(a) General. Under the SRWA, a Board-regulated institution’s total

risk-weighted assets for equity exposures equals the sum of the risk-weighted

asset amounts for each of the Board-regulated institution’s individual

equity exposures (other than equity exposures to an investment fund)

as determined under this section and the risk-weighted asset amounts

for each of the Board-regulated institution’s individual equity exposures

to an investment fund as determined under section 217.53.

(b) SRWA computation for individual

equity exposures. A Board-regulated institution must determine

the risk-weighted asset amount for an individual equity exposure (other

than an equity exposure to an investment fund) by multiplying the

adjusted carrying value of the equity exposure or the effective portion

and ineffective portion of a hedge pair (as defined in paragraph (c)

of this section) by the lowest applicable risk weight in this paragraph

(b).

(1) Zero percent

risk weight equity exposures. An equity exposure to a sovereign,

the Bank for International Settlements, the European Central Bank,

the European Commission, the International Monetary Fund, the European

Stability Mechanism, the European Financial Stability Facility, an

MDB, and any other entity whose credit exposures receive a zero percent

risk weight under section 217.32 may be assigned a zero percent risk

weight.

(2) 20 percent risk weight equity exposures. An equity exposure to a PSE, Federal Home Loan Bank or the Federal

Agricultural Mortgage Corporation (Farmer Mac) must be assigned a

20 percent risk weight.

(3) 100 percent risk weight equity exposures. The equity exposures set forth in this paragraph (b)(3) must be

assigned a 100 percent risk weight.

(i) Community development equity exposures.

(A) For state

member banks and bank holding companies, an equity exposure that qualifies

as a community development investment under 12 U.S.C. 24 (Eleventh),

excluding equity exposures to an unconsolidated small business investment

company and equity exposures held through a consolidated small business

investment company described in section 302 of the Small Business

Investment Act of 1958 (15 U.S.C. 682).

(B) For savings and loan holding companies,

an equity exposure that is designed primarily to promote community

welfare, including the welfare of low- and moderate-income communities

or families, such as by providing services or employment, and excluding

equity exposures to an unconsolidated small business investment company

and equity exposures held through a small business investment company

described in section 302 of the Small Business Investment Act of 1958

(15 U.S.C. 682).

(ii) Effective

portion of hedge pairs. The effective portion of a hedge pair.

(iii) Non-significant equity exposures. Equity

exposures, excluding significant investments in the capital of an

unconsolidated financial institution in the form of common stock and

exposures to an investment firm that would meet the definition of

a traditional securitization were it not for the application of paragraph

(8) of that definition in section 217.2 and has greater than immaterial

leverage, to the extent that the aggregate adjusted carrying value

of the exposures does not exceed 10 percent of the Board-regulated

institution’s total capital.

(A) To compute the aggregate

adjusted carrying value of a Board-regulated institution’s equity

exposures for purposes of this section, the Board-regulated institution

may exclude equity exposures described in paragraphs (b)(1), (b)(2),

(b)(3)(i), and (b)(3)(ii) of this section, the equity exposure in

a hedge pair with the smaller adjusted carrying value, and a proportion

of each equity exposure to an investment fund equal to the proportion

of the assets of the investment fund that are not equity exposures

or that meet the criterion of paragraph (b)(3)(i) of this section.

If a Board-regulated institution does not know the actual holdings

of the investment fund, the Board-regulated institution may calculate

the proportion of the assets of the fund that are not equity exposures

based on the terms of the prospectus, partnership agreement, or similar

contract that defines the fund’s permissible investments. If the sum

of the investment limits for all exposure classes within the fund

exceeds 100 percent, the Board-regulated institution must assume for

purposes of this section that the investment fund invests to the maximum

extent possible in equity exposures.

(B) When determining which of a Board-regulated

institution’s equity exposures qualify for a 100 percent risk weight

under this paragraph (b), a Board-regulated institution first must

include equity exposures to unconsolidated small business investment

companies or held through consolidated small business investment companies

described in section 302 of the Small Business Investment Act, then

must include publicly traded equity exposures (including those held

indirectly through investment funds), and then must include non-publicly

traded equity exposures (including those held indirectly through investment

funds).

(4) 250 percent risk weight equity exposures. Significant investments in the capital of unconsolidated financial

institutions in the form of common stock that are not deducted from

capital pursuant to section 217.22(d)(2) are assigned a 250 percent

risk weight.

(5) 300 percent

risk weight equity exposures. A publicly traded equity exposure

(other than an equity exposure described in paragraph (b)(7) of this

section and including the ineffective portion of a hedge pair) must

be assigned a 300 percent risk weight.

(6) 400 percent

risk weight equity exposures. An equity exposure (other than

an equity exposure described in paragraph (b)(7)) of this section

that is not publicly traded must be assigned a 400 percent risk weight.

(7) 600 percent risk weight equity exposures. An equity exposure

to an investment firm must be assigned a 600 percent risk weight,

provided that the investment firm:

(i) Would meet the definition

of a traditional securitization were it not for the application of

paragraph (8) of that definition; and

(ii) Has greater than immaterial leverage.

(c) Hedge transactions.

(1) Hedge pair. A hedge pair is two equity exposures that form an effective hedge

so long as each equity exposure is publicly traded or has a return

that is primarily based on a publicly traded equity exposure.

(2) Effective hedge. Two equity exposures form an effective hedge

if the exposures either have the same remaining maturity or each has

a remaining maturity of at least three months; the hedge relationship

is formally documented in a prospective manner (that is, before the

Board-regulated institution acquires at least one of the equity exposures);

the documentation specifies the measure of effectiveness (E) the Board-regulated

institution will use for the hedge relationship throughout the life

of the transaction; and the hedge relationship has an E greater than

or equal to 0.8. A Board-regulated institution must measure E at least

quarterly and must use one of three alternative measures of E as set

forth in this paragraph (c).

(i) Under the dollar-offset method of

measuring effectiveness, the Board-regulated institution must determine

the ratio of value change (RVC). The RVC is the ratio of the cumulative

sum of the changes in value of one equity exposure to the cumulative

sum of the changes in the value of the other equity exposure. If RVC

is positive, the hedge is not effective and E equals 0. If RVC is

negative and greater than or equal to −1 (that is, between zero and

−1), then E equals the absolute value of RVC. If RVC is negative and

less than −1, then E equals 2 plus RVC.

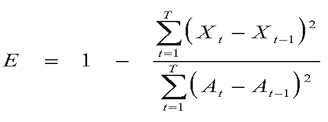

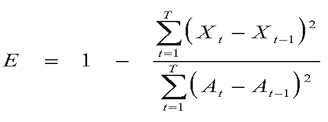

(ii) Under the variability-reduction

method of measuring effectiveness:

Figure 1. DISPLAY EQUATION

$$

E = 1 - \frac{\displaystyle\sum_{t=1}^{T}\big(X_t - X_{t-1}\big)^2}

{\displaystyle\sum_{t=1}^{T}\big(A_t - A_{t-1}\big)^2}

$$

where

(A) X i = A i − B t ;

(B) A t = the value at time t of one exposure in

a hedge pair; and

(C) B t = the value at time t of the other exposure

in a hedge pair.

(iii) Under the regression method of

measuring effectiveness, E equals the coefficient of determination

of a regression in which the change in value of one exposure in a

hedge pair is the dependent variable and the change in value of the

other exposure in a hedge pair is the independent variable. However,

if the estimated regression coefficient is positive, then E equals

zero.

(3)

The effective portion of a hedge pair is E multiplied by the greater

of the adjusted carrying values of the equity exposures forming a

hedge pair.

(4) The

ineffective portion of a hedge pair is (1-E) multiplied by the greater

of the adjusted carrying values of the equity exposures forming a

hedge pair.