transaction under section 217.132(d), EAD equals EADunstressed.

(3) Cleared transaction risk weights.

(i) For

a cleared transaction with a QCCP, a clearing member client Board-regulated

institution must apply a risk weight of:

(A) 2 percent if the collateral

posted by the Board-regulated institution to the QCCP or clearing

member is subject to an arrangement that prevents any loss to the

clearing member client Board-regulated institution due to the joint

default or a concurrent insolvency, liquidation, or receivership proceeding

of the clearing member and any other clearing member clients of the

clearing member; and the clearing member client Board-regulated institution

has conducted sufficient legal review to conclude with a well-founded

basis (and maintains sufficient written documentation of that legal

review) that in the event of a legal challenge (including one resulting

from an event of default or from liquidation, insolvency, or receivership

proceedings) the relevant court and administrative authorities would

find the arrangements to be legal, valid, binding, and enforceable

under the law of the relevant jurisdictions.

(B) 4 percent, if the requirements of paragraph

(b)(3)(i)(A) of this section are not met.

(ii) For a cleared transaction

with a CCP that is not a QCCP, a clearing member client Board-regulated

institution must apply the risk weight applicable to the CCP under

subpart D of this part.

(4) Collateral.

(i) Notwithstanding any other requirement

of this section, collateral posted by a clearing member client Board-regulated

institution that is held by a custodian (in its capacity as a custodian)

in a manner that is bankruptcy remote from the CCP, clearing member,

and other clearing member clients of the clearing member, is not subject

to a capital requirement under this section.

(ii) A clearing member client Board-regulated

institution must calculate a risk-weighted asset amount for any collateral

provided to a CCP, clearing member or a custodian in connection with

a cleared transaction in accordance with requirements under subparts

E or F of this part, as applicable.

(1) Risk-weighted

assets for cleared transactions.

(i) To determine the

risk-weighted asset amount for a cleared transaction, a clearing member

Board-regulated institution must multiply the trade exposure amount

for the cleared transaction, calculated in accordance with paragraph

(c)(2) of this section by the risk weight appropriate for the cleared

transaction, determined in accordance with paragraph (c)(3) of this

section.

(ii) A clearing

member Board-regulated institution’s total risk-weighted assets

for cleared transactions is the sum of the risk-weighted asset amounts

for all of its cleared transactions.

(2) Trade exposure

amount. A clearing member Board-regulated institution must calculate

its trade exposure amount for a cleared transaction as follows:

(i) For a cleared transaction that is a derivative contract or a

netting set of derivative contracts, trade exposure amount equals

the EAD calculated using the methodology used to calculate EAD for

derivative contracts set forth in section 217.132(c) or (d), plus

the fair value of the collateral posted by the clearing member Board-regulated

institution and held by the CCP in a manner that is not bankruptcy

remote. When the clearing member Board-regulated institution calculates

EAD for the cleared transaction using the methodology in section 217.132(d),

EAD equals EADunstressed.

(ii) For a cleared transaction that

is a repo-style transaction or netting set of repo-style transactions,

trade exposure amount equals the EAD calculated under section 217.132(b)(2)

or (3) or (d), plus the fair value of the collateral posted by the

clearing member Board-regulated institution and held by the CCP in

a manner that is not bankruptcy remote. When the clearing member Board-regulated

institution calculates EAD for the cleared transaction under section

217.132(d), EAD equals EADunstressed.

(3) Cleared transaction risk weights.

(i) A clearing member

Board-regulated institution must apply a risk weight of 2 percent

to the trade exposure amount for a cleared transaction with a QCCP.

(ii) For a cleared

transaction with a CCP that is not a QCCP, a clearing member Board-regulated

institution must apply the risk weight applicable to the CCP according

to subpart D of this part.

(iii) Notwithstanding paragraphs (c)(3)(i)

and (ii) of this section, a clearing member Board-regulated institution

may apply a risk weight of zero percent to the trade exposure amount

for a cleared transaction with a QCCP where the clearing member Board-regulated

institution is acting as a financial intermediary on behalf of a clearing

member client, the transaction offsets another transaction that satisfies

the requirements set forth in section 217.3(a), and the clearing member

Board-regulated institution is not obligated to reimburse the clearing

member client in the event of the QCCP default.

(4) Collateral.

(i) Notwithstanding any other requirement

of this section, collateral posted by a clearing member Board-regulated

institution that is held by a custodian (in its capacity

as a custodian) in a manner that is bankruptcy remote from the CCP,

clearing member, and other clearing member clients of the clearing

member, is not subject to a capital requirement under this section.

(ii) A clearing member

Board-regulated institution must calculate a risk-weighted asset amount

for any collateral provided to a CCP, clearing member or a custodian

in connection with a cleared transaction in accordance with requirements

under subparts E or F of this part, as applicable.

(1) General requirement. A clearing member Board-regulated institution must determine the

risk-weighted asset amount for a default fund contribution to a CCP

at least quarterly, or more frequently if, in the opinion of the Board-regulated

institution or the Board, there is a material change in the financial

condition of the CCP.

(2) Risk-weighted asset amount for default

fund contributions to nonqualifying CCPs. A clearing member Board-regulated

institution’s risk-weighted asset amount for default fund contributions

to CCPs that are not QCCPs equals the sum of such default fund contributions

multiplied by 1,250 percent, or an amount determined by the Board,

based on factors such as size, structure, and membership characteristics

of the CCP and riskiness of its transactions, in cases where such

default fund contributions may be unlimited.

(3) Risk-weighted

asset amount for default fund contributions to QCCPs. A clearing

member Board-regulated institution’s risk-weighted asset amount

for default fund contributions to QCCPs equals the sum of its capital

requirement, KCM for each QCCP, as calculated under the

methodology set forth in paragraph (d)(4) of this section, multiplied

by 12.5.

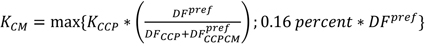

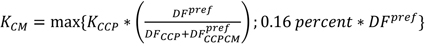

(4) Capital requirement for default fund contributions

to a QCCP. A clearing member Board-regulated institution’s

capital requirement for its default fund contribution to a QCCP (KCM) is equal to:

Figure 1. DISPLAY EQUATION

$$

K_{CM}=max \{ K_{CCP}\ast \Bigg( \frac{DF^{pref}}{DF_{CCP}+DF_{CCPCM}^{pref}} \Bigg) ;\text{0.16 }percent\ast DF^{pref} \}

$$

Where:

KCCP is the hypothetical capital requirement of the QCCP, as determined

under paragraph (d)(5) of this section;

DFpref is the

prefunded default fund contribution of the clearing member Board regulated

institution to the QCCP;

DFCCP is the QCCP’s own prefunded

amounts that are contributed to the default waterfall and are junior

or pari passu with prefunded default fund contributions of

clearing members of the QCCP; and

$$

+DF_{pref}^{CCPCM} \small{{\text{ is the total prefunded default fund contributions from clearing members of the QCCP to the QCCP.})

$$

(5) Hypothetical capital requirement of

a QCCP. Where a QCCP has provided its KCCP, a Board-regulated institution must rely on such disclosed

figure instead of calculating KCCP under

this paragraph (d)(5), unless the Board-regulated institution determines

that a more conservative figure is appropriate based on the nature,

structure, or characteristics of the QCCP. The hypothetical capital

requirement of a QCCP (KCCP), as determined

by the Board-regulated institution, is equal to:

Figure 2. DISPLAY EQUATION

$$

K_{CCP}= \sum\nolimits _{CM_{i}}^{}EAD_{i}\ast \text{1.6 }percent

$$

Where:

CMi is each clearing member of the QCCP; and

EADi is the exposure

amount of the QCCP to each clearing member of the QCCP, as determined

under paragraph (d)(6) of this section.

(6) EAD of a

QCCP to a clearing member.

(i) The EAD of a QCCP to

a clearing member is equal to the sum of the EAD for derivative contracts

determined under paragraph (d)(6)(ii) of this section and the EAD

for repo-style transactions determined under paragraph (d)(6)(iii)

of this section.

(ii) With respect to any derivative contracts between the QCCP and

the clearing member that are cleared transactions and any guarantees

that the clearing member has provided to the QCCP with respect to

performance of a clearing member client on a derivative contract, the

EAD is equal to the exposure amount of the QCCP to the clearing member

for all such derivative contracts and guarantees of derivative contracts

calculated under SA-CCR in section 217.132(c) (or, with respect to

a QCCP located outside the United States, under a substantially identical

methodology in effect in the jurisdiction) using a value of 10 business

days for purposes of section 217.132(c)(9)(iv); less the value of

all collateral held by the QCCP posted by the clearing member or a

client of the clearing member in connection with a derivative contract

for which the clearing member has provided a guarantee to the QCCP

and the amount of the prefunded default fund contribution of the clearing

member to the QCCP.

(iii) With respect to any repo-style transactions between the QCCP

and a clearing member that are cleared transactions, EAD is equal

to:

Figure 3. DISPLAY EQUATION

$$

EAD_i=max \{ EBRM_i-IM_i-DF_i;0 \}

$$

Where:

EBRMi is the exposure amount of the QCCP to each clearing member

for all repo-style transactions between the QCCP and the clearing

member, as determined under section 217.132(b)(2) and without recognition

of the initial margin collateral posted by the clearing member to

the QCCP with respect to the repo-style transactions or the prefunded

default fund contribution of the clearing member institution to the

QCCP;

IMi is the initial margin collateral posted by each clearing

member to the QCCP with respect to the repo-style transactions;

and

DFi is the prefunded default fund contribution of each

clearing member to the QCCP that is not already deducted in

paragraph (d)(6)(ii) of this section.

(iv) EAD must be calculated separately

for each clearing member’s sub-client accounts and sub-house

account (i.e., for the clearing member’s proprietary activities).

If the clearing member’s collateral and its client’s collateral

are held in the same default fund contribution account, then the EAD

of that account is the sum of the EAD for the client-related transactions

within the account and the EAD of the house-related transactions within

the account. For purposes of determining such EADs, the independent

collateral of the clearing member and its client must be allocated

in proportion to the respective total amount of independent collateral

posted by the clearing member to the QCCP.

(v) If any account or sub-account contains

both derivative contracts and repo-style transactions, the EAD of

that account is the sum of the EAD for the derivative contracts within

the account and the EAD of the repo-style transactions within the

account. If independent collateral is held for an account containing

both derivative contracts and repo-style transactions, then such collateral

must be allocated to the derivative contracts and repo-style transactions

in proportion to the respective product specific exposure amounts,

calculated, excluding the effects of collateral, according to section

217.132(b) for repo-style transactions and to section 217.132(c)(5)

for derivative contracts.

(vi) Notwithstanding any other provision

of paragraph (d) of this section, with the prior approval of the Board,

a Board-regulated institution may determine the risk-weighted asset

amount for a default fund contribution to a QCCP according to section

217.35(d)(3)(ii).