(a) Eligibility requirements. A Board-regulated institution must

use the SFA to determine its risk-weighted asset amount for a securitization

exposure if the Board-regulated institution can calculate on an ongoing

basis each of the SFA parameters in paragraph (e) of this section.

(b) Mechanics. The

risk-weighted asset amount for a securitization exposure equals its

SFA risk-based capital requirement as calculated under paragraph (c)

and (d) of this section, multiplied by 12.5.

(c) The SFA risk-based capital requirement.

(1) If KIRB is greater

than or equal to L+T, an exposure’s SFA risk-based capital requirement

equals the exposure amount.

(2) If KIRB is less than or

equal to L, an exposure’s SFA risk-based capital requirement is UE

multiplied by TP multiplied by the greater of:

(i) F •

T (where F is 0.016 for all securitization exposures); or

(ii) S[L + T] − S[L].

(3) If KIRB is greater than L and less than L +T, the Board-regulated

institution must apply a 1,250 percent risk weight to an amount equal

to UE • TP • (KIRB − L), and the exposure’s SFA risk-based

capital requirement is UE multiplied by TP multiplied by the greater

of:

(i) F • (T − (KIRB − L))

(where F is 0.016 for all other securitization exposures); or

(ii) S[L + T] − S[KIRB].

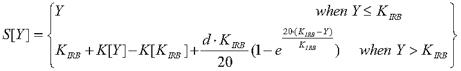

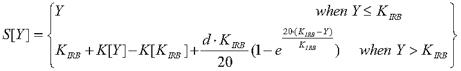

(d) The supervisory formula:

(1)

Figure 1. DISPLAY EQUATION

$$

S[Y] =

\begin{Bmatrix}

& Y & when \; Y \leq K_{IRB} \\

& K_{IRB} + K[Y] - K[K_{IRB}] + \frac{d \cdot K_{IRB}}{20} (1-e^{\frac{20(K_{IRB}-Y)}{K_{IRB}}})

& when \; Y > K_{IRB}

\end{Bmatrix}

$$

(2) K[Y]=(1− h)•[(1−β[Y;a,b ])• Y +β[Y;a+1, b]• c]

(3)

Figure 2. DISPLAY EQUATION

$$

h= \Big \lgroup 1 - \frac{K_{IRB}}{EWALGD} \Big \rgroup^N

$$

(4) a = g • c

(5) b = g • (1 − c)

(6)

Figure 3. DISPLAY EQUATION

$$

c = \frac{K_{IRB}}{1-h}

$$

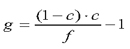

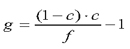

(7)

Figure 4. DISPLAY EQUATION

$$

g = \frac{(1-c) \cdot c}{f} - 1

$$

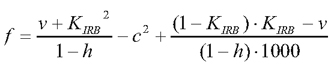

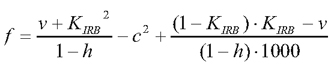

(8)

Figure 5. DISPLAY EQUATION

$$

f = \frac{v+ {K_{IRB}}^2}{1-h} - c^2 + \frac{(1-K_{IRB}) \cdot K_{IRB} -v}{(1-h) \cdot 1000}

$$

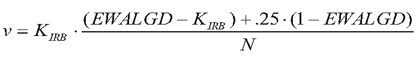

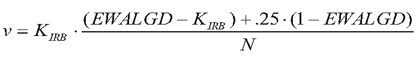

(9)

Figure 6. DISPLAY EQUATION

$$

v = K_{IRB} \cdot \frac{(EWALGD - K_{IRB}) + .25 \cdot (1-EWALGD)}{N}

$$

(10) d=1−(1−h )•(1−β[K IRB ;a,b ]).

(11) In these expressions, β[Y; a, b] refers

to the cumulative beta distribution with parameters a and b evaluated

at Y. In the case where N = 1 and EWALGD = 100 percent, S[Y] in formula

(1) must be calculated with K[Y] set equal to the product of KIRB and Y, and d set equal to 1−KIRB.

(e) SFA

parameters. For purposes of the calculations in paragraphs (c)

and (d) of this section:

(1) Amount of

the underlying exposures (UE). UE is the EAD of any underlying

exposures that are wholesale and retail exposures (including the amount

of any funded spread accounts, cash collateral accounts, and other

similar funded credit enhancements) plus the amount of any underlying

exposures that are securitization exposures (as defined in section

217.142(e)) plus the adjusted carrying value of any underlying exposures

that are equity exposures (as defined in section 217.151(b)).

(2) Tranche percentage (TP). TP is the ratio of the amount of the

Board-regulated institution’s securitization exposure to the amount

of the tranche that contains the securitization exposure.

(3) Capital requirement on underlying exposures (KIRB).

(i) KIRB is the ratio of:

(A) The sum of the risk-based capital requirements for the underlying

exposures plus the expected credit losses of the underlying exposures

(as determined under this subpart E as if the underlying exposures

were directly held by the Board-regulated institution); to

(B) UE.

(ii) The calculation of

KIRB must reflect the effects of any credit risk mitigant

applied to the underlying exposures (either to an individual underlying

exposure, to a group of underlying exposures, or to all of the underlying

exposures).

(iii)

All assets related to the securitization are treated as underlying

exposures, including assets in a reserve account (such as a cash collateral

account).

(4) Credit enhancement level (L).

(i) L is the ratio of:

(A) The amount of all securitization exposures

subordinated to the tranche that contains the Board-regulated institution’s

securitization exposure; to

(B) UE.

(ii) A Board-regulated institution must

determine L before considering the effects of any tranche-specific

credit enhancements.

(iii) Any gain-on-sale or CEIO associated with the securitization

may not be included in L.

(iv) Any reserve account funded by accumulated

cash flows from the underlying exposures that is subordinated to the

tranche that contains the Board-regulated institution’s securitization

exposure may be included in the numerator and denominator of L to

the extent cash has accumulated in the account. Unfunded reserve accounts

(that is, reserve accounts that are to be funded from future cash

flows from the underlying exposures) may not be included in the calculation

of L.

(v) In some

cases, the purchase price of receivables will reflect a discount that

provides credit enhancement (for example, first loss protection) for

all or certain tranches of the securitization. When this arises, L

should be calculated inclusive of this discount if the discount provides

credit enhancement for the securitization exposure.

(5) Thickness of tranche (T). T is the ratio

of:

(i) The amount of the tranche that contains

the Board-regulated institution’s securitization exposure; to

(ii) UE.

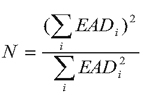

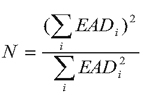

(6) Effective number of exposures (N).

(i) Unless the Board-regulated institution elects to use the formula

provided in paragraph (f) of this section,

Figure 7. DISPLAY EQUATION

$$

N = \frac{({\sum\limits_i}EAD_i)^2}{{\sum\limits_i}EAD^2_i}

$$

where EADi represents the EAD associated

with the ith instrument in the underlying exposures.

(ii) Multiple exposures

to one obligor must be treated as a single underlying exposure.

(iii) In the case of

a resecuritization, the Board-regulated institution must treat each

underlying exposure as a single underlying exposure and must not look

through to the originally securitized underlying exposures.

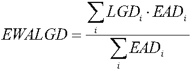

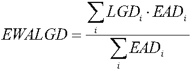

(7)

Exposure-weighted average loss given default

(EWALGD). EWALGD is calculated as:

Figure 8. DISPLAY EQUATION

$$

EWALGD = \frac{{\sum\limits_i}LGD_i \cdot EAD_i}{{\sum\limits_i}EAD_i}

$$

where

LGDi represents the average LGD associated with all exposures

to the ith obligor. In the case of a resecuritization,

an LGD of 100 percent must be assumed for the underlying exposures

that are themselves securitization exposures.

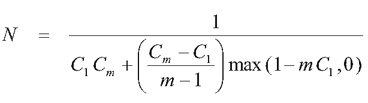

(f) Simplified method for computing

N and EWALGD.

(1) If all underlying exposures of a securitization

are retail exposures, a Board-regulated institution may apply the

SFA using the following simplifications:

(i) h = 0; and

(ii) v = 0.

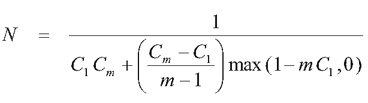

(2) Under the conditions

in sections 217.143(f)(3) and (f)(4), a Board-regulated institution

may employ a simplified method for calculating N and EWALGD.

(3) If C1 is no

more than 0.03, a Board-regulated institution may set EWALGD = 0.50

if none of the underlying exposures is a securitization exposure,

or may set EWALGD = 1 if one or more of the underlying exposures is

a securitization exposure, and may set N equal to the following amount:

N =

Figure 9. DISPLAY EQUATION

$$

N = \frac{1}

{C_1C_m + \Bigg \lgroup \frac{C_m - C_1}{m-1} \Bigg \rgroup \text{max}(1-mC_1,0)}

$$

where:

(i) Cm is the ratio of the sum of the amounts of the ‘m’

largest underlying exposures to UE; and

(ii) The level of m is to be selected

by the Board-regulated institution.

(4) Alternatively, if only C1 is available and C1 is no more than 0.03, the Board regulated

institution may set EWALGD = 0.50 if none of the underlying exposures

is a securitization exposure, or may set EWALGD = 1 if one or more

of the underlying exposures is a securitization exposure and may set

N = 1/C1.