(1) General rule. The annual percentage rate shall be the nominal annual percentage

rate determined by multiplying the unit-period rate by the number

of unit periods in a year.

(2) Term of the

transaction. The term of the transaction begins on the date of

its consummation, except that if the finance charge or any portion

of it is earned beginning on a later date, the term begins on the

later date. The term ends on the date the last payment is due, except

that if an advance is scheduled after that date, the term ends on

the later date. For computation purposes, the length of the term shall

be equal to the time interval between any point in time on the beginning

date to the same point in time on the ending date.

(3) Definitions

of time intervals.

(i) A period is the interval of time

between advances or between payments and includes the interval of

time between the date the finance charge begins to be earned and the

date of the first advance thereafter or the date of the first payment

thereafter, as applicable.

(ii) A common period is any period that

occurs more than once in a transaction.

(iii) A standard interval of time is

a day, week, semimonth, month, or a multiple of a week or a month

up to, but not exceeding, one year.

(iv) All months shall be considered

equal. Full months shall be measured from any point in time on a given

date of a given month to the same point in time on the same date of

another month. If a series of payments (or advances) is scheduled

for the last day of each month, months shall be measured from the

last day of the given month to the last day of another month. If payments

(or advances) are scheduled for the 29th or 30th of each month, the

last day of February shall be used when applicable.

(4) Unit period.

(i) In all transactions

other than a single advance, single payment transaction, the unit

period shall be that common period, not to exceed 1 year, that occurs

most frequently in the transaction, except that

(A) If two or

more common periods occur with equal frequency, the smaller of such

common periods shall be the unit period; or

(B) If there is no common period in the transaction,

the unit period shall be that period which is the average of all periods

rounded to the nearest whole standard interval of time. If the average

is equally near two standard intervals of time, the lower shall be

the unit period.

(ii) In a single advance, single payment

transaction, the unit period shall be the term of the transaction,

but shall not exceed one year.

(5) Number of

unit periods between two given dates.

(i) The number of days

between two dates shall be the number of 24-hour intervals between

any point in time on the first date to the same point in time on the

second date.

(ii)

If the unit period is a month, the number of full unit periods between

two dates shall be the number of months measured back from the later

date. The remaining fraction of a unit period shall be the number

of days measured forward from the earlier date to the beginning of

the first full unit period, divided by 30. If the unit period is a

month, there are 12 unit periods per year.

(iii) If the unit period is a semimonth

or a multiple of a month not exceeding 11 months, the number of days

between two dates shall be 30 times the number of full months measured

back from the later date, plus the number of remaining days. The number

of full unit periods and the remaining fraction of a unit period shall

be determined by dividing such number of days by 15 in the case of

a semimonthly unit period or by the appropriate multiple of 30 in

the case of a multimonthly unit period. If the unit period is a semimonth,

the number of unit periods per year shall be 24. If the number of

unit periods is a multiple of a month, the number of unit periods

per year shall be 12 divided by the number of months per unit period.

(iv) If the unit period

is a day, a week, or a multiple of a week, the number of full unit

periods and the remaining fractions of a unit period shall be determined

by dividing the number of days between the two given dates by the

number of days per unit period. If the unit period is a day, the number

of unit periods per year shall be 365. If the unit period is a week

or a multiple of a week, the number of unit periods per year shall

be 52 divided by the number of weeks per unit period.

(v) If the unit period

is a year, the number of full unit periods between two dates shall

be the number of full years (each equal to 12 months) measured back

from the later date. The remaining fraction of a unit period shall

be

(A) The remaining number of months divided

by 12 if the remaining interval is equal to a whole number of months,

or

(B) The remaining number

of days divided by 365 if the remaining interval is not equal to a

whole number of months.

(vi) In a single advance, single payment

transaction in which the term is less than a year and is equal to

a whole number of months, the number of unit periods in the term shall

be one, and the number of unit periods per year shall be 12 divided

by the number of months in the term or 365 divided by the number of

days in the term.

(vii) In a single advance, single payment transaction in which the

term is less than a year and is not equal to a whole number

of months, the number of unit periods in the term shall be one, and

the number of unit periods per year shall be 365 divided by the number

of days in the term.

(6) Percentage

rate for a fraction of a unit period. The percentage rate of

finance charge for a fraction (less than one) of a unit period

shall be equal to such fraction multiplied by the percentage rate

of finance charge per unit period.

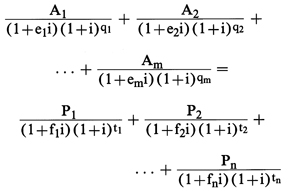

(7) Symbols. The symbols used to express the terms of a transaction in the equation

set forth in paragraph (b)(8) of this section are defined as follows:

Symbols

| Ak |

= |

The amount of the kth advance. |

| qk |

= |

The number of full unit periods from the

beginning of the term of the transaction to the kth advance. |

| ek |

= |

The fraction of a unit period in the time

interval from the beginning of the term of the transaction to the

kth advance. |

| m |

= |

The number of advances. |

| Pj |

= |

The amount of the jth payment. |

| tj |

= |

The number of full unit periods from the

beginning of the term of the transaction to the jth payment. |

| fj |

= |

The fraction of a unit period in the time

interval from the beginning of the term of the transaction to the

jth payment. |

| n |

= |

The number of payments. |

| i |

= |

The percentage rate of finance charge per

unit period, expressed as a decimal equivalent. |

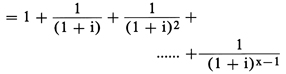

Symbols used

in the examples shown in this appendix are defined as follows:

Symbols used

in the examples

<mb;-6q>..<mb;0q><mh;-4.5q>a|m-<mb;4q><mh;-5.5q>x<mb;2q><tmpsz;6q>1<reset>

$$

\require{enclose}

\mathrm{\ddot{a}_{\enclose{actuarial}{x}}} =

$$

|

= |

The present value of 1 per unit period for

x unit periods, first payment due immediately. |

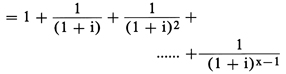

Figure 1. DISPLAY EQUATION

$$\mathrm{=1 + \frac{1}{(1 + i)}} + \frac{1}{(1 + \mathrm{i})^2}+ \\

\qquad\qquad\qquad\qquad\qquad\qquad\qquad....+ \frac{1}{(1 + \mathrm{i})^{\mathrm{x}-1}}

$$

Symbols used

in the examples

| w |

= |

The number of unit periods per year. |

| I |

= |

wi × 100 = The nominal annual percentage

rate. |

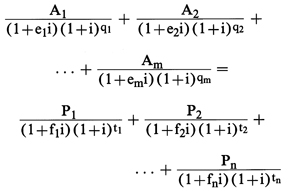

(8) General equation. The following equation

sets forth the relationship among the terms of a transaction:

Figure 2. DISPLAY EQUATION

$$

\mathrm{\frac{A_1}{(1+e_1i)(1+i)^{q_1}} + \frac{A_2}{(1+e_2i)(1+i)^{q_2}} +}

\\

\qquad\qquad...+ \mathrm{\frac{A_m}{(1+e_mi)(1+i)^{q_m}}} =

\\

\qquad \mathrm{\frac{P_1}{(1+f_1i)(1+i)^{t_1}} + \frac{P_2}{(1+f_2i)(1+i)^{t_2}} +}

\\

\qquad\qquad\qquad\qquad\qquad...+ \mathrm{\frac{P_n}{(1+f_ni)(1+i)^{t_n}}}

$$

(9) Solution of general equation by iteration process.

(i) The general equation in paragraph

(b)(8) of this section, when applied to a simple transaction in which

a loan of $1000 is repaid by 36 monthly payments of $33.61 each, takes

the special form:

Figure 3. DISPLAY EQUATION

$$

\require{enclose}

\mathrm{A = \frac{33.61\ddot{a}_{\enclose{actuarial}{36}}}{(1+i)}}

$$

Step 1:

- Let I1 = estimated annual percentage rate

=%12.50%

- Evaluate expression for A, letting i = I1 /(100w) = %.010416667

- Results (referred to as A‘) =%1004.674391

Step 2:

- Let I2 = I1 +.1 =%12.60%

- Evaluate expression for A, letting i = I2 /(100w) = %.010500000

- Result (referred to as A“) =%1003.235366

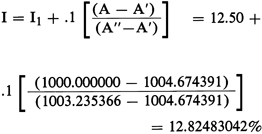

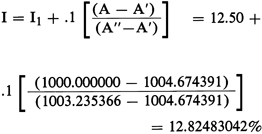

Step 3:

- Interpolate for I (annual percentage rate):

Figure 4. DISPLAY EQUATION

$$

\mathrm{I = I_1 + .1}

\begin{bmatrix}

\mathrm{(A-A^{\prime})} \\[0.3em]

\hline

\mathrm{(A^{\prime\prime}-A^{\prime})} \\[0.3em]

\end{bmatrix}

= 12.50 + \\

.1

\begin{bmatrix}

(1000.000000 - 1004.674391) \\[0.3em]

\hline

(1003.235366 - 1004.674391) \\[0.3em]

\end{bmatrix}

\\

\qquad\qquad\qquad\qquad = 12.82483042\%

$$

Step 4:

- First iteration, let I1 =

12.82483042% and repeat Steps 1, 2, and 3

obtaining a new I = .82557859%

- Second iteration, let I1 =

12.82557859% and repeat Steps 1, 2, and 3

obtaining a new I = .82557529%

In this case, no further iterations are required to obtain

the annual percentage rate correct to two decimal places, 12.83%.

(ii) When the iteration

approach is used, it is expected that calculators or computers will

be programmed to carry all available decimals throughout the calculation

and that enough iterations will be performed to make virtually certain

that the annual percentage rate obtained, when rounded to two decimals,

is correct. Annual percentage rates in the examples below were obtained

by using a 10-digit programmable calculator and the iteration procedure

described above.

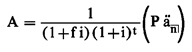

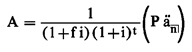

(1) Single-advance

transaction, with or without an odd first period, and otherwise regular. The general equation in paragraph (b)(8) of this section can be

put in the following special form for this type of transaction:

Figure 5. DISPLAY EQUATION

$$

\require{enclose}

\mathrm{A = \frac{1}{(1+fi)(1+i)^t}} \bigg( \mathrm{P\mathrm{\ddot{a}_{\enclose{actuarial}{n}}}} \bigg)

$$

Example (i): Monthly payments

(regular first period)

Amount advanced (A) = $5000. Payment (P)

= $230.

Number of

payments (n) = 24.

Unit period = 1 month. Unit periods per year

(w) = 12.

Advance, 1-10-78. First payment, 2-10-78.

From 1-10-78 through 2-10-78 = 1 unit period. (t = 1;

f = 0)

Annual percentage rate (I) = wi = .0969 = 9.69%

Example (ii): Monthly

payments (long first period)

Amount advanced (A) = $6000. Payment (P) = $200.

Number of payments (n) = 36.

Unit period = 1 month. Unit periods per year (w) = 12.

Advance, 2-10-78. First payment, 4-1-78.

From 3-1-78 through 4-1-78 = 1 unit period. (t = 1)

From 2-10-78 through 3-1-78 = 19 days. (f = 19/30)

Annual percentage rate (I) = wi = .1182 =

11.82%

Example (iii): Semimonthly payments (short first

period)

Amount advanced (A) = $5000. Payment (P) = $219.17.

Number of payments (n) = 24.

Unit period =½ month. Unit periods per year (w) = 24.

Advance, 2-23-78. First payment, 3-1-78. Payments made

on 1st and 16th of each month.

From 2-23-78 through 3-1-78 = 6 days. (t = 0; f = 6/15)

Annual percentage rate (I) = wi = .1034 =

10.34%

Example (iv): Quarterly payments (long first period)

Amount advanced (A) = $10,000. Payment (P) = $385.

Number of payments (n) = 40.

Unit period = 3 months. Unit periods per year (w) = 4.

Advance, 5-23-78. First payment, 10-1-78.

From 7-1-78 through 10-1-78 = 1 unit period. (t = 1)

From 6-1-78 through 7-1-78 = 1 month = 30 days. From 5-23-78

through 6-1-78 = 9 days. (f = 39/90)

Annual percentage rate (I) = wi = .0897 =

8.97%

Example (v): Weekly payments (long first period)

Amount advanced (A) = $500. Payment (P) = $17.60.

Number of payments (n) = 30.

Unit period = 1 week. Unit periods per year (w) = 52.

Advance, 3-20-78. First payment, 4-21-78.

From 3-24-78 through 4-21-78 = 4 unit periods. (t = 4)

From 3-20-78 through 3-24-78 = 4 days. (f = 4/7)

Annual percentage rate (I) = wi = .1496 =

14.96%

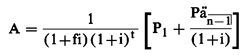

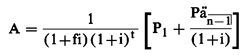

(2) Single-advance transaction, with an

odd first payment, with or without an odd first period, and otherwise

regular. The general equation in paragraph (b)(8) of this section

can be put in the following special form for this type of transaction:

Figure 6. DISPLAY EQUATION

$$

\require{enclose}

\mathrm{A} = \frac{1}{(1+\mathrm{fi})(1+\mathrm{i})^\mathrm{t}}

\Bigg[ \mathrm{P}_1 + \frac{\mathrm{P}\ddot{\mathrm{a}}_\enclose{actuarial}{\mathrm{n}-1}}{(1+\mathrm{i})} \Bigg]

$$

Example (i): Monthly payments (regular first period

and irregular first payment)

Amount advanced (A) $5000. First payment (P1) = $250.

Regular payment (P) = $230. Number of payments (n) = 24.

Unit period = 1 month. Unit periods per year (w) = 12.

Advance, 1-10-78. First payment, 2-10-78.

From 1-10-78 through 2-10-78 = 1 unit period. (t = 1;

f = 0)

Annual percentage rate (I) = wi = .1008 =

10.08%

Example (ii): Payments every four weeks (long

first period and irregular first payment)

Amount advanced (A) = $400. First payment (P1) = $39.50.

Regular payment (P) = $38.31. Number of payments (n) =

12.

Unit period = 4 weeks. Unit periods per year (w) = 52/4

= 13.

Advance, 3-18-78. First payment, 4-20-78.

From 3-23-78 through 4-20-78 = 1 unit period. (t = 1)

From 3-18-78 through 3-23-78 = 5 days. (f = 5/28)

Annual percentage rate (I) = wi = .2850 =

28.50%.

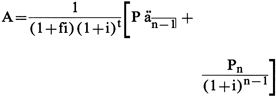

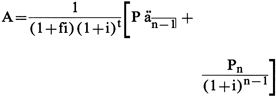

(3) Single-advance transaction, with an odd final

payment, with or without an odd first period, and otherwise regular. The general equation in paragraph (b)(8) of this section can be

put in the following special form for this type of transaction:

Figure 7. DISPLAY EQUATION

$$

\require{enclose}

\begin{align*}

\mathrm{A} = \frac{1}{(1+\mathrm{fi})(1+\mathrm{i})^\mathrm{t}}

\Bigg[ \mathrm{P}\ddot{\mathrm{a}}_\enclose{actuarial}{\mathrm{n}-1} +&\\

&\frac{\mathrm{P}_\mathrm{n}}{(1+\mathrm{i})^{\mathrm{n}-1}} \Bigg]

\end{align*}

$$

Example (i): Monthly payments (regular first period

and irregular final payment)

Amount advanced (A) = $5000. Regular payment (P) = $230.

Final payment (Pn) = $280. Number of payments

(n) = 24.

Unit period = 1 month. Unit periods per year (w) = 12.

Advance, 1-10-78. First payment, 2-10-78.

From 1-10-78 through 2-10-78 = 1 unit period. (t = 1;

f = 0)

Annual percentage rate (I) = wi = .1050 =

10.50%

Example (ii): Payments every two weeks (short

first period and irregular final payment)

Amount advanced (A) = $200. Regular payment (P) = $9.50.

Final payment (Pn) = $30. Number of payments

(n) = 20.

Unit period = 2 weeks. Unit periods per year (w) = 52/2

= 26.

Advance, 4-3-78. First payment, 4-11-78.

From 4-3-78 through 4-11-78 = 8 days. (t

= 0; f = 8/14)

Annual percentage rate (I) = wi = .1222 =

12.22%

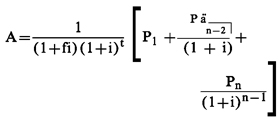

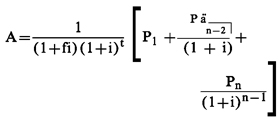

(4) Single-advance transaction, with an odd first

payment, odd final payment, with or without an odd first period, and

otherwise regular. The general equation in paragraph (b)(8) of

this section can be put in the following special form for this type of transaction:

Figure 8. DISPLAY EQUATION

$$

\require{enclose}

\begin{align*}

\mathrm{A = \frac{1}{(1+fi)(1+i)^t}}

\Bigg[ \mathrm{P_1} + &\mathrm{\frac{P\ddot{a}_\enclose{actuarial}{n-2}}{(1+i)}} +\\

&\mathrm{\frac{P_n}{(1+i)^{n-1}}} \Bigg]

\end{align*}

$$

Example (i): Monthly payments

(regular first period, irregular first payment, and irregular final

payment)

Amount advanced (A) = $5000. First payment (P1) = $250.

Regular payment (P) = $230. Final payment (Pn) = $280.

Number of payments (n) = 24. Unit period = 1 month.

Unit periods per year (w) = 12.

Advance, 1-10-78. First payment, 2-10-78.

From 1-10-78 through 2-10-78 = 1 unit period. (t = 1;

f = 0)

Annual percentage rate (I) = wi = .1090 =

10.90%

Example

(ii): Payments every two months (short first period, irregular

first payment, and irregular final payment)

Amount advanced (A) = $8000. First payment (P1) = $449.36.

Regular payment (P) = $465. Final payment (Pn) = $200.

Number of payments (n) = 20. Unit period = 2 months.

Unit periods per year (w) = 12/2 = 6.

Advance, 1-10-78. First payment, 3-1-78.

From 2-1-78 through 3-1-78 = 1 month. From 1-10-78 through

2-1-78 = 22 days. (t = 0; f = 52/60)

Annual percentage rate (I) = wi = .0730 =

7.30%

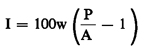

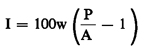

(5) Single-advance, single-payment transaction. The general equation in paragraph (b)(8) of this section can be

put in the special forms below for single advance, single payment

transactions. Forms 1 through 3 are for the direct determination of

the annual percentage rate under special conditions. Form 4 requires

the use of the iteration procedure of paragraph (b)(9) of this section

and can be used for all single-advance, single-payment transactions

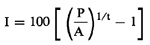

regardless of term.

Form 1—Term less than one year:

Figure 9. DISPLAY EQUATION

$$

\mathrm{I} = 100\mathrm{w} \Bigg( \mathrm{\frac{P}{A}} -1 \Bigg)

$$

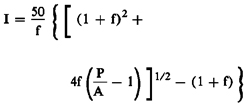

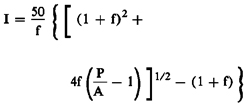

Form 2—Term

more than one year but less than two years:

Figure 10. DISPLAY EQUATION

$$

\begin{align*}

\mathrm{I = \frac{50}{f}}

\Bigg\{\Bigg[ & \mathrm{(1+f)^2} + \\[8pt]

& \mathrm{4f} \Bigg( \mathrm{\frac{P}{A} -1} \Bigg) \Bigg]^{1/2} - (1 + \mathrm{f}) \Bigg\}

\end{align*}

$$

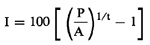

Form 3—Term

equal to exactly a year or exact multiple of a year:

Figure 11. DISPLAY EQUATION

$$

\mathrm{I = 100}

\Bigg[ \Bigg(\mathrm{\frac{P}{A} \Bigg)^{1/\mathrm{t}} -1} \Bigg]

$$

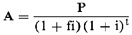

Form 4—Special

form for iteration procedure (no restriction on term):

Figure 12. DISPLAY EQUATION

$$

\mathrm{A = \frac{P}{(1+fi)(1+i)^t}}

$$

Example (i): Single-advance,

single-payment (term of less than one year, measured in days)

Amount advanced (A) = $1000. Payment (P) = $1080.

Unit period = 255 days. Unit periods per year (w) = 365/255.

Advance, 1-3-78. Payment, 9-15-78.

From 1-3-78 through 9-15-78 = 255 days. (t = 1; f = 0)

Annual percentage rate (I) = wi = .1145 =

11.45%. (Use form 1 or 4.)

Example (ii): Single-advance,

single-payment (term of less than one year, measured in exact calendar

months)

Amount advanced (A) = $1000. Payment (P) = $1044.

Unit period = 6 months. Unit periods per year (w) = 2.

Advance, 7-15-78. Payment, 1-15-79.

From 7-15-78 through 1-15-79 = 6 mos. (t = 1; f = 0)

Annual percentage rate (I) = wi = .0880 =

8.80%. (Use form 1 or 4.)

Example (iii): Single-advance,

single-payment (term of more than one year but less than two years,

fraction measured in exact months)

Amount advanced (A) = $1000. Payment (P) = $1135.19.

Unit period = 1 year. Unit periods per year (w) = 1.

Advance, 7-17-78. Payment, 1-17-80.

From 1-17-79 through 1-17-80 = 1 unit period. (t = 1)

From 7-17-78 through 1-17-79 = 6 mos. (f = 6/12)

Annual percentage rate (I) = wi = .0876 =

8.76%. (Use form 2 or 4.)

Example (iv): Single-advance,

single-payment (term of exactly two years)

Amount advanced (A) = $1000. Payment (P) = $1240.

Unit period = 1 year. Unit periods per year (w) = 1.

Advance, 1-3-78. Payment, 1-3-80.

From 1-3-78 through 1-3-79 = 1 unit period. (t = 2; f

= 0)

Annual percentage rate (I) = wi = .1136 =

11.36%. (Use form 3 or 4.)

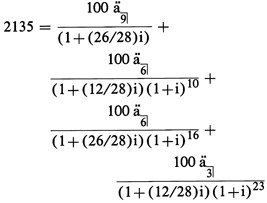

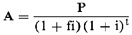

(6) Complex single-advance

transaction.

Example (i): Skipped-payment loan (payments every

four weeks)

A loan of $2135 is advanced on 1-25-78. It is to be repaid

by 24 payments of $100 each. Payments are due every four weeks beginning

2-20-78. However, in those months in which two payments would be due,

only the first of the two payments is made and the following payment

is delayed by two weeks to place it in the next month.

Unit period = 4 weeks. Unit periods per year (w) = 52/4

= 13.

First series of payments begins 26 days after 1-25-78.

(t1 = 0; f1 = 26/28)

Second series of payments begins nine unit periods plus

two weeks after start of first series. (t2 = 10; f2 = 12/28)

Third series of payments begins six unit

periods plus two weeks after start of second series. (t3 = 16; f3 = 26/28)

Last series of payments begins six unit periods plus two

weeks after start of third series. (t4 = 23; f4 = 12/28)

The general equation in paragraph (b)(8) of this section

can be written in the special form:

Figure 13. DISPLAY EQUATION

$$

\require{enclose}

\begin{align*}

2135 = & \mathrm{\frac{100\ddot{a}_\enclose{actuarial}{9}}{(1+(26/28)i)} +} \\[8pt]

& \mathrm{\frac{100\ddot{a}_\enclose{actuarial}{6}}{(1+(12/28)i)(1+i)^{10}} + } \\[8pt]

& \mathrm{\frac{100\ddot{a}_\enclose{actuarial}{6}}{(1+(26/28)i)(1+i)^{16}} +} \\[8pt]

& \qquad\qquad \mathrm{\frac{100\ddot{a}_\enclose{actuarial}{3}}{(1+(12/28)i)(1+i)^{23}} } \\

\end{align*}

$$

Annual percentage rate (I) = wi = .1200 =

12.00%

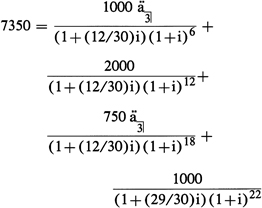

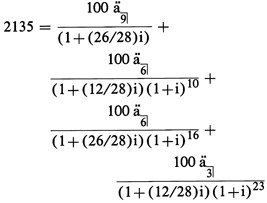

Example

(ii): Skipped-payment loan plus single payments

A loan of $7350 on 3-3-78 is to be repaid by three monthly

payments of $1000 each beginning 9-15-78, plus a single payment of

$2000 on 3-15-79, plus three more monthly payments of $750 each beginning

9-15-79, plus a final payment of $1000 on 2-1-80.

Unit period = 1 month. Unit periods per year (w) = 12.

First series of payments begins six unit periods plus

12 days after 3-3-78. (t1 = 6; f1 = 12/30)

Second series of payments (single payment) occurs 12 unit

periods plus 12 days after 3-3-78. (t2 = 12; f2 = 12/30)

Third series of payments begins 18 unit periods plus 12

days after 3-3-78. (t3 = 18; f3 = 12/30)

Final payment occurs 22 unit periods plus 29

days after 3-3-78. (t4 = 22; f4 = 29/30)

The general equation in paragraph (b)(8) of this section

can be written in the special form:

Figure 14. DISPLAY EQUATION

$$

\require{enclose}

\begin{align*}

7350 = & \mathrm{\frac{1000\ddot{a}_\enclose{actuarial}{3}}{(1+(12/30)i)(1+i)^6} +} \\[8pt]

& \mathrm{\frac{2000}{(1+(12/30)i)(1+i)^{12}} + } \\[8pt]

& \mathrm{\frac{750\ddot{a}_\enclose{actuarial}{3}}{(1+(12/30)i)(1+i)^{18}} +} \\[8pt]

& \qquad\qquad \mathrm{\frac{1000}{(1+(29/30)i)(1+i)^{22}} } \\

\end{align*}

$$

Annual percentage rate

(I) = wi = .1022 = 10.22%

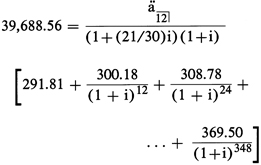

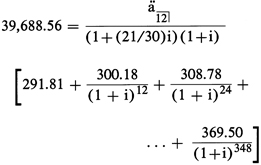

Example (iii): Mortgage with

varying payments

A loan of $39,688.56 (net) on 4-10-78 is to be repaid by 360 monthly

payments beginning 6-1-78. Payments are the same for 12 months at

a time as follows:

Mortgage with

varying payments

| Year |

Monthly payment |

Year |

Monthly payment |

| 1 |

$291.81 |

16 |

$383.67 |

| 2 |

300.18 |

17 |

383.13 |

| 3 |

308.78 |

18 |

382.54 |

| 4 |

317.61 |

19 |

381.90 |

| 5 |

326.65 |

20 |

381.20 |

| 6 |

335.92 |

21 |

380.43 |

| 7 |

345.42 |

22 |

379.60 |

| 8 |

355.15 |

23 |

378.68 |

| 9 |

365.12 |

24 |

377.69 |

| 10 |

375.33 |

25 |

376.60 |

| 11 |

385.76 |

26 |

375.42 |

| 12 |

385.42 |

27 |

374.13 |

| 13 |

385.03 |

28 |

372.72 |

| 14 |

384.62 |

29 |

371.18 |

| 15 |

384.17 |

30 |

369.50 |

Unit period = 1 month. Unit periods per year (w) = 12.

From 5-1-78 through 6-1-78 = 1 unit period. (t = 1)

From 4-10-78 through 5-1-78 = 21 days. (f = 21/30)

The general equation in paragraph (b)(8) of this section

can be written in the special form:

Figure 15. DISPLAY EQUATION

$$

\require{enclose}

\begin{align*}

39&,688.56 = \mathrm{\frac{\ddot{a}_\enclose{actuarial}{12}}{(1+(21/30)i)(1+i)} } \\[8pt]

& \Bigg[291.81 + \frac{300.18}{(1+\mathrm{i})^{12}} + \frac{308.78}{(1+\mathrm{i})^{24}} + \\[8pt]

& \qquad\qquad\qquad\qquad... + \frac{369.50}{(1+\mathrm{i})^{348}} \Bigg]

\end{align*}

$$

Annual percentage rate

(I) = wi = .0980 = 9.80%

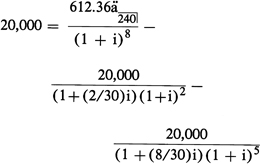

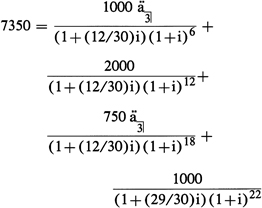

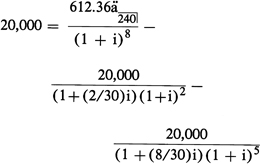

(7) Multiple-advance

transactions.

Example (i): Construction loan

Three advances of $20,000 each are made on 4-10-79, 6-12-79,

and 9-18-79. Repayment is by 240 monthly payments of $612.36 each

beginning 12-10-79.

Unit period = 1 month. Unit periods per year

(w) = 12.

From 4-10-79 through 6-12-79 = (2+2/30) unit periods.

From 4-10-79 through 9-18-79 = (5+8/30) unit periods.

From 4-10-79 through 12-10-79 = (8) unit periods.

The general equation in

paragraph (b)(8) of this section is changed to the single-advance

mode by treating the second and third advances as negative payments:

Figure 16. DISPLAY EQUATION

$$

\require{enclose}

\begin{align*}

20,0000 &= \mathrm{\frac{612.36\ddot{a}_{\enclose{actuarial}{240}}}{(1+i)^8} } -\\[8pt]

& \frac{20,000}{(1+(2/30)\mathrm{i})(1+\mathrm{i})^2} - \\[8pt]

& \qquad\qquad \frac{20,000}{(1+(8/30)\mathrm{i}(1+\mathrm{i})^5}

\end{align*}

$$

Annual percentage rate

(I) = wi = .1025 = 10.25%

Example (ii): Student loan

A student loan consists of eight advances: $1800 on 9-5-78,

9-5-79, 9-5-80, and 9-5-81; plus $1000 on 1-5-79, 1-5-80, 1-5-81,

and 1-5-82. The borrower is to make 50 monthly payments of $240 each

beginning 7-1-78 (prior to first advance).

Unit period = 1 month. Unit periods per year (w) = 12.

Zero point is date of first payment since it precedes

first advance.

From 7-1-78 to 9-5-78 = (2+4/30) unit periods.

From 7-1-78 to 9-5-79 = (14+4/30) unit periods.

From 7-1-78 to 9-5-80 = (26+4/30) unit periods.

From 7-1-78 to 9-5-81 = (38+4/30) unit periods.

From 7-1-78 to 1-5-79 = (6+4/30) unit periods.

From 7-1-78 to 1-5-80 = (18+4/30) unit periods.

From 7-1-78 to 1-5-81 = (30+4/30) unit periods.

From 7-1-78 to 1-5-82 = (42+4/30) unit periods.

Since the zero point is

date of first payment, the general equation in paragraph (b)(8) of

this section is written in the single-advance form below by treating

the first payment as a negative advance and the eight advances as

negative payments:

Figure 17. DISPLAY EQUATION

$$

\require{enclose}

\begin{align*}

-&240 = \mathrm{\frac{240\ddot{a}_\enclose{actuarial}{49}}{(1+i)}}

- \mathrm{\frac{1800}{(1+ (4/30)i}} \\[8pt]

& \Bigg[ \mathrm{\frac{1}{(1+i)^2}} + \mathrm{\frac{1}{(1+i)^{14}}} + \mathrm{\frac{1}{(1+i)^{26}}} \\[8pt]

& \qquad + \mathrm{\frac{1}{(1+i)^{38}}} \Bigg] - \mathrm{\frac{1000}{(1+(4/30)i)}} \\[8pt]

& \qquad\qquad \Bigg[ \mathrm{\frac{1}{(1+i)^6}} + \mathrm{\frac{1}{(1+i)^{18}}} + \\[8pt]

& \qquad\qquad\qquad \mathrm{\frac{1}{(1+i)^{30}}} + \mathrm{\frac{1}{(1+i)^{42}}} \Bigg]

\end{align*}

$$

Annual percentage

rate

(I) = wi =

.3204 = 32.04%