(1) Instead of an LGD estimation methodology,

a Board-regulated institution may use the following methodologies

to recognize the benefits of financial collateral in mitigating the

counterparty credit risk of repo-style transactions, eligible margin

loans, collateralized OTC derivative contracts and single product

netting sets of such transactions, and to recognize the benefits of

any collateral in mitigating the counterparty credit risk of repo-style

transactions that are included in a Board-regulated institution’s

VaR-based measure under subpart F of this part:

(i) The

collateral haircut approach set forth in paragraph (b)(2) of this

section;

(ii) The

internal models methodology set forth in paragraph (d) of this section;

and

(iii) For single

product netting sets of repo-style transactions and eligible margin

loans, the simple VaR methodology set forth in paragraph (b)(3) of

this section.

(2) A Board-regulated institution may use

any combination of the three methodologies for collateral recognition;

however, it must use the same methodology for transactions in the

same category.

(3) A

Board-regulated institution must use the methodology in paragraph

(c) of this section, or with prior written approval of the Board,

the internal model methodology in paragraph (d) of this section, to

calculate EAD for an OTC derivative contract or a set of OTC derivative

contracts subject to a qualifying master netting agreement. To estimate

EAD for qualifying cross-product master netting agreements, a Board-regulated

institution may only use the internal models methodology in paragraph

(d) of this section.

(4) A Board-regulated institution must also use the methodology in

paragraph (e) of this section to calculate the risk-weighted asset

amounts for CVA for OTC derivatives.

(1) General. A Board-regulated institution may recognize the credit risk mitigation

benefits of financial collateral that secures an eligible margin loan,

repo-style transaction, or single-product netting set of such transactions

by factoring the collateral into its LGD estimates for the exposure.

Alternatively, a Board-regulated institution may estimate an unsecured

LGD for the exposure, as well as for any repo-style transaction that

is included in the Board-regulated institution’s VaR-based measure

under subpart F of this part, and determine the EAD of the exposure

using:

(i) The collateral haircut approach

described in paragraph (b)(2) of this section;

(ii) For netting sets only,

the simple VaR methodology described in paragraph (b)(3) of this section;

or

(iii) The internal

models methodology described in paragraph (d) of this section.

(2) Collateral haircut approach.

(i) EAD equation. A Board-regulated institution

may determine EAD for an eligible margin loan, repo-style transaction,

or netting set by setting EAD equal to max {0, [(∑E − ∑C) + ∑(Es × Hs) + ∑(Efx × Hfx)]},

where:

(A) ∑E equals the value of the exposure (the

sum of the current fair values of all instruments, gold, and cash

the Board-regulated institution has lent, sold subject to repurchase,

or posted as collateral to the counterparty under the transaction

(or netting set));

(B)

∑C equals the value of the collateral (the sum of the current fair

values of all instruments, gold, and cash the Board-regulated institution

has borrowed, purchased subject to resale, or taken as collateral

from the counterparty under the transaction (or netting set));

(C) Es equals

the absolute value of the net position in a given instrument or in

gold (where the net position in a given instrument or in gold equals

the sum of the current fair values of the instrument or gold the Board-regulated

institution has lent, sold subject to repurchase, or posted as collateral

to the counterparty minus the sum of the current fair values of that

same instrument or gold the Board-regulated institution has borrowed,

purchased subject to resale, or taken as collateral from the counterparty);

(D) Hs equals

the market price volatility haircut appropriate to the instrument

or gold referenced in Es;

(E) Efx equals the absolute value

of the net position of instruments and cash in a currency that is

different from the settlement currency (where the net position in

a given currency equals the sum of the current fair values of any

instruments or cash in the currency the Board-regulated institution

has lent, sold subject to repurchase, or posted as collateral to the

counterparty minus the sum of the current fair values of any instruments

or cash in the currency the Board-regulated institution has borrowed,

purchased subject to resale, or taken as collateral from the counterparty);

and

(F) Hfx equals

the haircut appropriate to the mismatch between the currency referenced

in Efx and the settlement currency.

(ii) Standard supervisory haircuts.

(A) Under the

standard supervisory haircuts approach:

(1) A Board-regulated institution must use the haircuts for

market price volatility (Hs) in Table 1 to section 217.132,

as adjusted in certain circumstances as provided in paragraphs (b)(2)(ii)(A)(3) and (4) of this section;

Table 1 to section

217.132—Standard supervisory market price volatility haircuts

| |

Haircut (in percent) assigned based on: |

Investment grade securitization exposures

(in percent) |

| Residual maturity |

Sovereign issuers risk weight under section 217.1322 (in percent) |

Non-sovereign issuers risk weight under section

217.132 (in percent) |

| Less than or

equal to 1 year |

0.5 |

1.0 |

15.0 |

1.0 |

2.0 |

4.0 |

4.0 |

| Greater than

1 year and less than or equal to 5 years |

2.0 |

3.0 |

15.0 |

4.0 |

6.0 |

8.0 |

12.0 |

| Greater than

5 years |

4.0 |

6.0 |

15.0 |

8.0 |

12.0 |

16.0 |

24.0 |

| Main index equities

(including convertible bonds) and gold |

15.0 |

| Other publicly traded

equities (including convertible bonds) |

25.0 |

| Mutual funds |

Highest

haircut applicable to any security in which the fund can invest. |

| Cash collateral held |

Zero |

| Other exposure

types |

25.0 |

1 The market price volatility haircuts in Table 1 to section

217.132 are based on a 10 business-day holding period.

2 Includes

a foreign PSE that receives a zero percent risk weight.

(2) For currency mismatches,

a Board-regulated institution must use a haircut for foreign exchange

rate volatility (Hfx) of 8 percent, as adjusted in certain

circumstances as provided in paragraphs (b)(2)(ii)(A)(3) and

(4) of this section.

(3) For repo-style transactions and client-facing derivative

transactions, a Board-regulated institution may multiply the supervisory

haircuts provided in paragraphs (b)(2)(ii)(A)(1) and (2) of this section by the square root of ½ (which equals 0.707107).

If the Board-regulated institution determines that a longer holding

period is appropriate for client-facing derivative transactions, then

it must use a larger scaling factor to adjust for the longer holding

period pursuant to paragraph (b)(2)(ii)(A)(6) of this section.

(4) A Board-regulated

institution must adjust the supervisory haircuts upward on the basis

of a holding period longer than ten business days (for eligible margin

loans) or five business days (for repo-style transactions), using

the formula provided in paragraph (b)(2)(ii)(A)(6) of this

section where the conditions in this paragraph (b)(2)(ii)(A)(4) apply. If the number of trades in a netting set exceeds 5,000 at

any time during a quarter, a Board-regulated institution must adjust

the supervisory haircuts upward on the basis of a minimum holding

period of twenty business days for the following quarter (except when

a Board-regulated institution is calculating EAD for a cleared transaction

under section 217.133). If a netting set contains one or more trades

involving illiquid collateral, a Board-regulated institution must

adjust the supervisory haircuts upward on the basis of a minimum holding

period of twenty business days. If over the two previous quarters

more than two margin disputes on a netting set have occurred that

lasted longer than the holding period, then the Board-regulated institution

must adjust the supervisory haircuts upward for that netting set on

the basis of a minimum holding period that is at least two times the

minimum holding period for that netting set.

(5)(i) A Board-regulated

institution must adjust the supervisory haircuts upward on the basis

of a holding period longer than ten business days for collateral

associated with derivative contracts (five business days for client-facing

derivative contracts) using the formula provided in paragraph (b)(2)(ii)(A)(6) of this section where the conditions in this paragraph (b)(2)(ii)(A)(5)(i) apply. For collateral associated with a derivative

contract that is within a netting set that is composed of more than

5,000 derivative contracts that are not cleared transactions, a Board-regulated

institution must use a minimum holding period of twenty business days.

If a netting set contains one or more trades involving illiquid collateral

or a derivative contract that cannot be easily replaced, a Board-regulated

institution must use a minimum holding period of twenty business days.

(ii) Notwithstanding

paragraph (b)(2)(ii)(A)(1) or (3) or (b)(2)(ii)(A)(5)(i) of this section, for collateral associated with

a derivative contract in a netting set under which more than two margin

disputes that lasted longer than the holding period occurred during

the two previous quarters, the minimum holding period is twice the

amount provided under paragraph (b)(2)(ii)(A)(1) or (3) or (b)(2)(ii)(A)(5)(i) of this section.

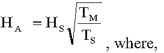

(6) A Board-regulated

institution must adjust the standard supervisory haircuts upward,

pursuant to the adjustments provided in paragraphs (b)(2)(ii)(A)(3) through (5) of this section, using the following formula:

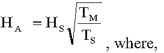

Figure 1. DISPLAY EQUATION

$$

H_{A}=H_{S}\sqrt[]{\frac{T_{M}}{T_{S}}}

$$

Where:

TM equals a holding

period of longer than 10 business days for eligible margin loans and

derivative contracts other than client-facing derivative transactions

or longer than 5 business days for repo-style transactions and client-facing

derivative transactions;

HS equals the standard supervisory haircut; and

TS equals 10 business

days for eligible margin loans and derivative contracts other than

client-facing derivative transactions or 5 business days for repo-style

transactions and client-facing derivative transactions.

(7) If the instrument

a Board-regulated institution has lent, sold subject to repurchase,

or posted as collateral does not meet the definition of financial

collateral, the Board-regulated institution must use a 25.0 percent

haircut for market price volatility (HS).

(iii) Own internal estimates for haircuts. With

the prior written approval of the Board, a Board-regulated institution

may calculate haircuts (Hs and Hfx) using its

own internal estimates of the volatilities of market prices and foreign

exchange rates.

(A) To receive Board approval to use its own

internal estimates, a Board-regulated institution must satisfy the

following minimum quantitative standards:

(1) A Board-regulated institution must use a 99th percentile

one-tailed confidence interval.

(2) The minimum holding period for

a repo-style transaction is five business days and for an eligible

margin loan is ten business days except for transactions or netting

sets for which paragraph (b)(2)(iii)(A)(3) of this section

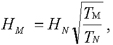

applies. When a Board-regulated institution calculates an own-estimates

haircut on a TN -day holding period, which is different

from the minimum holding period for the transaction type, the applicable

haircut (HM) is calculated using the following square root

of time formula:

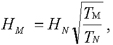

Figure 2. DISPLAY EQUATION

$$

H_M = H_N \sqrt{\frac{T_M}{T_N}} \text{ , }

$$

where

(i) TM equals 5 for repo-style

transactions and 10 for eligible margin loans;

(ii) TN equals the holding

period used by the Board-regulated institution to derive HN; and

(iii) HN equals the haircut based on the holding period TN.

(3) If the number of trades in a netting set exceeds 5,000 at

any time during a quarter, a Board-regulated institution must calculate

the haircut using a minimum holding period of twenty business days

for the following quarter (except when a Board-regulated institution

is calculating EAD for a cleared transaction under section 217.133).

If a netting set contains one or more trades involving illiquid collateral

or an OTC derivative that cannot be easily replaced, a Board-regulated

institution must calculate the haircut using a minimum holding period

of twenty business days. If over the two previous quarters more than

two margin disputes on a netting set have occurred that lasted more

than the holding period, then the Board-regulated institution must

calculate the haircut for transactions in that netting set on the

basis of a holding period that is at least two times the minimum holding

period for that netting set.

(4) A Board-regulated institution

is required to calculate its own internal estimates with inputs calibrated

to historical data from a continuous 12-month period that reflects

a period of significant financial stress appropriate to the security

or category of securities.

(5) A Board-regulated institution must have policies and procedures

that describe how it determines the period of significant financial

stress used to calculate the Board-regulated institution’s own internal

estimates for haircuts under this section and must be able to provide

empirical support for the period used. The Board-regulated institution

must obtain the prior approval of the Board for, and notify the Board

if the Board-regulated institution makes any material changes to,

these policies and procedures.

(6) Nothing in this section prevents

the Board from requiring a Board-regulated institution to use a different

period of significant financial stress in the calculation of own internal

estimates for haircuts.

(7) A Board-regulated institution must update its data sets

and calculate haircuts no less frequently than quarterly and must

also reassess data sets and haircuts whenever market prices change

materially.

(B) With respect to debt securities that are investment grade, a

Board-regulated institution may calculate haircuts for categories

of securities. For a category of securities, the Board-regulated institution

must calculate the haircut on the basis of internal volatility estimates

for securities in that category that are representative of the securities

in that category that the Board-regulated institution has lent, sold

subject to repurchase, posted as collateral, borrowed, purchased subject

to resale, or taken as collateral. In determining relevant categories,

the Board-regulated institution must at a minimum take into account:

(1) The type of issuer of the security;

(2) The credit quality

of the security;

(3) The maturity of the security; and

(4) The interest rate sensitivity

of the security.

(C) With respect to debt securities that are

not investment grade and equity securities, a Board-regulated institution

must calculate a separate haircut for each individual security.

(D) Where an exposure or

collateral (whether in the form of cash or securities) is denominated

in a currency that differs from the settlement currency, the Board-regulated

institution must calculate a separate currency mismatch haircut for

its net position in each mismatched currency based on estimated volatilities

of foreign exchange rates between the mismatched currency and the

settlement currency.

(E)

A Board-regulated institution’s own estimates of market price and

foreign exchange rate volatilities may not take into account the correlations

among securities and foreign exchange rates on either the exposure

or collateral side of a transaction (or netting set) or the correlations

among securities and foreign exchange rates between the exposure and

collateral sides of the transaction (or netting set).

(3) Simple VaR methodology. With the prior

written approval of the Board, a Board-regulated institution may estimate

EAD for a netting set using a VaR model that meets the requirements

in paragraph (b)(3)(iii) of this section. In such event, the Board-regulated

institution must set EAD equal to max {0, [(ΣE− ΣC) + PFE]}, where:

(i) ∑E equals the value of the exposure (the sum of the current fair

values of all instruments, gold, and cash the Board-regulated institution

has lent, sold subject to repurchase, or posted as collateral to the

counterparty under the netting set);

(ii) ∑C equals the value of the collateral

(the sum of the current fair values of all instruments, gold, and

cash the Board-regulated institution has borrowed, purchased subject

to resale, or taken as collateral from the counterparty under the

netting set); and

(iii) PFE (potential future exposure) equals the Board-regulated

institution’s empirically based best estimate of the 99th percentile,

one-tailed confidence interval for an increase in the value of (∑E − ∑C)

over a five-business-day holding period for repo-style transactions,

or over a ten-business-day holding period for eligible margin loans

except for netting sets for which paragraph (b)(3)(iv) of this section

applies using a minimum one-year historical observation period of price

data representing the instruments that the Board-regulated institution

has lent, sold subject to repurchase, posted as collateral, borrowed,

purchased subject to resale, or taken as collateral. The Board-regulated

institution must validate its VaR model by establishing and maintaining

a rigorous and regular backtesting regime.

(iv) If the number of trades in a netting

set exceeds 5,000 at any time during a quarter, a Board-regulated

institution must use a twenty-business-day holding period for the

following quarter (except when a Board-regulated institution is calculating

EAD for a cleared transaction under section 217.133). If a netting

set contains one or more trades involving illiquid collateral, a Board-regulated

institution must use a twenty-business-day holding period. If over

the two previous quarters more than two margin disputes on a netting

set have occurred that lasted more than the holding period, then the

Board-regulated institution must set its PFE for that netting set

equal to an estimate over a holding period that is at least two times

the minimum holding period for that netting set.

(1) Options for

determining EAD. A Board-regulated institution must determine

the EAD for a derivative contract using the standardized approach

for counterparty credit risk (SA-CCR) under paragraph (c)(5) of this

section or using the internal models methodology described in paragraph

(d) of this section. If a Board-regulated institution elects to use

SA-CCR for one or more derivative contracts, the exposure amount determined

under SA-CCR is the EAD for the derivative contract or derivatives

contracts. A Board-regulation institution must use the same methodology

to calculate the exposure amount for all its derivative contracts

and may change its election only with prior approval of the Board.

A Board-regulated institution may reduce the EAD calculated according

to paragraph (c)(5) of this section by the credit valuation adjustment

that the Board-regulated institution has recognized in its balance

sheet valuation of any derivative contracts in the netting set. For

purposes of this paragraph (c)(1), the credit valuation adjustment does

not include any adjustments to common equity tier 1 capital attributable

to changes in the fair value of the Board-regulated institution’s

liabilities that are due to changes in its own credit risk since the

inception of the transaction with the counterparty.

(2) Definitions. For purposes of this paragraph (c) of this section, the following

definitions apply:

(i) End date means the last date

of the period referenced by an interest rate or credit derivative

contract or, if the derivative contract references another instrument,

by the underlying instrument, except as otherwise provided in paragraph

(c) of this section.

(ii) Start date means the first date of the period referenced

by an interest rate or credit derivative contract or, if the derivative

contract references the value of another instrument, by underlying

instrument, except as otherwise provided in paragraph (c) of this

section.

(iii) Hedging set means:

(A) With respect to interest rate derivative

contracts, all such contracts within a netting set that reference

the same reference currency;

(B) With respect to exchange rate derivative contracts, all such

contracts within a netting set that reference the same currency pair;

(C) With respect to credit

derivative contract, all such contracts within a netting set;

(D) With respect to equity derivative

contracts, all such contracts within a netting set;

(E) With respect to a commodity derivative

contract, all such contracts within a netting set that reference one

of the following commodity categories: Energy, metal, agricultural,

or other commodities;

(F) With respect to basis derivative contracts, all such contracts

within a netting set that reference the same pair of risk factors

and are denominated in the same currency; or

(G) With respect to volatility derivative

contracts, all such contracts within a netting set that reference

one of interest rate, exchange rate, credit, equity, or commodity

risk factors, separated according to the requirements under paragraphs

(c)(2)(iii)(A) through (E) of this section.

(H) If the risk of a derivative contract materially

depends on more than one of interest rate, exchange rate, credit,

equity, or commodity risk factors, the Board may require a Board-regulated

institution to include the derivative contract in each appropriate

hedging set under paragraphs (c)(1)(iii)(A) through (E) of this section.

(3) Credit derivatives. Notwithstanding

paragraphs (c)(1) and (c)(2) of this section:

(i) A Board-regulated

institution that purchases a credit derivative that is recognized

under section 217.134 or section 217.135 as a credit risk mitigant

for an exposure that is not a covered position under subpart F of

this part is not required to calculate a separate counterparty credit

risk capital requirement under this section so long as the Board-regulated

institution does so consistently for all such credit derivatives and

either includes or excludes all such credit derivatives that are subject

to a master netting agreement from any measure used to determine counterparty

credit risk exposure to all relevant counterparties for risk-based

capital purposes.

(ii) A Board-regulated institution that is the protection provider

in a credit derivative must treat the credit derivative as a wholesale

exposure to the reference obligor and is not required to calculate

a counterparty credit risk capital requirement for the credit derivative

under this section, so long as it does so consistently for all such

credit derivatives and either includes all or excludes all such credit

derivatives that are subject to a master netting agreement from any

measure used to determine counterparty credit risk exposure to all

relevant counterparties for risk-based capital purposes (unless the

Board-regulated institution is treating the credit derivative as a

covered position under subpart F of this part, in which case the Board-regulated

institution must calculate a supplemental counterparty credit risk

capital requirement under this section).

(4) Equity derivatives. A Board-regulated institution must treat

an equity derivative contract as an equity exposure and compute a

risk-weighted asset amount for the equity derivative contract under

sections 217.151-217.155 (unless the Board-regulated institution is

treating the contract as a covered position under subpart F of this

part). In addition, if the Board-regulated institution is treating

the contract as a covered position under subpart F of this part, and

under certain other circumstances described in section 217.155, the

Board-regulated institution must also calculate a risk-based capital

requirement for the counterparty credit risk of an equity derivative

contract under this section.

(5) Exposure

amount.

(i) The exposure amount of a netting

set, as calculated under paragraph (c) of this section, is equal to

1.4 multiplied by the sum of the replacement cost of the netting set,

as calculated under paragraph (c)(6) of this section, and the potential

future exposure of the netting set, as calculated under paragraph

(c)(7) of this section.

(ii) Notwithstanding the requirements of paragraph (c)(5)(i) of this

section, the exposure amount of a netting set subject to a variation

margin agreement, excluding a netting set that is subject to a variation

margin agreement under which the counterparty to the variation margin

agreement is not required to post variation margin, is equal to the

lesser of the exposure amount of the netting set calculated under

paragraph (c)(5)(i) of this section and the exposure amount of the

netting set calculated under paragraph (c)(5)(i) of this section as

if the netting set were not subject to a variation margin agreement.

(iii) Notwithstanding

the requirements of paragraph (c)(5)(i) of this section, the exposure

amount of a netting set that consists of only sold options in which

the premiums have been fully paid by the counterparty to the options

and where the options are not subject to a variation margin agreement

is zero.

(iv) Notwithstanding

the requirements of paragraph (c)(5)(i) of this section, the exposure

amount of a netting set in which the counterparty is a commercial

end-user is equal to the sum of replacement cost, as calculated under

paragraph (c)(6) of this section, and the potential future exposure

of the netting set, as calculated under paragraph (c)(7) of this section.

(v) For purposes of

the exposure amount calculated under paragraph (c)(5)(i) of this section

and all calculations that are part of that exposure amount, a Board-regulated

institution may elect to treat a derivative contract that is a cleared

transaction that is not subject to a variation margin agreement as

one that is subject to a variation margin agreement, if the derivative

contract is subject to a requirement that the counterparties make

daily cash payments to each other to account for changes in the fair

value of the derivative contract and to reduce the net position of

the contract to zero. If a Board-regulated institution makes an election

under this paragraph (c)(5)(v) for one derivative contract, it must

treat all other derivative contracts within the same netting set that

are eligible for an election under this paragraph (c)(5)(v) as derivative

contracts that are subject to a variation margin agreement.

(vi) For purposes of the

exposure amount calculated under paragraph (c)(5)(i) of this section

and all calculations that are part of that exposure amount, a Board-regulated

institution may elect to treat a credit derivative contract, equity

derivative contract, or commodity derivative contract that references

an index as if it were multiple derivative contracts each referencing

one component of the index.

(6) Replacement

cost of a netting set.

(i) Netting

set subject to a variation margin agreement under which the

counterparty must post variation margin. The replacement cost

of a netting set subject to a variation margin agreement, excluding

a netting set that is subject to a variation margin agreement under

which the counterparty is not required to post variation margin, is

the greater of:

(A) The sum of the fair values (after excluding

any valuation adjustments) of the derivative contracts within the

netting set less the sum of the net independent collateral amount

and the variation margin amount applicable to such derivative contracts;

(B) The sum of the variation

margin threshold and the minimum transfer amount applicable to the

derivative contracts within the netting set less the net independent

collateral amount applicable to such derivative contracts; or

(C) Zero.

(ii) Netting sets not subject to a variation margin agreement under which

the counterparty must post variation margin. The replacement

cost of a netting set that is not subject to a variation margin agreement

under which the counterparty must post variation margin to the Board-regulated

institution is the greater of:

(A) The sum of the fair values

(after excluding any valuation adjustments) of the derivative contracts

within the netting set less the sum of the net independent collateral

amount and variation margin amount applicable to such derivative contracts;

or

(B) Zero.

(iii) Multiple netting sets subject to a single variation

margin agreement. Notwithstanding paragraphs (c)(6)(i) and (ii)

of this section, the replacement cost for multiple netting sets subject

to a single variation margin agreement must be calculated according

to paragraph (c)(10)(i) of this section.

(iv) Netting

set subject to multiple variation margin agreements or a hybrid netting

set. Notwithstanding paragraphs (c)(6)(i) and (ii) of this section,

the replacement cost for a netting set subject to multiple variation

margin agreements or a hybrid netting set must be calculated according

to paragraph (c)(11)(i) of this section.

(7) Potential future exposure of a netting set. The potential future

exposure of a netting set is the product of the PFE multiplier and

the aggregated amount.

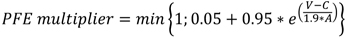

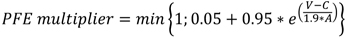

(i) PFE multiplier. The PFE multiplier is calculated according to the following formula:

Figure 3. DISPLAY EQUATION

$$

\textit{PFE multiplier}=min \Bigg\{ 1;0.05+0.95\ast e^{ \Big( \frac{V-C}{1.9\ast A} \Big) } \Bigg\}

$$

Where:

V is the sum

of the fair values (after excluding any valuation adjustments) of

the derivative contracts within the netting set;

C is the sum of the net independent

collateral amount and the variation margin amount applicable to the

derivative contracts within the netting set; and

A is the aggregated amount of

the netting set.

(ii) Aggregated amount. The aggregated

amount is the sum of all hedging set amounts, as calculated under

paragraph (c)(8) of this section, within a netting set.

(iii) Multiple

netting sets subject to a single variation margin agreement. Notwithstanding

paragraphs (c)(7)(i) and (ii) of this section and when calculating

the potential future exposure for purposes of total leverage exposure

under section 217.10(c)(2)(ii)(B), the potential future exposure for

multiple netting sets subject to a single variation margin agreement

must be calculated according to paragraph (c)(10)(ii) of this section.

(iv) Netting set subject to multiple variation margin agreements or a

hybrid netting set. Notwithstanding paragraphs (c)(7)(i) and

(ii) of this section and when calculating the potential future exposure

for purposes of total leverage exposure under section 217.10(c)(2)(ii)(B),

the potential future exposure for a netting set subject to multiple

variation margin agreements or a hybrid netting set must be calculated

according to paragraph (c)(11)(ii) of this section.

(8) Hedging set amount.

(i) Interest

rate derivative contracts. To calculate the hedging set amount

of an interest rate derivative contract hedging set, a Board-regulated

institution may use either of the formulas provided in paragraphs

(c)(8)(i)(A) and (B) of this section:

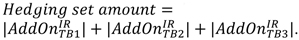

(A) Formula 1 is as follows:

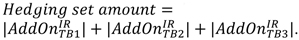

Figure 4. FIGURE 4 DISPLAY

EQUATION

$$

\textit{Hedging set amount}= \Bigg[ \Bigg( AddOn_{TB1}^{IR} \Bigg) ^{2}+ \Bigg( AddOn_{TB2}^{IR} \Bigg) ^{2}+ \Bigg( AddOn_{TB3}^{IR} \Bigg) ^{2}+1.4\ast AddOn_{TB1}^{IR}\ast AddOn_{TB2}^{IR}+1.4\ast AddOn_{TB2}^{IR}\ast AddOn_{TB3}^{IR}+0.6\ast AddOn_{TB1}^{IR}\ast AddOn_{TB3}^{IR} \Bigg) \Bigg] ^{\frac{1}{2}} \text{; or}

$$

(B) Formula 2 is as follows:

Figure 5. FIGURE 5 DISPLAY

EQUATION

$$

\textit{Hedging set amount}= \vert AddOn_{TB1}^{IR} \vert + \vert AddOn_{TB2}^{IR} \vert + \vert AddOn_{TB3}^{IR} \vert

$$

Where in paragraphs

(c)(8)(i)(A) and (B) of this section:

Figure 6. FIGURE 5 DISPLAY

EQUATION

$$

AddOn_{TB1}^{IR}

$$

is the sum of the adjusted derivative contract amounts, as calculated

under paragraph

(c)(9) of this section, within the hedging set with

an end date of less than one year from the present date;

Figure 7. DISPLAY EQUATION

$$

AddOn_{TB2}^{IR}

$$

is the sum of the adjusted derivative contract amounts, as calculated

under paragraph

(c)(9) of this section, within the hedging set with

an end date of one to five years from the present date; and

Figure 8. DISPLAY EQUATION

$$

AddOn_{TB3}^{IR}

$$

is the sum of the adjusted derivative contract amounts, as

calculated under paragraph

(c)(9) of this section, within the hedging

set with an end date of more than five years from the present date.

(ii) Exchange rate derivative contracts. For

an exchange rate derivative contract hedging set, the hedging set

amount equals the absolute value of the sum of the adjusted derivative

contract amounts, as calculated under paragraph (c)(9) of this section,

within the hedging set.

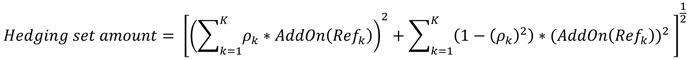

(iii) Credit

derivative contracts and equity derivative contracts. The hedging

set amount of a credit derivative contract hedging set or equity derivative

contract hedging set within a netting set is calculated according

to the following formula:

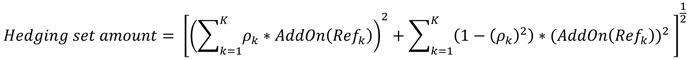

Figure 9. DISPLAY EQUATION

$$

\textit{Hedging set amount}= \Bigg[ \Bigg( \sum\nolimits_{k=1}^{K} \rho _{k}\ast AddOn \Bigg( Ref_{k} \Bigg) \Bigg) ^{2}+ \sum\nolimits _{k=1}^{K} \Bigg( 1- \Bigg( \rho _{k} \Bigg) ^{2} \Bigg) \ast \Bigg( AddOn \Bigg( Ref_{k} \Bigg) \Bigg) ^{2}~ \Bigg] ^{\frac{1}{2}}

$$

Where:

k is each reference

entity within the hedging set.

K is the number of reference

entities within the hedging set.

AddOn (Refk) equals the sum of the adjusted derivative contract amounts,

as determined under paragraph (c)(9) of this section, for all derivative

contracts within the hedging set that reference reference entity k.

ρk equals the applicable supervisory correlation

factor, as provided in Table 3 to this section.

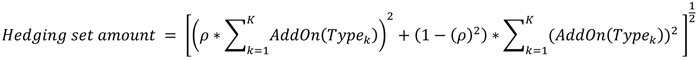

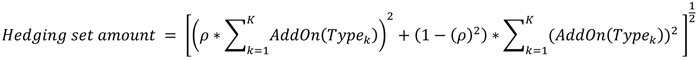

(iv) Commodity

derivative contracts. The hedging set amount of a commodity derivative

contract hedging set within a netting set is calculated according

to the following formula:

Figure 10. FIGURE 10 DISPLAY

EQUATION

$$

\textit{Hedging set amount} = \Bigg[ \Bigg( \rho \ast \sum\nolimits _{k=1}^{K}AddOn \Bigg( Type_{k} \Bigg) \Bigg) ^{2}+ \Bigg( 1- \Bigg( \rho \Bigg) ^{2} \Bigg) \ast \sum\nolimits _{k=1}^{K} \Bigg( AddOn \Bigg( Type_{k} \Bigg) \Bigg) ^{2}~ \Bigg] ^{\frac{1}{2}}

$$

Where:

k is each commodity

type within the hedging set.

K is the number of commodity

types within the hedging set.

AddOn (Typek) equals the sum of the adjusted derivative contract amounts, as

determined under paragraph (c)(9) of this section, for all derivative

contracts within the hedging set that reference reference commodity

type.

ρ equals

the applicable supervisory correlation factor, as provided in Table

3 to this section.

(v) Basis

derivative contracts and volatility derivative contracts. Notwithstanding

paragraphs (c)(8)(i) through (iv) of this section, a Board-regulated

institution must calculate a separate hedging set amount for each

basis derivative contract hedging set and each volatility derivative

contract hedging set. A Board-regulated institution must calculate

such hedging set amounts using one of the formulas under paragraphs

(c)(8)(i) through (iv) that corresponds to the primary risk factor

of the hedging set being calculated.

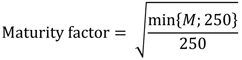

(9) Adjusted

derivative contract amount.

(i) Summary. To calculate the adjusted derivative contract amount

of a derivative contract, a Board-regulated institution must determine

the adjusted notional amount of derivative contract, pursuant to paragraph

(c)(9)(ii) of this section, and multiply the adjusted notional amount

by each of the supervisory delta adjustment, pursuant to paragraph

(c)(9)(iii) of this section, the maturity factor, pursuant to paragraph

(c)(9)(iv) of this section, and the applicable supervisory factor,

as provided in Table 3 to this section.

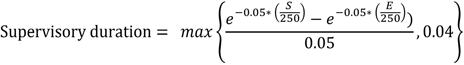

(ii) Adjusted

notional amount.

(A)(1) For an interest rate

derivative contract or a credit derivative contract, the adjusted

notional amount equals the product of the notional amount of the derivative

contract, as measured in U.S. dollars using the exchange rate on the

date of the calculation, and the supervisory duration, as calculated

by the following formula:

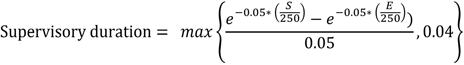

Figure 11. FIGURE 10 DISPLAY

EQUATION

$$

\text{Supervisory duration}=~ max \Bigg\{ \frac{e^{-0.05\ast \Big( \frac{S_{~}}{250} \Big) }-e^{-0.05\ast \Big( \frac{E_{~}}{250} \Big) } \Big) }{0.05},0.04 \Bigg\}

$$

Where:

S is the number of business

days from the present day until the start date of the derivative contract,

or zero if the start date has already passed; and

E is the number of business days from

the present day until the end date of the derivative contract.

(2) For purposes

of paragraph (c)(9)(ii)(A)(1) of this section:

(i) For an interest rate derivative

contract or credit derivative contract that is a variable notional

swap, the notional amount is equal to the time-weighted average of

the contractual notional amounts of such a swap over the remaining

life of the swap; and

(ii) For an interest rate derivative contract or a credit

derivative contract that is a leveraged swap, in which the notional

amount of all legs of the derivative contract are divided by a factor

and all rates of the derivative contract are multiplied by the same

factor, the notional amount is equal to the notional amount of an

equivalent unleveraged swap.

(B)(1) For an exchange rate

derivative contract, the adjusted notional amount is the notional

amount of the non-U.S. denominated currency leg of the derivative

contract, as measured in U.S. dollars using the exchange rate on the

date of the calculation. If both legs of the exchange rate derivative

contract are denominated in currencies other than U.S. dollars, the

adjusted notional amount of the derivative contract is the largest

leg of the derivative contract, as measured in U.S. dollars using

the exchange rate on the date of the calculation.

(2) Notwithstanding paragraph (c)(9)(ii)(B)(1) of this section, for an exchange rate derivative contract

with multiple exchanges of principal, the Board-regulated institution

must set the adjusted notional amount of the derivative contract equal

to the notional amount of the derivative contract multiplied by the

number of exchanges of principal under the derivative contract.

(C)(1)

For an equity derivative contract or a commodity derivative contract,

the adjusted notional amount is the product of the fair value of one unit

of the reference instrument underlying the derivative contract and

the number of such units referenced by the derivative contract.

(2) Notwithstanding

paragraph (c)(9)(ii)(C)(1) of this section, when calculating

the adjusted notional amount for an equity derivative contract or

a commodity derivative contract that is a volatility derivative contract,

the Board-regulated institution must replace the unit price with the

underlying volatility referenced by the volatility derivative contract

and replace the number of units with the notional amount of the volatility

derivative contract.

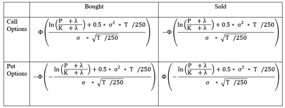

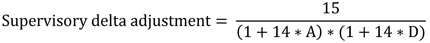

(iii) Supervisory

delta adjustments.

(A) For a derivative contract that is not

an option contract or collateralized debt obligation tranche, the

supervisory delta adjustment is 1 if the fair value of the derivative

contract increases when the value of the primary risk factor increases

and - 1 if the fair value of the derivative contract decreases when

the value of the primary risk factor increases.

(B) (1) For a derivative

contract that is an option contract, the supervisory delta adjustment

is determined by the following formulas, as applicable:

(1) (i) With prior

written approval from the Board, a Board-regulated institution may

use the internal models methodology in this paragraph (d) to determine

EAD for counterparty credit risk for derivative contracts (collateralized

or uncollateralized) and single-product netting sets thereof, for

eligible margin loans and single-product netting sets thereof, and

for repo-style transactions and single-product netting sets thereof.

(ii) A Board-regulated

institution that uses the internal models methodology for a particular

transaction type (derivative contracts, eligible margin loans, or

repo- style transactions) must use the internal models methodology

for all transactions of that transaction type. A Board-regulated institution

may choose to use the internal models methodology for one or two of

these three types of exposures and not the other types.

(iii) A Board-regulated

institution may also use the internal models methodology for derivative

contracts, eligible margin loans, and repo-style transactions subject

to a qualifying cross-product netting agreement if:

(A) The Board-regulated

institution effectively integrates the risk mitigating effects of

cross-product netting into its risk management and other information

technology systems; and

(B) The Board-regulated institution obtains the prior written approval

of the Board.

(iv) A Board-regulated institution that

uses the internal models methodology for a transaction type must receive

approval from the Board to cease using the methodology for that transaction

type or to make a material change to its internal model.

(2) Risk-weighted assets using IMM. Under the IMM, a Board-regulated

institution uses an internal model to estimate the expected exposure

(EE) for a netting set and then calculates EAD based on that EE. A

Board-regulated institution must calculate two EEs and two EADs (one

stressed and one unstressed) for each netting set as follows:

(i) EADunstressed is calculated using an EE estimate based on the

most recent data meeting the requirements of paragraph (d)(3)(vii)

of this section;

(ii) EADstressed is calculated using an EE estimate based

on a historical period that includes a period of stress to the credit

default spreads of the Board-regulated institution’s counterparties

according to paragraph (d)(3)(viii) of this section;

(iii) The Board-regulated institution

must use its internal model’s probability distribution for changes

in the fair value of a netting set that are attributable to changes

in market variables to determine EE; and

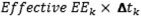

(iv) Under the internal models methodology,

EAD = Max (0, α × effective EPE − CVA), or, subject to the prior

written approval of Board as provided in paragraph (d)(10) of this

section, a more conservative measure of EAD.

(A) CVA equals

the credit valuation adjustment that the Board-regulated institution

has recognized in its balance sheet valuation of any OTC derivative

contracts in the netting set. For purposes of this paragraph (d),

CVA does not include any adjustments to common equity tier 1 capital

attributable to changes in the fair value of the Board-regulated institution’s

liabilities that are due to changes in its own credit risk since the

inception of the transaction with the counterparty.

(B)

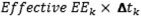

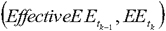

Figure 17. DISPLAY EQUATION

$$

\mathit{Effective} \: EPE_{t_k} = \sum^n_{k=1}

$$

Figure 18. DISPLAY EQUATION

$$

\mathit{Effective} \: EE_k \times \; \Delta t_k

$$

(that

is, effective EPE is the time-weighted average of effective EE where

the weights are the proportion that an individual effective EE represents

in a one-year time interval) where:

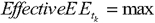

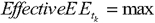

(1)

Figure 19. DISPLAY EQUATION

$$

\mathit{Effective}EE_{t_k} = \text{max}

$$

Figure 20. DISPLAY EQUATION

$$

\bigg( \mathit{Effective} EE_{t_{k-1}}, EE_{t_k } \bigg)

$$

(that is, for a specific

date tk, effective EE is the greater of EE at that date

or the effective EE at the previous date); and

(2) tk represents the kth future time period in the model and there are n time periods

represented in the model over the first year, and

(C) α = 1.4 except as provided

in paragraph (d)(6) of this section, or when the Board has determined

that the Board-regulated institution must set α higher based on the

Board-regulated institution’s specific characteristics of counterparty

credit risk or model performance.

(v) A Board-regulated institution may

include financial collateral currently posted by the counterparty

as collateral (but may not include other forms of collateral) when

calculating EE.

(vi) If a Board-regulated institution hedges some or all of the counterparty

credit risk associated with a netting set using an eligible credit

derivative, the Board-regulated institution may take the reduction

in exposure to the counterparty into account when estimating EE. If

the Board-regulated institution recognizes this reduction in exposure

to the counterparty in its estimate of EE, it must also use its internal

model to estimate a separate EAD for the Board-regulated institution’s

exposure to the protection provider of the credit derivative.

(3) Prior approval relating to EAD calculation. To obtain Board approval to calculate the distributions of exposures

upon which the EAD calculation is based, the Board-regulated institution

must demonstrate to the satisfaction of the Board that it has been

using for at least one year an internal model that broadly meets the

following minimum standards, with which the Board-regulated institution

must maintain compliance:

(i) The model must have the systems

capability to estimate the expected exposure to the counterparty on

a daily basis (but is not expected to estimate or report expected

exposure on a daily basis);

(ii) The model must estimate expected

exposure at enough future dates to reflect accurately all the future

cash flows of contracts in the netting set;

(iii) The model must account for the

possible non-normality of the exposure distribution, where appropriate;

(iv) The Board-regulated

institution must measure, monitor, and control current counterparty

exposure and the exposure to the counterparty over the whole life

of all contracts in the netting set;

(v) The Board-regulated institution

must be able to measure and manage current exposures gross and net

of collateral held, where appropriate. The Board-regulated institution

must estimate expected exposures for OTC derivative contracts both

with and without the effect of collateral agreements;

(vi) The Board-regulated institution

must have procedures to identify, monitor, and control wrong-way risk

throughout the life of an exposure. The procedures must include stress

testing and scenario analysis;

(vii) The model must use current market

data to compute current exposures. The Board-regulated institution

must estimate model parameters using historical data from the most

recent three-year period and update the data quarterly or more frequently

if market conditions warrant. The Board-regulated institution should consider

using model parameters based on forward-looking measures, where appropriate;

(viii) When estimating

model parameters based on a stress period, the Board-regulated institution

must use at least three years of historical data that include a period

of stress to the credit default spreads of the Board-regulated institution’s

counterparties. The Board-regulated institution must review the data

set and update the data as necessary, particularly for any material

changes in its counterparties. The Board-regulated institution must

demonstrate, at least quarterly, and maintain documentation of such

demonstration, that the stress period coincides with increased CDS

or other credit spreads of the Board-regulated institution’s counterparties.

The Board-regulated institution must have procedures to evaluate the

effectiveness of its stress calibration that include a process for

using benchmark portfolios that are vulnerable to the same risk factors

as the Board-regulated institution’s portfolio. The Board may require

the Board-regulated institution to modify its stress calibration to

better reflect actual historic losses of the portfolio;

(ix) A Board-regulated

institution must subject its internal model to an initial validation

and annual model review process. The model review should consider

whether the inputs and risk factors, as well as the model outputs,

are appropriate. As part of the model review process, the Board-regulated

institution must have a backtesting program for its model that includes

a process by which unacceptable model performance will be determined

and remedied;

(x)

A Board-regulated institution must have policies for the measurement,

management and control of collateral and margin amounts; and

(xi) A Board-regulated institution

must have a comprehensive stress testing program that captures all

credit exposures to counterparties, and incorporates stress testing

of principal market risk factors and creditworthiness of counterparties.

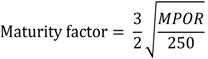

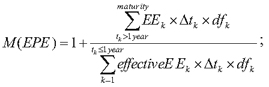

(4) Calculating the maturity of exposures.

(i) If the remaining maturity of the exposure or the longest-dated

contract in the netting set is greater than one year, the Board-regulated

institution must set M for the exposure or netting set equal to the

lower of five years or M(EPE), where:

(A)

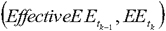

Figure 21. DISPLAY EQUATION

$$

M(EPE)=1 + \frac{

{\sum\limits^{\mathit{maturity}}_{t_k > \text{1 year}}} EE_k \times \Delta t_k \times df_k

}

{

{\sum\limits^{t_k \leq \text{1 year}}_{k=1} }

effectiveE \: E_k \times \Delta t_k \times df_k} \text{ ;}

$$

(B) dfk is the

risk-free discount factor for future time period tk; and

(C) Δt k = t k − t kâ1.

(ii) If the remaining maturity of the

exposure or the longest-dated contract in the netting set is one year

or less, the Board-regulated institution must set M for the exposure

or netting set equal to one year, except as provided in section 217.131(d)(7).

(iii) Alternatively,

a Board-regulated institution that uses an internal model to calculate

a one-sided credit valuation adjustment may use the effective credit

duration estimated by the model as M(EPE) in place of the formula

in paragraph (d)(4)(i) of this section.

(5) Effects of

collateral agreements on EAD. A Board-regulated institution may

capture the effect on EAD of a collateral agreement that requires

receipt of collateral when exposure to the counterparty increases,

but may not capture the effect on EAD of a collateral agreement that

requires receipt of collateral when counterparty credit quality deteriorates.

Two methods are available to capture the effect of a collateral agreement,

as set forth in paragraphs (d)(5)(i) and (ii) of this section:

(i) With prior written approval from the Board, a Board-regulated

institution may include the effect of a collateral agreement within

its internal model used to calculate EAD. The Board-regulated institution

may set EAD equal to the expected exposure at the end

of the margin period of risk. The margin period of risk means, with

respect to a netting set subject to a collateral agreement, the time

period from the most recent exchange of collateral with a counterparty

until the next required exchange of collateral, plus the period of

time required to sell and realize the proceeds of the least liquid

collateral that can be delivered under the terms of the collateral

agreement and, where applicable, the period of time required to re-hedge

the resulting market risk upon the default of the counterparty. The

minimum margin period of risk is set according to paragraph (d)(5)(iii)

of this section; or

(ii) As an alternative to paragraph (d)(5)(i) of this section, a

Board-regulated institution that can model EPE without collateral

agreements but cannot achieve the higher level of modeling sophistication

to model EPE with collateral agreements can set effective EPE for

a collateralized netting set equal to the lesser of:

(A) An add-on

that reflects the potential increase in exposure of the netting set

over the margin period of risk, plus the larger of:

(1) The current exposure of the netting

set reflecting all collateral held or posted by the Board-regulated

institution excluding any collateral called or in dispute; or

(2) The largest net exposure

including all collateral held or posted under the margin agreement

that would not trigger a collateral call. For purposes of this section,

the add-on is computed as the expected increase in the netting set’s

exposure over the margin period of risk (set in accordance with paragraph

(d)(5)(iii) of this section); or

(B) Effective EPE without a collateral agreement

plus any collateral the Board-regulated institution posts to the counterparty

that exceeds the required margin amount.

(iii) For purposes of this

part, including paragraphs (d)(5)(i) and (ii) of this section, the

margin period of risk for a netting set subject to a collateral agreement

is:

(A) Five business days for repo-style transactions subject to daily

remargining and daily marking-to-market, and ten business days for

other transactions when liquid financial collateral is posted under

a daily margin maintenance requirement, or

(B) Twenty business days if the number of

trades in a netting set exceeds 5,000 at any time during the previous

quarter (except if the Board-regulated institution is calculating

EAD for a cleared transaction under section 217.133) or contains one

or more trades involving illiquid collateral or any derivative contract

that cannot be easily replaced. If over the two previous quarters

more than two margin disputes on a netting set have occurred that

lasted more than the margin period of risk, then the Board-regulated

institution must use a margin period of risk for that netting set

that is at least two times the minimum margin period of risk for that

netting set. If the periodicity of the receipt of collateral is N-days,

the minimum margin period of risk is the minimum margin period of

risk under this paragraph (d) plus N minus 1. This period should be

extended to cover any impediments to prompt re-hedging of any market

risk.

(C) Five business

days for an OTC derivative contract or netting set of OTC derivative

contracts where the Board-regulated institution is either acting as

a financial intermediary and enters into an offsetting transaction

with a CCP or where the Board-regulated institution provides a guarantee

to the CCP on the performance of the client. A Board-regulated institution

must use a longer holding period if the Board-regulated institution

determines that a longer period is appropriate. Additionally, the

Board may require the Board-regulated institution to set a longer

holding period if the Board determines that a longer

period is appropriate due to the nature, structure, or characteristics

of the transaction or is commensurate with the risks associated with

the transaction.

(6) Own estimate

of alpha. With prior written approval of the Board, a Board-regulated

institution may calculate alpha as the ratio of economic capital from

a full simulation of counterparty exposure across counterparties that

incorporates a joint simulation of market and credit risk factors

(numerator) and economic capital based on EPE (denominator), subject

to a floor of 1.2. For purposes of this calculation, economic capital

is the unexpected losses for all counterparty credit risks measured

at a 99.9 percent confidence level over a one-year horizon. To receive

approval, the Board-regulated institution must meet the following

minimum standards to the satisfaction of the Board:

(i) The

Board-regulated institution’s own estimate of alpha must capture in

the numerator the effects of:

(A) The material sources of stochastic

dependency of distributions of fair values of transactions or portfolios

of transactions across counterparties;

(B) Volatilities and correlations of market

risk factors used in the joint simulation, which must be related to

the credit risk factor used in the simulation to reflect potential

increases in volatility or correlation in an economic downturn, where

appropriate; and

(C) The

granularity of exposures (that is, the effect of a concentration in

the proportion of each counterparty’s exposure that is driven by a

particular risk factor).

(ii) The Board-regulated institution

must assess the potential model uncertainty in its estimates of alpha.

(iii) The Board-regulated

institution must calculate the numerator and denominator of alpha

in a consistent fashion with respect to modeling methodology, parameter

specifications, and portfolio composition.

(iv) The Board-regulated institution

must review and adjust as appropriate its estimates of the numerator

and denominator of alpha on at least a quarterly basis and more frequently

when the composition of the portfolio varies over time.

(7) Risk-based capital requirements for transactions with specific wrong-way

risk. A Board-regulated institution must determine if a repo-style

transaction, eligible margin loan, bond option, or equity derivative

contract or purchased credit derivative to which the Board-regulated

institution applies the internal models methodology under this paragraph

(d) has specific wrong-way risk. If a transaction has specific wrong-way

risk, the Board-regulated institution must treat the transaction as

its own netting set and exclude it from the model described in section

217.132(d)(2) and instead calculate the risk-based capital requirement

for the transaction as follows:

(i) For an equity derivative

contract, by multiplying:

(A) K, calculated using the appropriate risk-based

capital formula specified in Table 1 of section 217.131 using the

PD of the counterparty and LGD equal to 100 percent, by

(B) The maximum amount the Board-regulated

institution could lose on the equity derivative.

(ii) For a purchased

credit derivative by multiplying:

(A) K, calculated using the appropriate

risk-based capital formula specified in Table 1 of section 217.131

using the PD of the counterparty and LGD equal to 100 percent, by

(B) The fair value of the

reference asset of the credit derivative.

(iii) For a bond option,

by multiplying:

(A) K, calculated using the appropriate risk-based

capital formula specified in Table 1 of section 217.131 using the

PD of the counterparty and LGD equal to 100 percent, by

(B) The smaller of the notional

amount of the underlying reference asset and the maximum potential

loss under the bond option contract.

(iv) For a repo-style transaction

or eligible margin loan by multiplying:

(A) K, calculated using the

appropriate risk-based capital formula specified in Table 1 of section

217.131 using the PD of the counterparty and LGD equal to 100 percent,

by

(B) The EAD of the

transaction determined according to the EAD equation in section 217.132(b)(2),

substituting the estimated value of the collateral assuming a default

of the counterparty for the value of the collateral in ΣC of

the equation.

(8) Risk-weighted

asset amount for IMM exposures with specific wrong-way risk. The

aggregate risk-weighted asset amount for IMM exposures with specific

wrong-way risk is the sum of a Board-regulated institution’s risk-based

capital requirement for purchased credit derivatives that are not

bond options with specific wrong-way risk as calculated under paragraph

(d)(7)(ii) of this section, a Board-regulated institution’s risk-based

capital requirement for equity derivatives with specific wrong-way

risk as calculated under paragraph (d)(7)(i) of this section, a Board-regulated

institution’s risk-based capital requirement for bond options with

specific wrong-way risk as calculated under paragraph (d)(7)(iii)

of this section, and a Board-regulated institution’s risk-based capital

requirement for repo-style transactions and eligible margin loans

with specific wrong-way risk as calculated under paragraph (d)(7)(iv)

of this section, multiplied by 12.5.

(9) Risk-weighted

assets for IMM exposures.

(i) The Board-regulated

institution must insert the assigned risk parameters for each counterparty

and netting set into the appropriate formula specified in Table 1

of section 217.131 and multiply the output of the formula by the EADunstressed of the netting set to obtain the unstressed capital

requirement for each netting set. A Board-regulated institution that

uses an advanced CVA approach that captures migrations in credit spreads

under paragraph (e)(3) of this section must set the maturity adjustment

(b) in the formula equal to zero. The sum of the unstressed capital

requirement calculated for each netting set equals Kunstressed.

(ii) The Board-regulated

institution must insert the assigned risk parameters for each wholesale

obligor and netting set into the appropriate formula specified in

Table 1 of section 217.131 and multiply the output of the formula

by the EADstressed of the netting set to obtain the stressed

capital requirement for each netting set. A Board-regulated institution

that uses an advanced CVA approach that captures migrations in credit

spreads under paragraph (e)(6) of this section must set the maturity

adjustment (b) in the formula equal to zero. The sum of the stressed

capital requirement calculated for each netting set equals Kstressed.

(iii) The Board-regulated

institution’s dollar risk-based capital requirement under the internal

models methodology equals the larger of Kunstressed and

Kstressed. A Board-regulated institution’s risk-weighted

assets amount for IMM exposures is equal to the capital requirement

multiplied by 12.5, plus risk-weighted assets for IMM exposures with

specific wrong-way risk in paragraph (d)(8) of this section and those

in paragraph (d)(10) of this section.

(10) Other measures

of counterparty exposure.

(i) With prior written

approval of the Board, a Board-regulated institution may set EAD equal

to a measure of counterparty credit risk exposure, such as peak EAD,

that is more conservative than an alpha of 1.4 times the larger of

EPEunstressed and EPEstressed for every counterparty

whose EAD will be measured under the alternative measure of counterparty

exposure. The Board-regulated institution must demonstrate the conservatism

of the measure of counterparty credit risk exposure used for EAD.

With respect to paragraph (d)(10)(i) of this section:

(A) For material

portfolios of new OTC derivative products, the Board-regulated institution

may assume that the standardized approach for counterparty credit

risk pursuant to paragraph (c) of this section meets the conservatism

requirement of this section for a period not to exceed 180 days.

(B) For immaterial portfolios

of OTC derivative contracts, the Board-regulated institution generally

may assume that the standardized approach for counterparty credit

risk pursuant to paragraph (c) of this section meets the conservatism

requirement of this section.

(ii) To calculate risk-weighted assets

for purposes of the approach in paragraph (d)(10)(i) of this section,

the Board-regulated institution must insert the assigned risk parameters

for each counterparty and netting set into the appropriate formula

specified in Table 1 of section 217.131, multiply the output of the

formula by the EAD for the exposure as specified above, and multiply

by 12.5.

(1) In general. With respect to its OTC derivative contracts, a Board-regulated

institution must calculate a CVA risk-weighted asset amount for its

portfolio of OTC derivative transactions that are subject to the CVA

capital requirement using the simple CVA approach described in paragraph

(e)(5) of this section or, with prior written approval of the Board,

the advanced CVA approach described in paragraph (e)(6) of this section.

A Board-regulated institution that receives prior Board approval to

calculate its CVA risk-weighted asset amounts for a class of counterparties

using the advanced CVA approach must continue to use that approach

for that class of counterparties until it notifies the Board in writing

that the Board-regulated institution expects to begin calculating

its CVA risk-weighted asset amount using the simple CVA approach.

Such notice must include an explanation of the Board-regulated institution’s

rationale and the date upon which the Board-regulated institution

will begin to calculate its CVA risk-weighted asset amount using the

simple CVA approach.

(2) Market risk Board-regulated institutions. Notwithstanding the prior approval requirement in paragraph (e)(1)

of this section, a market risk Board-regulated institution may calculate

its CVA risk-weighted asset amount using the advanced CVA approach

if the Board-regulated institution has Board approval to:

(i) Determine

EAD for OTC derivative contracts using the internal models methodology

described in paragraph (d) of this section; and

(ii) Determine its specific risk add-on

for debt positions issued by the counterparty using a specific risk

model described in section 217.207(b).

(3) Recognition

of hedges.

(i) A Board-regulated institution may

recognize a single name CDS, single name contingent CDS, any other

equivalent hedging instrument that references the counterparty directly,

and index credit default swaps (CDSind) as a CVA hedge

under paragraph (e)(5)(ii) of this section or paragraph (e)(6) of

this section, provided that the position is managed as a CVA hedge

in accordance with the Board-regulated institution’s hedging policies.

(ii) A Board-regulated

institution shall not recognize as a CVA hedge any tranched or nth-to-default credit derivative.

(4) Total CVA

risk-weighted assets. Total CVA risk-weighted assets is the CVA

capital requirement, KCVA, calculated for a Board-regulated

institution’s entire portfolio of OTC derivative counterparties that

are subject to the CVA capital requirement, multiplied by 12.5.

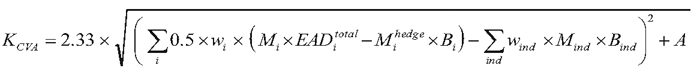

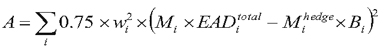

(5) Simple CVA approach.

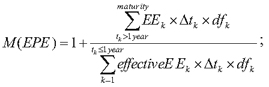

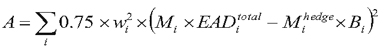

(i) Under

the simple CVA approach, the CVA capital requirement, KCVA, is calculated according to the following formula:

Figure 22. DISPLAY EQUATION

$$

K_{CVA} = 2.33 \times \sqrt{

\Bigg \lgroup

{\sum\limits_i}0.5 \times w_i \times \bigg(M_i \times EAD^{\mathit{total}}_i - M^{\mathit{hedge}}_i \times B_i \bigg) -

{\sum\limits_{ind}} w_{ind} \times M_{ind} \times B_{ind}

\Bigg \rgroup ^2 + A

}

$$

Where:

Figure 23. DISPLAY EQUATION

$$

A = {\sum\limits_i} 0.75 \times w^2_i \times \big( M_i \times EAD^{\mathit{total}}_i - M^{\mathit{headge}}_i \times B_i \big)^2

$$

(A) wi = the weight applicable

to counterparty i under Table 4 to this section;

(B) Mi = the EAD-weighted average

of the effective maturity of each netting set with counterparty i (where each netting set’s effective maturity can be no less

than one year.)

(C) EADitotal = the sum of the EAD for all netting sets

of OTC derivative contracts with counterparty i calculated

using the standardized approach to counterparty credit risk described

in paragraph (c) of this section or the internal models methodology

described in paragraph (d) of this section. When the Board-regulated

institution calculates EAD under paragraph (c) of this section, such

EAD may be adjusted for purposes of calculating EADitotal by multiplying EAD by (1-exp(-0.05 × Mi))/(0.05

× Mi), where “exp” is the exponential function. When the

Board-regulated institution calculates EAD under paragraph (d) of

this section, EADitotal equals EADunstressed.

(D) Mihedge = the notional weighted average maturity of the hedge

instrument.

(E) Bi = the sum of the notional amounts of any purchased single

name CDS referencing counterparty i that is used to hedge CVA

risk to counterparty i multiplied by (1-exp(-0.05 × Mihedge))/(0.05 × Mihedge).

(F) Mind = the maturity

of the CDSind or the notional weighted average maturity

of any CDSind purchased to hedge CVA risk of counterparty i.

(G) Bind = the notional amount of one or more CDSind purchased

to hedge CVA risk for counterparty i multiplied by (1-exp(-0.05

× M ind))/(0.05 × M ind)

(H) w ind = the weight applicable to the CDSind based on the average weight of the underlying reference names that

comprise the index under Table 4 to this section.

(ii) The Board-regulated

institution may treat the notional amount of the index attributable

to a counterparty as a single name hedge of counterparty i (B i,) when calculating KCVA, and

subtract the notional amount of B i from

the notional amount of the CDSind. A Board-regulated institution

must treat the CDSind hedge with the notional amount reduced

by B i as a CVA hedge.

Table 4 to section

217.132—Assignment of counterparty weight

| Internal PD (in percent) |

Weight wi (in percent) |

| 0.00-0.07 |

0.70 |

| >0.070-0.15 |

0.80 |

| >0.15-0.40 |

1.00 |

| >0.40-2.00 |

2.00 |

| >2.00-6.00 |

3.00 |

| >6.00 |

10.00 |

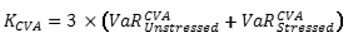

(6) Advanced CVA approach.

(i) A Board-regulated

institution may use the VaR model that it uses to determine specific

risk under section 217.207(b) or another VaR model that meets the

quantitative requirements of section 217.205(b) and section 217.207(b)(1)

to calculate its CVA capital requirement for a counterparty by modeling

the impact of changes in the counterparties’ credit spreads, together

with any recognized CVA hedges, on the CVA for the counterparties,

subject to the following requirements:

(A) The VaR model must incorporate only changes

in the counterparties’ credit spreads, not changes in other risk factors.

The VaR model does not need to capture jump-to-default risk;

(B) A Board-regulated institution

that qualifies to use the advanced CVA approach must include in that

approach any immaterial OTC derivative portfolios for which it uses

the standardized approach to counterparty credit risk in paragraph

(c) of this section according to paragraph (e)(6)(viii) of this section;

and

(C) A Board-regulated

institution must have the systems capability to calculate the CVA

capital requirement for a counterparty on a daily basis (but is not

required to calculate the CVA capital requirement on a daily basis).

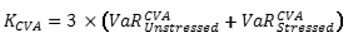

(ii)

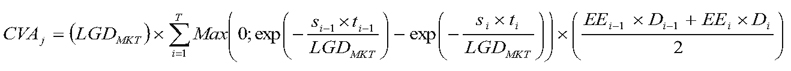

Under the advanced CVA approach, the CVA capital requirement, KCVA, is calculated according to the following formulas:

Figure 24. DISPLAY EQUATION

$$

K_{CVA} = 3 \times \bigg( VaR^{\mathit{CVA}}_{\mathit{Unstressed}} + VaR^{\mathit{CVA}}_{\mathit{Stressed}} \bigg)

$$

where VaR CVAj is the 99% VaR reflecting

changes of CVA j and fair value of eligible

hedges (aggregated across all counterparties and eligible hedges)

resulting from simulated changes of credit spreads over a 10-day time

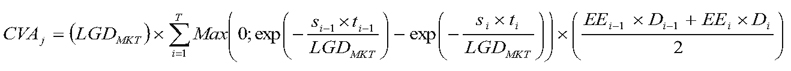

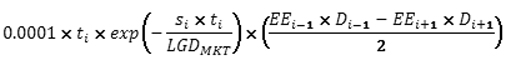

horizon. CVA j for a given counterparty must

be calculated according to

Figure 25. DISPLAY EQUATION

$$

CVA_j =

\bigg( LGD_{MKT} \bigg) \times

{\sum\limits^T_{i=1}} Max

\Bigg \lgroup

0; \text{exp}

\Bigg \lgroup

-

\frac{s_{i-1} \times t_{i-1}}{LGD_{MKT}}

\Bigg \rgroup

- \text{exp}

\Bigg \lgroup

-

\frac{s_i \times t_i}{LGD_{MKT}}

\Bigg \rgroup

\Bigg \rgroup

\times

\Bigg \lgroup

\frac{EE_{i-1} \times D_{i-1} + EE_i \times D_i}{2}

\Bigg \rgroup

$$

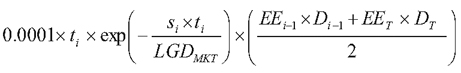

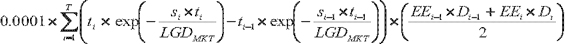

Where

(A) t i = the time

of the i -th revaluation time bucket starting from t 0 = 0.

(B) t T = the longest contractual maturity

across the OTC derivative contracts with the counterparty.

(C) s i = the CDS spread for the counterparty at tenor t i used to calculate the CVA for the counterparty. If a

CDS spread is not available, the Board-regulated institution must

use a proxy spread based on the credit quality, industry and region

of the counterparty.

(D) LGD MKT = the loss given default of the counterparty

based on the spread of a publicly traded debt instrument of the counterparty,

or, where a publicly traded debt instrument spread is not available,

a proxy spread based on the credit quality, industry, and region of

the counterparty. Where no market information and no reliable proxy

based on the credit quality, industry, and region of the counterparty

are available to determine LGDMKT, a Board-regulated institution

may use a conservative estimate when determining LGDMKT, subject to approval by the Board.

(E) EE i = the sum

of the expected exposures for all netting sets with the counterparty

at revaluation time t i, calculated according

to paragraphs (e)(6)(iv)(A) and (e)(6)(v)(A) of this section.