(a) Scaling specified by the Board.

(1) Scaling between

the U.S. Federal banking capital rules and NAIC RBC.

(i) Scaling

capital requirement. When calculating the building block capital

requirement for a building block parent in accordance with section

217.607, where the indicated capital framework is NAIC RBC or the

U.S. Federal banking capital rules, and where the indicated capital

framework of the appropriate downstream building block parent is NAIC

RBC or the U.S. Federal banking capital rules, the capital requirement

scaling modifier is provided by table 1 to this paragraph (a)(1)(i).

Table 1 to

paragraph (a)(1)(i)—Capital requirement scaling modifiers for

NAIC RBC and the U.S. federal banking capital rules

| |

Upstream building block parent’s indicated capital

framework: |

| NAIC RBC |

U.S. federal banking capital rules |

| Downstream building block parent’s indicated capital framework: |

|

|

| U.S. federal banking capital

rules |

0.0106 |

1 |

| NAIC RBC |

1 |

94.3 |

(ii) Scaling

available capital. When calculating the building block available

capital for a building block parent in accordance with section 217.608,

where the indicated capital framework is NAIC RBC or the U.S. Federal

banking capital rules, and where the indicated capital framework of

the appropriate downstream building block parent is NAIC RBC or the

U.S. Federal banking capital rules, the available capital scaling

modifier is provided by table 2 to this paragraph (a)(1)(ii).

Table 2 to paragraph

(a)(1)(ii)—Available capital scaling modifiers for NAIC RBC

and the U.S. federal banking capital rules

| |

Upstream building block parent’s indicated capital

framework: |

| NAIC RBC |

U.S. federal banking capital rules |

| Downstream building block parent’s indicated capital framework: |

|

|

| U.S. federal banking capital rules |

Recalculated building block capital requirement * 0.063 |

0 |

| NAIC RBC |

0 |

Recalculated building block capital requirement * 5.9 |

| Capital framework: |

|

|

| NAIC RBC |

0 |

Recalculated building block capital requirement * 5.9 |

(2) Scaling to

determine BBA ratio. For purposes of determining the BBA ratio

under section 217.603(b)—

(i) A depository institution

holding company for which the indicated capital framework is the U.S.

Federal banking capital rules scales its building block available

capital and building block capital requirement the common capital

framework by using the methods described in paragraphs (a)(1) of this

section. For purposes of scaling under this paragraph (a)(2)(i), the

downstream building block parent’s indicated capital framework

is the U.S. Federal banking capital rules and the upstream building

block parent’s indicated capital framework is NAIC RBC; and

(ii) A depository institution

holding company for which the indicated capital framework is NAIC

RBC does not scale its building block available capital or building

block capital requirement.

(b) Scaling not specified by the Board

but framework is scalar compatible. Where a scaling modifier

to be used in section 217.607 or section 217.608 is not specified

in paragraph (a) of this section, and the building block parent’s

indicated capital framework (i.e., jurisdictional capital framework)

is scalar compatible, a building block parent determines the scaling

modifier as follows:

(1) Definitions. For purposes of this section, the following definitions apply:

(i) Jurisdictional intervention point. The jurisdictional

intervention point is the capital level, under the laws of the jurisdiction

for its domestic insurers, at which the supervisory authority in the

jurisdiction may intervene as to a company subject its capital framework

by imposing restrictions on distributions and discretionary bonus

payments by the company or, if no such intervention may occur in a

jurisdiction, then the capital level at which the supervisory authority

would first have the authority to take action against a company based

on its capital level.

(ii) Jurisdiction adjustment. The jurisdictional adjustment

is the risk adjustment set forth in table 3 to this paragraph (b)(1)(ii),

based on the country risk classification set by the Organization for

Economic Cooperation and Development (OECD) for the jurisdiction.

This adjustment is applied to the jurisdictional intervention point.

Table 3 to paragraph

(b)(1)(ii)—Jurisdictional adjustments by OECD country risk classification

| OECD CRC |

Jurisdictional adjustment (percent) |

| 0-1, including jurisdictions with no OECD country risk classification |

0 |

| 2 |

20 |

| 3 |

50 |

| 4-6 |

100 |

| 7 |

150 |

(2) Scaling capital

requirement. When calculating the building block capital requirement

for a building block parent in accordance with section 217.607, where

the indicated capital framework of the appropriate downstream building

block parent is a scalar-compatible framework for which the Board

has not specified a capital requirement scaling modifier, the capital

requirement scaling modifier is calculated according to the following

formula:

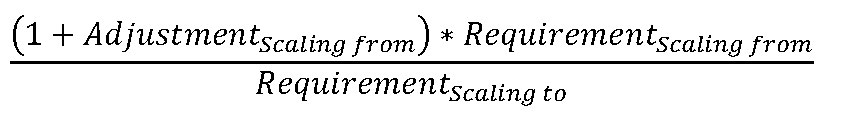

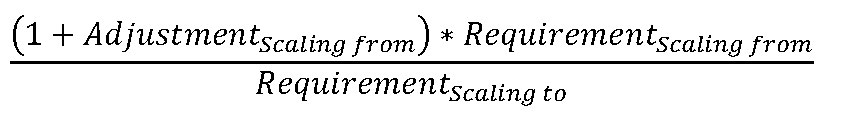

Figure 1. DISPLAY EQUATION

$$

\frac{(1 + \textit{Adjustment}_\textit{Scaling from}) * \textit{Requirement}_\textit{Scaling from}}

{ \textit{Requirement}_\textit{Scaling to} }

$$

Where:

Adjustmentscaling from is equal to the jurisdictional adjustment

of the downstream building block parent;

Requirementscaling from is equal to the jurisdictional intervention point of the downstream

building block parent; and

Requirementscaling to is equal to the jurisdictional intervention point of the upstream

building block parent.

(3) Scaling available

capital. When calculating the building block available capital

for a building block parent in accordance with section 217.608, where

the indicated capital framework of the appropriate downstream building

block parent is a scalar-compatible framework for which the Board

has not specified an available capital scaling modifier, the available

capital scaling modifier is equal to zero.