(a) Eligibility and operational criteria for double default treatment. A Board-regulated institution may recognize the credit risk mitigation

benefits of a guarantee or credit derivative covering an exposure

described in section 217.134(a)(1) by applying the double default

treatment in this section if all the following criteria are satisfied:

(1) The hedged exposure is

fully covered or covered on a pro rata basis by:

(i) An

eligible guarantee issued by an eligible double default guarantor;

or

(ii) An eligible

credit derivative that meets the requirements of section 217.134(b)(2)

and that is issued by an eligible double default guarantor.

(2) The guarantee or credit

derivative is:

(i) An uncollateralized guarantee or

uncollateralized credit derivative (for example, a credit default

swap) that provides protection with respect to a single reference

obligor; or

(ii)

An nth-to-default credit derivative (subject to the requirements

of section 217.142(m).

(3) The hedged exposure is a wholesale

exposure (other than a sovereign exposure).

(4) The obligor of the hedged exposure

is not:

(i) An eligible double default guarantor

or an affiliate of an eligible double default guarantor; or

(ii) An affiliate of the

guarantor.

(5) The Board-regulated institution does not recognize any credit

risk mitigation benefits of the guarantee or credit derivative for

the hedged exposure other than through application of the double default

treatment as provided in this section.

(6) The Board-regulated institution has

implemented a process (which has received the prior, written approval

of the Board) to detect excessive correlation between the creditworthiness

of the obligor of the hedged exposure and the protection provider.

If excessive correlation is present, the Board-regulated institution

may not use the double default treatment for the hedged exposure.

(b) Full coverage. If a transaction meets the criteria in paragraph (a) of this section

and the protection amount (P) of the guarantee or credit derivative

is at least equal to the EAD of the hedged exposure, the Board-regulated

institution may determine its risk-weighted asset amount for the hedged

exposure under paragraph (e) of this section.

(c) Partial coverage. If a transaction meets

the criteria in paragraph (a) of this section and the protection amount

(P) of the guarantee or credit derivative is less than the EAD of

the hedged exposure, the Board-regulated institution must treat the

hedged exposure as two separate exposures (protected and unprotected)

in order to recognize double default treatment on the protected portion

of the exposure:

(1) For the protected exposure, the Board-regulated

institution must set EAD equal to P and calculate its risk-weighted

asset amount as provided in paragraph (e) of this section; and

(2) For the unprotected

exposure, the Board-regulated institution must set EAD equal to the

EAD of the original exposure minus P and then calculate its risk-weighted

asset amount as provided in section 217.131.

(d) Mismatches. For any

hedged exposure to which a Board-regulated institution applies double

default treatment under this part, the Board-regulated institution

must make applicable adjustments to the protection amount as required

in section 217.134(d), (e), and (f).

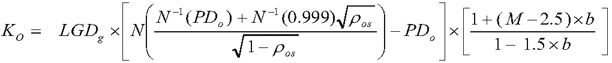

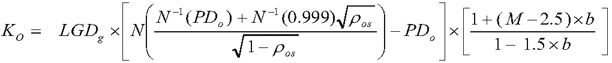

(e) The double default dollar risk-based capital

requirement. The dollar risk-based capital requirement for a

hedged exposure to which a Board-regulated institution has applied

double default treatment is KDD multiplied by the EAD of

the exposure. KDD is calculated according to the following

formula: KDD = Ko × (0.15 + 160 × PDg), where:

(1)

Figure 1. DISPLAY EQUATION

$$

K_O = LGD_g \times

\Bigg[ N \Bigg \lgroup \frac{N^{-1}(PD_o) + N^{-1}(0.999)\sqrt{\rho_{os}}}{\sqrt{1-\rho_{os}}} \Bigg \rgroup - PD_o \Bigg]

\times

\bigg[ \frac{1 + (M - 2.5) \times b}{1-1.5 \times b} \bigg]

$$

(2) PDg = PD of the protection

provider.

(3) PDo = PD of the obligor of the hedged exposure.

(4) LGDg =

(i) The lower

of the LGD of the hedged exposure (not adjusted to reflect the guarantee

or credit derivative) and the LGD of the guarantee or credit derivative,

if the guarantee or credit derivative provides the Board-regulated

institution with the option to receive immediate payout on triggering

the protection; or

(ii) The LGD of the guarantee or credit derivative, if the guarantee

or credit derivative does not provide the Board-regulated institution

with the option to receive immediate payout on triggering the protection;

and

(5)

ρos (asset value correlation of the obligor) is calculated

according to the appropriate formula for (R) provided in Table 1 in

section 217.131, with PD equal to PDo.

(6) b (maturity adjustment coefficient)

is calculated according to the formula for b provided in Table 1 in

section 217.131, with PD equal to the lesser of PDo and

PDg; and

(7) M (maturity) is the effective maturity of the guarantee or credit

derivative, which may not be less than one year or greater than five

years.